AVAX/USD Technical Analysis: Is A Pullback Imminent For Avalanche?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

AVAX/USD Technical Analysis: Is a Pullback Imminent for Avalanche?

Avalanche (AVAX), the popular layer-1 blockchain platform, has seen significant price action recently. While the bullish sentiment surrounding AVAX remains strong, technical indicators are hinting at a potential pullback. This analysis delves into the current state of the AVAX/USD market, examining key technical factors to determine if a correction is on the horizon.

Current Market Sentiment and Recent Price Action:

The cryptocurrency market has experienced periods of both volatility and consolidation in recent weeks. While Bitcoin's price action often dictates the overall crypto market trend, AVAX has shown relative strength, indicating strong underlying interest in the Avalanche ecosystem. However, its recent rally has been quite steep, raising concerns about potential overbought conditions. This rapid price increase makes a pullback a reasonable possibility, although not a certainty.

Technical Indicators Suggesting a Potential Pullback:

Several technical indicators suggest that a price correction for AVAX/USD might be imminent. These include:

-

Overbought RSI: The Relative Strength Index (RSI) is a momentum indicator frequently used to identify overbought or oversold conditions. An RSI above 70 generally suggests an overbought market, increasing the likelihood of a price pullback. Currently, the AVAX/USD RSI is showing signs of approaching or exceeding this level.

-

MACD Divergence: Moving Average Convergence Divergence (MACD) is another powerful indicator. A bearish divergence, where the price makes higher highs while the MACD makes lower highs, suggests weakening bullish momentum and potential for a price reversal. Traders should carefully monitor the MACD for AVAX/USD for such signals.

-

Resistance Levels: AVAX has encountered several key resistance levels in its recent price surge. Failure to break through these levels convincingly could trigger a price correction as selling pressure increases. Identifying these crucial resistance levels is key to anticipating potential pullbacks.

-

Volume Analysis: Examining trading volume alongside price action is crucial. A significant price increase without corresponding volume growth could be a warning sign, suggesting weak buying pressure and a possible upcoming price drop. Monitoring volume is essential for confirming any technical analysis findings.

Potential Support Levels and Targets:

While a pullback seems likely, identifying potential support levels is crucial for traders. Previous support levels, as well as psychological price points, could act as areas where buying pressure might outweigh selling pressure, potentially halting a significant decline. Careful analysis of past price action and chart patterns can help pinpoint these crucial support levels. Traders need to be vigilant and have a well-defined risk management strategy.

Conclusion: Navigating the Potential AVAX/USD Pullback:

Based on the current technical analysis, a pullback in the AVAX/USD price appears to be a plausible scenario. However, it's essential to remember that technical analysis is not an exact science. While indicators suggest a potential correction, the actual timing and extent of any pullback remain uncertain. Traders should remain cautious and employ proper risk management techniques. Monitoring key indicators closely, along with staying informed about broader market trends and Avalanche ecosystem developments, is critical for navigating this potential market shift. Remember to always conduct your own thorough research before making any investment decisions. The information provided here is for educational and informational purposes only, and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on AVAX/USD Technical Analysis: Is A Pullback Imminent For Avalanche?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

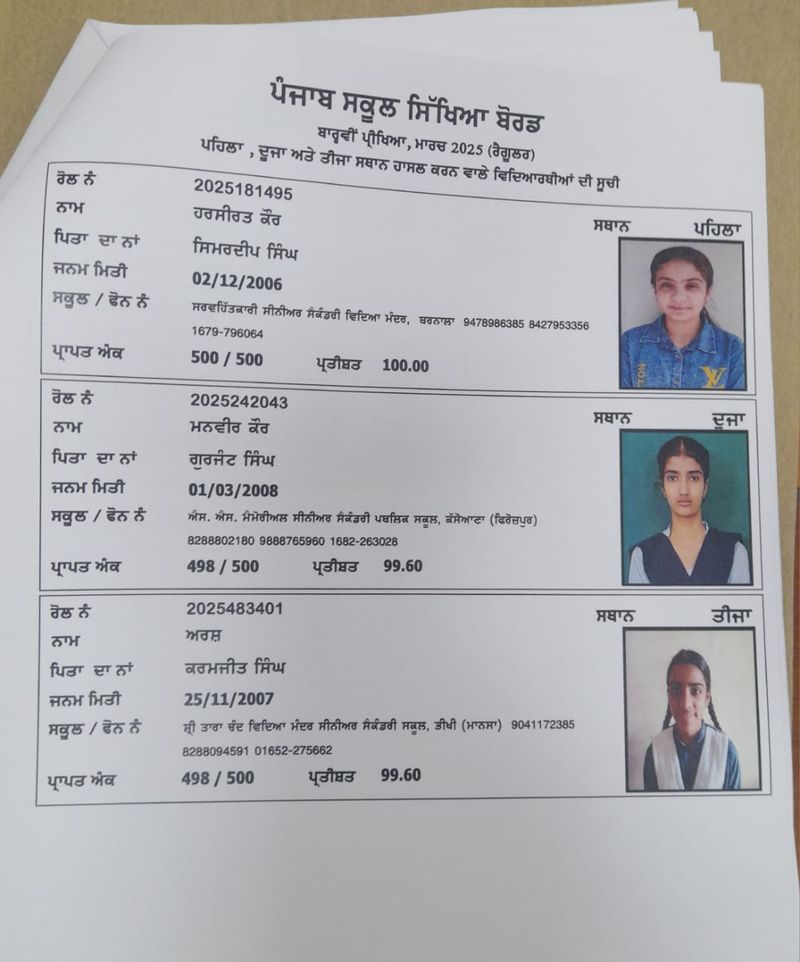

Pseb 12th Result 2024 Barnala Student Achieves Perfect 100 Score

May 14, 2025

Pseb 12th Result 2024 Barnala Student Achieves Perfect 100 Score

May 14, 2025 -

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025 -

Lauren Sanchez Celebrates Mothers Day With Rare Family Photo My Whole World

May 14, 2025

Lauren Sanchez Celebrates Mothers Day With Rare Family Photo My Whole World

May 14, 2025 -

Analyzing The Bruins 2025 Nhl Draft Addressing A Significant Roster Deficiency

May 14, 2025

Analyzing The Bruins 2025 Nhl Draft Addressing A Significant Roster Deficiency

May 14, 2025 -

Ford Issues Nationwide Recall 200 000 Vehicles Kentucky Plants Involved

May 14, 2025

Ford Issues Nationwide Recall 200 000 Vehicles Kentucky Plants Involved

May 14, 2025

Latest Posts

-

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025 -

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025 -

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025 -

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025 -

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025