Beaten-Down Tech Stocks Poised For A Comeback: Analyst Insights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Beaten-Down Tech Stocks Poised for a Comeback: Analyst Insights

The tech sector has taken a significant beating in the past year, with many high-profile companies experiencing substantial drops in valuation. But could this downturn be nearing its end? Several leading analysts believe that beaten-down tech stocks are poised for a remarkable comeback, fueled by several key factors. This isn't just blind optimism; a careful examination of market trends and expert predictions points towards a potential resurgence.

The Bear Market's Toll on Tech:

The 2022-2023 bear market hit the technology sector particularly hard. Rising interest rates, inflation concerns, and a shift in investor sentiment all contributed to a significant decline in tech stock prices. Companies heavily reliant on future growth, particularly those in the software-as-a-service (SaaS) and artificial intelligence (AI) sectors, saw their valuations plummet as investors sought safer, more immediate returns. This correction, however, has created opportunities for shrewd investors.

Signs of a Tech Sector Rebound:

Several indicators suggest that the worst may be over for the tech sector. While challenges remain, these positive trends are fueling analyst optimism:

- Valuation Adjustments: Many tech stocks are now trading at significantly lower price-to-earnings (P/E) ratios than they were at the peak of the bull market. This makes them more attractive to value investors.

- Strong Fundamentals: Despite the market downturn, many tech companies continue to demonstrate strong underlying fundamentals, including robust revenue growth and increasing market share.

- AI-Driven Innovation: The rapid advancement of artificial intelligence is creating new opportunities for growth and innovation within the tech sector, driving demand for specialized hardware and software.

- Increased Investor Confidence: As inflation cools and interest rate hikes slow, investor confidence is gradually returning, creating a more favorable environment for riskier assets like tech stocks.

- Government Regulations: While regulatory scrutiny remains a concern, many anticipate more clarity and stability in government policy concerning technology companies, lessening the uncertainty that contributed to the sell-off.

Analyst Predictions and Investment Strategies:

Leading analysts are increasingly optimistic about the prospects for a tech sector rebound. Several investment firms have revised their outlook on tech stocks, predicting significant growth in the coming years. For instance, Morgan Stanley recently upgraded several tech giants, highlighting their strong long-term potential. However, it's important to note that these are predictions, not guarantees.

Investing in the Tech Sector Comeback:

Investors interested in capitalizing on this potential comeback should consider a diversified approach:

- Focus on fundamentals: Instead of chasing short-term gains, concentrate on companies with strong underlying fundamentals, consistent revenue growth, and a clear path to profitability.

- Diversification is key: Spread your investments across different segments of the tech sector to mitigate risk. Don't put all your eggs in one basket.

- Long-term perspective: Remember that investing in the tech sector requires a long-term perspective. Short-term volatility is to be expected.

- Consult with a financial advisor: Before making any investment decisions, seek advice from a qualified financial advisor who can assess your risk tolerance and help you develop a personalized investment strategy.

The Future of Tech:

The technology sector remains a dynamic and innovative landscape. While past performance is not indicative of future results, the current market conditions, coupled with the continued advancements in AI and other technologies, suggest a compelling case for a significant comeback. However, investors should approach the market with a balanced perspective, carefully weighing potential risks and rewards before making any investment decisions. The road to recovery may not be linear, but the potential rewards for patient investors could be substantial.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Beaten-Down Tech Stocks Poised For A Comeback: Analyst Insights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Decipher Todays Nyt Connections Game April 7 2025

Apr 07, 2025

Decipher Todays Nyt Connections Game April 7 2025

Apr 07, 2025 -

Exploring The Llama 4 Herd Native Multimodality In Ai

Apr 07, 2025

Exploring The Llama 4 Herd Native Multimodality In Ai

Apr 07, 2025 -

Offensive Collapse Concerns Knights Coach Ahead Of Crucial Games

Apr 07, 2025

Offensive Collapse Concerns Knights Coach Ahead Of Crucial Games

Apr 07, 2025 -

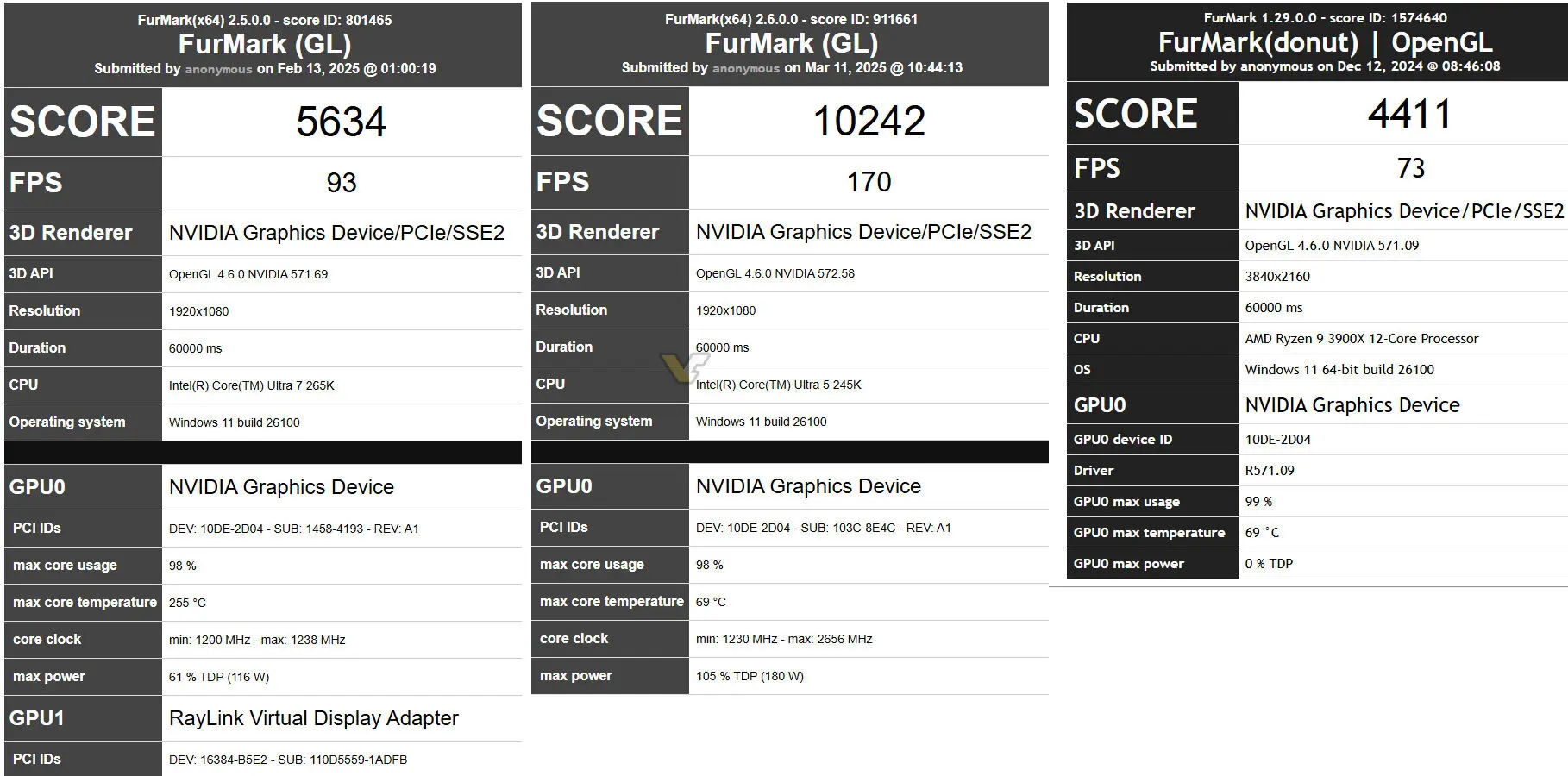

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025 -

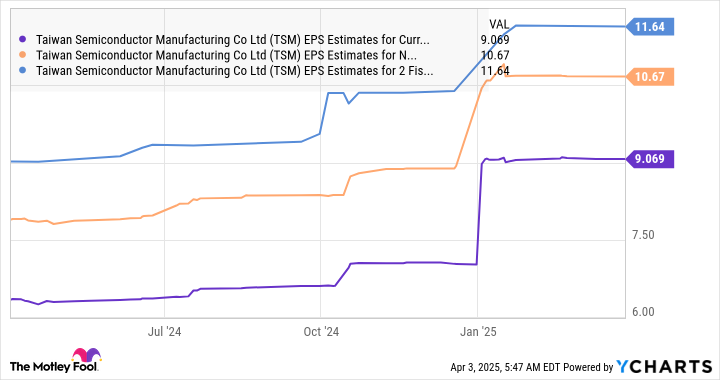

Top Ai Stock Down 25 Should You Buy Before The April 17 Deadline

Apr 07, 2025

Top Ai Stock Down 25 Should You Buy Before The April 17 Deadline

Apr 07, 2025