BigBear.ai (BBAI) Stock: A Q1 Earnings Buying Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

BigBear.ai (BBAI) Stock: A Q1 Earnings Buying Opportunity?

BigBear.ai (BBAI) stock has experienced significant volatility. After a period of decline, some analysts are questioning whether its recent Q1 earnings report presents a compelling buying opportunity for savvy investors. This article delves into the company's performance, market position, and future prospects to help you determine if BBAI stock is a worthwhile addition to your portfolio.

Q1 Earnings: A Mixed Bag?

BigBear.ai's Q1 2024 earnings report revealed a mixed bag of results. While the company showcased growth in certain key areas, some metrics fell short of analyst expectations. This discrepancy led to a sharp initial reaction in the stock price, creating uncertainty for investors. A closer look at the specifics, however, reveals a more nuanced picture.

-

Revenue Growth: While overall revenue growth might not have met some projections, a closer examination reveals strong growth in specific sectors, highlighting the potential for future expansion. This selective growth underscores the importance of understanding BBAI's strategic focus and its potential for future market share gains.

-

Contract Wins: The number of new contracts secured during Q1 is a crucial indicator of future revenue streams. Analyzing the size and scope of these contracts can provide valuable insights into BBAI's long-term financial health and growth trajectory. Significant wins in high-growth sectors suggest a positive outlook.

-

Profitability: BigBear.ai's path to profitability remains a key concern for investors. Analyzing the company's operating expenses, margins, and projected profitability timeline is crucial to assess the long-term viability of the stock. Any signs of improved cost management or increased operational efficiency could significantly impact investor sentiment.

BigBear.ai's Market Position and Competitive Landscape:

BigBear.ai operates in the rapidly expanding market for artificial intelligence (AI) and data analytics solutions. Understanding its competitive positioning within this sector is essential.

-

Technological Differentiation: BigBear.ai's core technology and its ability to differentiate itself from competitors are key factors. Innovative AI solutions and specialized expertise in specific sectors can provide a strong competitive edge.

-

Government Contracts: A significant portion of BigBear.ai's revenue comes from government contracts. The stability and potential growth of this sector are crucial to the company's future performance. Securing large-scale government contracts can provide a reliable revenue stream and bolster investor confidence.

-

Private Sector Growth: Expansion into the private sector is another important factor. Success in penetrating this market can diversify revenue streams and mitigate reliance on government contracts.

Risks and Potential Downsides:

Despite the potential upside, investing in BBAI stock carries inherent risks.

-

Volatility: The stock's price has shown significant volatility, reflecting the inherent uncertainty associated with a growth company in a rapidly evolving market.

-

Competition: The AI and data analytics market is highly competitive, with established players and emerging startups vying for market share.

-

Financial Performance: Consistent profitability remains a key challenge for BigBear.ai. Any failure to meet financial projections could negatively impact investor sentiment.

Is BBAI Stock a Buy?

Whether BigBear.ai stock represents a buying opportunity after its Q1 earnings report depends on individual risk tolerance and investment strategy. While the Q1 results presented a mixed picture, the underlying potential of the company within the booming AI market remains attractive. Thorough due diligence, including a detailed review of the company's financial statements and competitive landscape, is crucial before making any investment decisions. Consulting with a financial advisor is also recommended. The information provided here is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on BigBear.ai (BBAI) Stock: A Q1 Earnings Buying Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tottenham Hotspur Vs Bodo Glimt Europa League Semi Final First Leg Preview

May 02, 2025

Tottenham Hotspur Vs Bodo Glimt Europa League Semi Final First Leg Preview

May 02, 2025 -

Royal Shock Prince Harrys Unforeseen 2025 Decision

May 02, 2025

Royal Shock Prince Harrys Unforeseen 2025 Decision

May 02, 2025 -

Manchester United Vs Athletic Bilbao De Geas Performance Under The Spotlight

May 02, 2025

Manchester United Vs Athletic Bilbao De Geas Performance Under The Spotlight

May 02, 2025 -

2025 Bet Mgm Premier League Night 13 Winners Losers And Betting Predictions

May 02, 2025

2025 Bet Mgm Premier League Night 13 Winners Losers And Betting Predictions

May 02, 2025 -

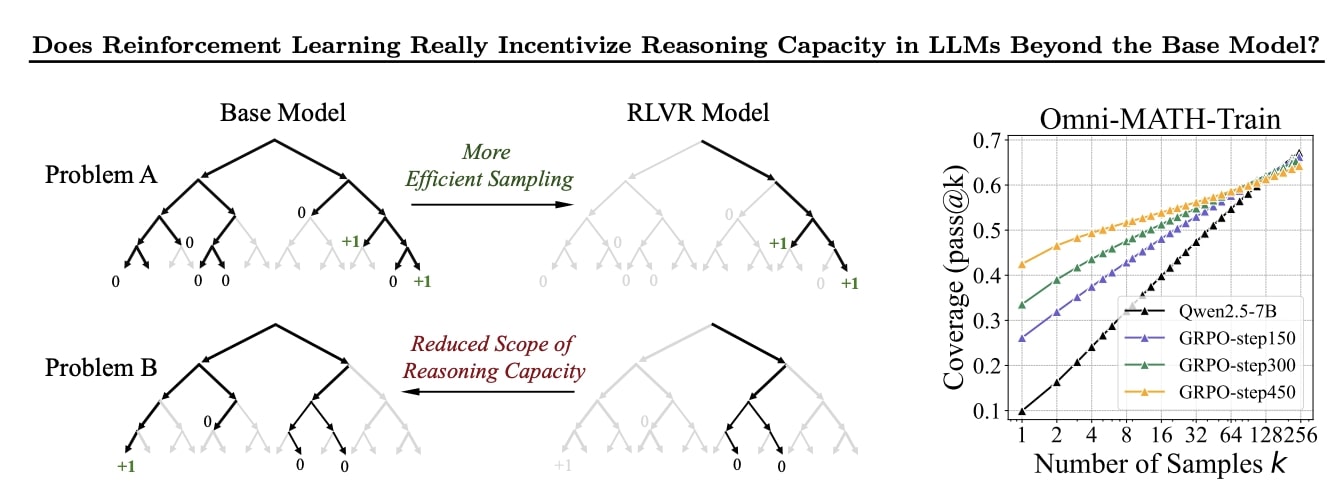

Debunking The Hype Reinforcement Learnings Impact On Ai Model Improvement

May 02, 2025

Debunking The Hype Reinforcement Learnings Impact On Ai Model Improvement

May 02, 2025