Bitcoin Rally: $100K Milestone Ignites Largest Short Squeeze

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Bitcoin Rally: $100K Milestone Ignites Largest Short Squeeze in Crypto History

Bitcoin's meteoric rise towards the $100,000 mark has triggered the largest short squeeze in cryptocurrency history, sending shockwaves through the market and leaving many short sellers scrambling to cover their positions. The dramatic price surge has not only captivated investors but also sparked intense debate about Bitcoin's future and the inherent volatility of the digital asset market.

The past week witnessed a breathtaking rally, with Bitcoin's price jumping over 20% in a matter of days. This explosive growth directly fueled a massive short squeeze, a phenomenon where investors who bet against Bitcoin's price (short sellers) are forced to buy back the cryptocurrency to limit their losses as the price rises. The scale of this squeeze is unprecedented, dwarfing previous events in the crypto space.

What Fueled This Epic Bitcoin Rally?

Several factors contributed to this stunning Bitcoin rally and subsequent short squeeze:

- Institutional Adoption: Continued institutional investment in Bitcoin, with major corporations adding the cryptocurrency to their balance sheets, has signaled growing confidence and legitimacy in the asset class. This influx of capital has directly supported price increases.

- Regulatory Clarity (in some regions): While regulatory uncertainty remains a significant concern globally, some positive regulatory developments in certain jurisdictions have fostered a more positive sentiment among investors.

- Macroeconomic Factors: Global economic instability, including high inflation and concerns about fiat currency devaluation, has driven investors towards alternative assets like Bitcoin, perceived as a hedge against inflation.

- FOMO (Fear Of Missing Out): The rapid price appreciation has fueled a strong Fear Of Missing Out sentiment, pushing more retail investors into the market, further accelerating the price surge.

- Technical Analysis: Many technical indicators pointed towards a potential breakout, leading to a self-fulfilling prophecy as traders piled into the market.

The Impact of the Short Squeeze

The short squeeze has had a significant impact on the broader cryptocurrency market:

- Altcoin Surge: The Bitcoin rally has had a positive spillover effect on other cryptocurrencies (altcoins), with many experiencing substantial price increases.

- Increased Market Volatility: The dramatic price swings have highlighted the inherent volatility of the cryptocurrency market, reminding investors of the risks involved.

- Liquidation Events: Numerous liquidation events occurred as short sellers were forced to cover their positions, leading to significant losses for some investors.

What Does the Future Hold for Bitcoin?

While the recent rally has been spectacular, predicting Bitcoin's future price remains highly speculative. Experts hold widely differing views, with some predicting further price increases and others warning of a potential correction. The following factors will likely play a significant role in shaping Bitcoin's future trajectory:

- Regulatory landscape: The evolving regulatory environment will continue to be a major influence on Bitcoin's price.

- Technological advancements: Further developments in Bitcoin's underlying technology could impact its adoption and value.

- Macroeconomic conditions: Global economic conditions will undoubtedly continue to influence investor sentiment towards Bitcoin.

The $100,000 milestone represents a crucial psychological barrier for Bitcoin. While the recent rally and short squeeze are undeniably impressive, investors should proceed with caution, recognizing the inherent risks associated with this volatile asset class. The cryptocurrency market remains dynamic and unpredictable, requiring careful analysis and risk management strategies. This historic event underscores the need for informed decision-making and a thorough understanding of the market before investing in Bitcoin or any other cryptocurrency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Bitcoin Rally: $100K Milestone Ignites Largest Short Squeeze. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Elsbeth Ep Addresses Kayas Exit The Importance Of Female Friendship Remains

May 11, 2025

Elsbeth Ep Addresses Kayas Exit The Importance Of Female Friendship Remains

May 11, 2025 -

Champions League Star Cody Gakpo Alan Shearer Tips Liverpool Move

May 11, 2025

Champions League Star Cody Gakpo Alan Shearer Tips Liverpool Move

May 11, 2025 -

Westbrook And Gilgeous Alexander The Dynamic And Sometimes Tense Duo

May 11, 2025

Westbrook And Gilgeous Alexander The Dynamic And Sometimes Tense Duo

May 11, 2025 -

Nrl Live Key Moments And Scores Storm Tigers And Sea Eagles Sharks Match Updates

May 11, 2025

Nrl Live Key Moments And Scores Storm Tigers And Sea Eagles Sharks Match Updates

May 11, 2025 -

Irs Layoffs Spark Concerns Could Ai Replace Human Workers

May 11, 2025

Irs Layoffs Spark Concerns Could Ai Replace Human Workers

May 11, 2025

Latest Posts

-

Virat Kohlis Test Retirement A Legacy Defined

May 12, 2025

Virat Kohlis Test Retirement A Legacy Defined

May 12, 2025 -

The Grim Reaper Of Ai Hundreds Of Jobs Lost At Tech Giants Ibm And Crowd Strike

May 12, 2025

The Grim Reaper Of Ai Hundreds Of Jobs Lost At Tech Giants Ibm And Crowd Strike

May 12, 2025 -

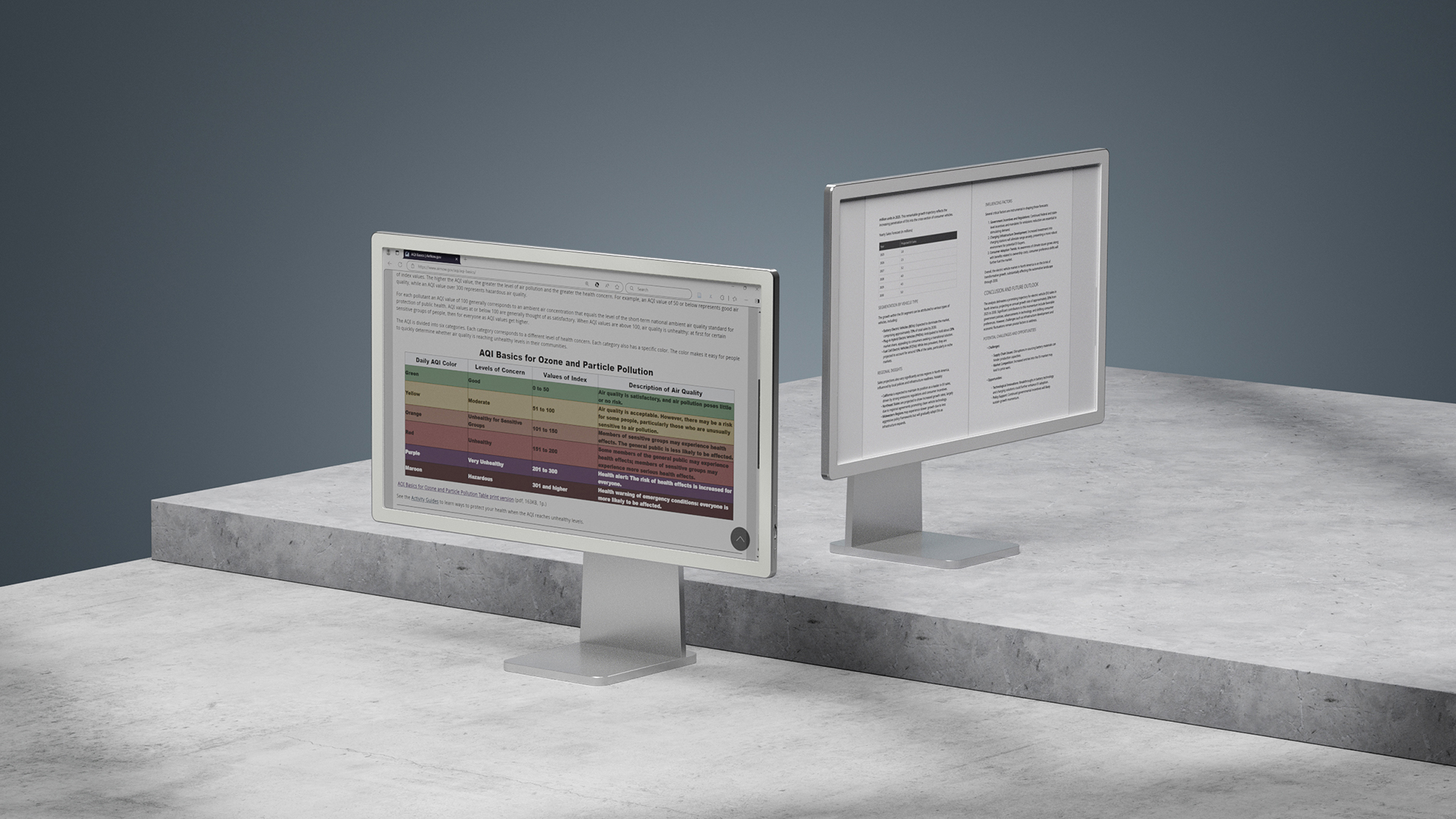

Lcd To E Ink Is A 25 Inch Color E Ink Display Worth The Cost

May 12, 2025

Lcd To E Ink Is A 25 Inch Color E Ink Display Worth The Cost

May 12, 2025 -

Atp Rome 2024 Day 6 Betting Tips And Match Predictions

May 12, 2025

Atp Rome 2024 Day 6 Betting Tips And Match Predictions

May 12, 2025 -

Deep Dive Into Ethereums Pectra Upgrade Features And Benefits Explained

May 12, 2025

Deep Dive Into Ethereums Pectra Upgrade Features And Benefits Explained

May 12, 2025