Could Trump's Bitcoin Policy Usher In A New Crypto Era?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could Trump's Bitcoin Policy Usher in a New Crypto Era?

The potential impact of a Trump presidency on the cryptocurrency market is a topic of intense debate and speculation. Donald Trump's past statements on Bitcoin and cryptocurrency, combined with his potential future policies, leave many wondering if a second Trump term could fundamentally reshape the crypto landscape. This article delves into the possibilities, examining both the potential upsides and downsides for Bitcoin and the broader cryptocurrency market.

Trump's Past Statements and Actions: A Mixed Bag

Trump's public pronouncements on Bitcoin have been infrequent and somewhat contradictory. While he hasn't explicitly endorsed Bitcoin, his administration's actions regarding cryptocurrency regulation have been a significant factor in shaping the market. The focus has often been on combating illicit activities using cryptocurrencies, rather than outright bans. This ambiguous stance leaves room for various interpretations and potential future policies.

Scenario 1: Increased Regulation and Scrutiny

One potential outcome of a Trump presidency is a more stringent regulatory framework for cryptocurrencies. This could involve increased scrutiny of exchanges, stricter KYC/AML (Know Your Customer/Anti-Money Laundering) regulations, and potentially even limitations on certain crypto activities. While this might initially create uncertainty and market volatility, it could also, paradoxically, lead to increased legitimacy and mainstream adoption in the long run. A more regulated market could attract institutional investors who currently hesitate due to regulatory ambiguity.

- Potential Impacts: Decreased volatility in the short term, but potential for long-term growth due to increased institutional investment and legitimacy.

- Keywords: Bitcoin regulation, cryptocurrency regulation, KYC/AML, institutional investment, market volatility.

Scenario 2: A Laissez-Faire Approach

Alternatively, a Trump administration might take a more hands-off approach to cryptocurrency regulation, fostering innovation and allowing the market to self-regulate. This could lead to rapid growth and innovation within the crypto space, potentially attracting even more individual investors and fostering the development of decentralized finance (DeFi) and other cutting-edge technologies.

- Potential Impacts: Increased volatility and rapid growth, potential for a crypto "Wild West" environment with increased risks.

- Keywords: Decentralized Finance (DeFi), crypto innovation, rapid growth, market volatility, self-regulation.

Scenario 3: Focus on Technological Advancement

Trump has often expressed interest in technological advancement. A focus on blockchain technology, the underlying infrastructure of Bitcoin and many other cryptocurrencies, could lead to government investment in research and development, potentially benefiting the entire cryptocurrency ecosystem. This could involve initiatives focused on improving scalability and security within blockchain networks.

- Potential Impacts: Long-term growth driven by technological advancements and government support. Increased focus on infrastructure and security.

- Keywords: Blockchain technology, scalability, security, government investment, technological advancement.

The Wildcard Factor: The Global Crypto Landscape

The global cryptocurrency landscape is constantly evolving. The actions and policies of other major world powers, especially China and the European Union, will significantly influence the overall trajectory of the crypto market, regardless of US policy. Any potential impact of a Trump presidency needs to be considered within this broader global context.

Conclusion: Navigating Uncertainty

Predicting the precise impact of a Trump presidency on Bitcoin and the wider crypto market remains challenging. The possibilities range from increased regulation and stability to a period of rapid growth and potential instability. Regardless of the specific outcome, one thing is clear: the cryptocurrency market is highly sensitive to political developments, and a Trump presidency would undoubtedly create a period of significant uncertainty and potential transformation for the crypto world. Investors should carefully consider these potential scenarios and adjust their strategies accordingly. The future of Bitcoin and the broader crypto market under a Trump administration will be a fascinating story to unfold.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could Trump's Bitcoin Policy Usher In A New Crypto Era?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing 21 Capitals Bitcoin Approach Cantor Tether And Soft Banks Replication

Apr 25, 2025

Analyzing 21 Capitals Bitcoin Approach Cantor Tether And Soft Banks Replication

Apr 25, 2025 -

Adobe Expands Ai Capabilities With New Image Generators

Apr 25, 2025

Adobe Expands Ai Capabilities With New Image Generators

Apr 25, 2025 -

Suncorp Stadium A Double Header And Australian First

Apr 25, 2025

Suncorp Stadium A Double Header And Australian First

Apr 25, 2025 -

Triunfo De Comesana En Madrid Supera Al Numero 14 Mundial

Apr 25, 2025

Triunfo De Comesana En Madrid Supera Al Numero 14 Mundial

Apr 25, 2025 -

Strong Q1 Results Drive Ciccs Upgraded Pop Mart Price Target To 220

Apr 25, 2025

Strong Q1 Results Drive Ciccs Upgraded Pop Mart Price Target To 220

Apr 25, 2025

Latest Posts

-

The Epic Games Store Mobile Launch A Retrospective

Apr 29, 2025

The Epic Games Store Mobile Launch A Retrospective

Apr 29, 2025 -

Swiatek Survives Upset Bid Advances To Madrid Quarterfinals

Apr 29, 2025

Swiatek Survives Upset Bid Advances To Madrid Quarterfinals

Apr 29, 2025 -

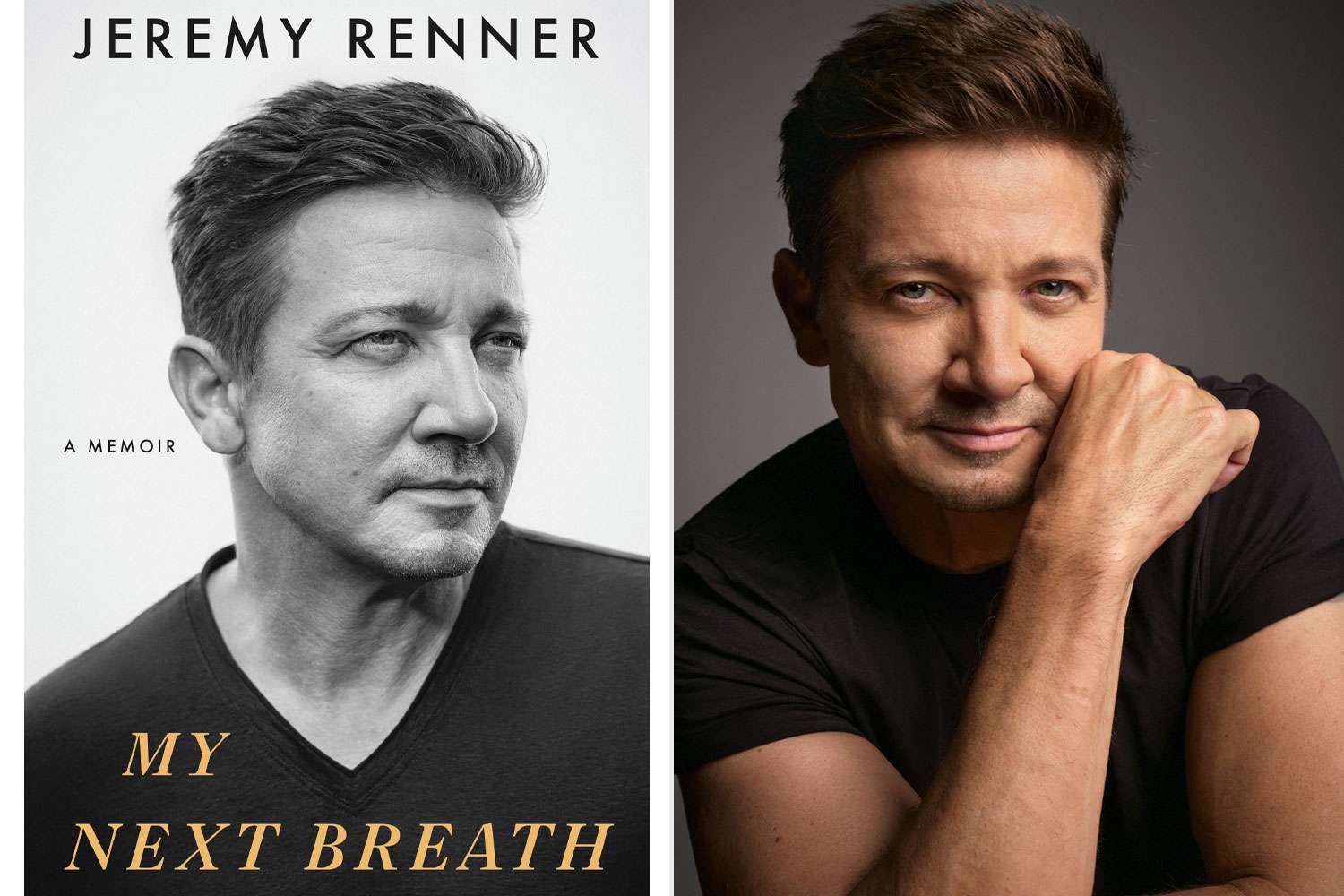

My Left Eye With My Right Eye Jeremy Renner Details The Severity Of His Near Fatal Accident

Apr 29, 2025

My Left Eye With My Right Eye Jeremy Renner Details The Severity Of His Near Fatal Accident

Apr 29, 2025 -

Engines Of Fury And Treeverse Significant Developments In Web3 Gaming

Apr 29, 2025

Engines Of Fury And Treeverse Significant Developments In Web3 Gaming

Apr 29, 2025 -

Auto Tariff Relief Trumps Announcement And Industry Reaction

Apr 29, 2025

Auto Tariff Relief Trumps Announcement And Industry Reaction

Apr 29, 2025