Crypto Exchange OKX Faces Another Fine: $1.2M In Malta For AML Non-Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Exchange OKX Faces Another Fine: $1.2M Malta Penalty for AML Non-Compliance

Cryptocurrency exchange OKX is facing another significant financial penalty, this time a hefty €1.1 million ($1.2 million USD) fine levied by the Malta Gaming Authority (MGA). The fine stems from alleged breaches of Anti-Money Laundering (AML) regulations, highlighting ongoing challenges for digital asset platforms in navigating complex regulatory landscapes.

The MGA's announcement, released on [Date of Release - Insert Actual Date Here], details several instances where OKX allegedly fell short of AML compliance standards. This latest fine adds to the growing list of regulatory actions against cryptocurrency exchanges globally, emphasizing the increasing scrutiny of the industry and the importance of robust compliance frameworks.

Key Violations Cited by the MGA

The MGA's investigation uncovered several key areas where OKX reportedly failed to meet its AML obligations. While the specifics remain somewhat veiled in the official statement, key violations appear to center around:

- Insufficient Customer Due Diligence (CDD): The MGA alleges that OKX failed to adequately verify the identities of its customers, a crucial step in preventing money laundering and terrorist financing. This includes potential shortcomings in verifying source of funds and beneficial ownership.

- Inadequate Transaction Monitoring: The regulator suggests that OKX's systems for monitoring suspicious transactions were deficient, potentially allowing illicit activities to go undetected. Effective transaction monitoring is a cornerstone of any robust AML program.

- Weaknesses in Reporting Procedures: The MGA likely found flaws in OKX's processes for reporting suspicious activity to the relevant authorities. Timely and accurate reporting is critical for disrupting money laundering networks.

OKX's Response and Future Implications

OKX has yet to release a comprehensive public statement directly addressing the specifics of the MGA's findings. However, a spokesperson for OKX is reported to have stated [Insert Quote from OKX, if available. Otherwise remove this sentence and the following one. If no statement is available, replace with something like: "The company is currently reviewing the MGA's decision and considering its options."] that they are reviewing the decision and are committed to enhancing their AML compliance program.

This fine carries significant implications for OKX and the broader cryptocurrency industry. It underscores the heightened regulatory pressure on exchanges to implement robust and effective AML/KYC (Know Your Customer) programs. Failure to do so can result in substantial financial penalties, reputational damage, and potential operational restrictions.

Navigating the Regulatory Maze: A Challenge for Crypto Exchanges

The OKX fine serves as a stark reminder of the challenges facing cryptocurrency exchanges in navigating the evolving regulatory landscape. AML compliance is not merely a box to tick; it's an ongoing process requiring significant investment in technology, training, and internal controls. Exchanges that fail to prioritize compliance risk facing hefty fines, operational disruptions, and a damaged reputation.

This case highlights the crucial need for:

- Proactive Compliance Strategies: Crypto exchanges must proactively identify and address potential AML vulnerabilities before regulatory action is taken.

- Investment in Technology: Robust AML/KYC technology is essential for efficient customer due diligence and transaction monitoring.

- Ongoing Training and Education: Staff training on AML regulations and best practices is critical for maintaining compliance.

The future of cryptocurrency hinges on the industry's ability to demonstrate its commitment to responsible practices and regulatory compliance. The OKX fine serves as a cautionary tale for other exchanges, emphasizing the importance of prioritizing AML compliance to ensure long-term sustainability and trustworthiness.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Exchange OKX Faces Another Fine: $1.2M In Malta For AML Non-Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Semiconductor Packaging Japanese Conglomerate Expands Key Material Production

Apr 08, 2025

Semiconductor Packaging Japanese Conglomerate Expands Key Material Production

Apr 08, 2025 -

Cybersecurity Firm Secure Ideas Gains Crest Accreditation And Cmmc Level 1 Compliance

Apr 08, 2025

Cybersecurity Firm Secure Ideas Gains Crest Accreditation And Cmmc Level 1 Compliance

Apr 08, 2025 -

1 Billion Eu Fine For Elon Musks X A Deep Dive Into The Disinformation Controversy

Apr 08, 2025

1 Billion Eu Fine For Elon Musks X A Deep Dive Into The Disinformation Controversy

Apr 08, 2025 -

Fha Changes Residency Rules Impact On Loan Eligibility

Apr 08, 2025

Fha Changes Residency Rules Impact On Loan Eligibility

Apr 08, 2025 -

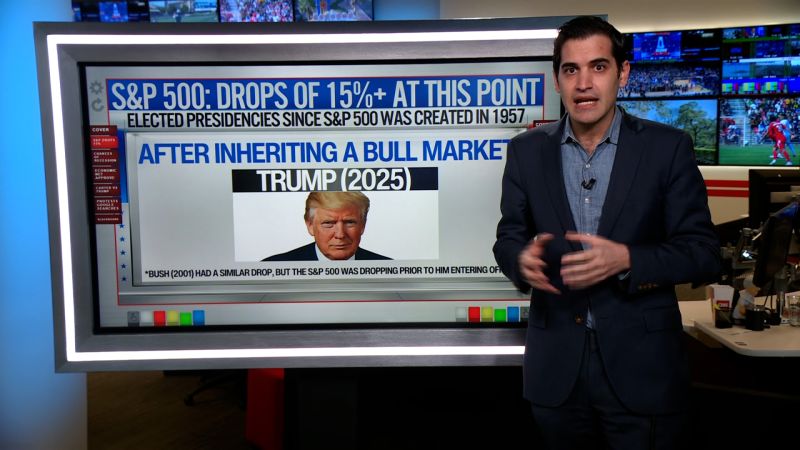

Dow Futures Continue Freefall Amidst Widespread Market Sell Off

Apr 08, 2025

Dow Futures Continue Freefall Amidst Widespread Market Sell Off

Apr 08, 2025