Crypto Taxation In Ukraine: Details Of The Proposed 18% Levy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Taxation in Ukraine: Proposed 18% Levy Sparks Debate

Ukraine, a nation increasingly embracing cryptocurrency despite ongoing conflict, is poised to implement a new 18% tax on crypto transactions. This proposed levy, currently undergoing legislative processes, has ignited a heated debate among investors, businesses, and policymakers, raising questions about its impact on innovation and economic growth.

The proposed legislation aims to bring cryptocurrency transactions under a more formalized tax regime, aligning them with traditional financial assets. This move is intended to increase government revenue and improve transparency within the burgeoning crypto market. However, critics argue that the 18% tax rate, while seemingly moderate, could stifle innovation and discourage investment in a sector already facing regulatory uncertainty globally.

Key Details of the Proposed 18% Levy:

- Broad Scope: The proposed tax is expected to cover a wide range of crypto transactions, including buying, selling, exchanging, and staking cryptocurrencies. This comprehensive approach aims to minimize loopholes and ensure fair taxation across the board.

- Tax Calculation: The 18% tax will likely be calculated based on the profit generated from each transaction. This means that investors will only pay taxes on their gains, not on the entire transaction value. However, the specifics of calculating profit, especially considering the volatile nature of crypto markets, remain unclear and are a source of ongoing discussion.

- Implementation Timeline: While the exact implementation date remains uncertain, the government is actively pushing for its swift enactment. This urgency stems from the need to consolidate revenue streams amid ongoing economic challenges.

- Potential Exemptions: Discussions are ongoing regarding potential exemptions for certain types of crypto activities, such as charitable donations or long-term investments. These potential exemptions are crucial for maintaining a balance between tax revenue generation and fostering growth within the crypto sector.

Concerns and Counterarguments:

The proposed tax has faced significant pushback from various stakeholders. Concerns include:

- Impact on Innovation: Critics argue that a high tax rate could deter both domestic and foreign investment in Ukrainian crypto projects and startups. This could hinder the development of a vibrant and competitive crypto ecosystem within the country.

- Complexity and Enforcement: The complexities of tracking cryptocurrency transactions present a significant challenge for tax enforcement. Ensuring accurate and efficient tax collection will require significant investment in infrastructure and expertise.

- International Competitiveness: Compared to other countries with more favorable crypto tax regimes, Ukraine's proposed levy could make it less attractive for crypto businesses and investors. This could lead to capital flight and missed opportunities for economic development.

Looking Ahead:

The proposed 18% crypto tax in Ukraine is a significant development with far-reaching consequences. While it aims to increase government revenue and regulate the crypto market, its potential impact on economic growth and innovation remains a subject of intense debate. The final details of the legislation and its eventual implementation will be closely watched by investors, businesses, and policymakers alike, both within Ukraine and internationally. Further clarification on tax calculation methods, potential exemptions, and enforcement mechanisms is crucial to address the concerns raised and ensure a balanced and effective tax policy. The success of this legislation will hinge on striking a delicate balance between generating revenue and fostering a thriving crypto ecosystem in Ukraine.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Taxation In Ukraine: Details Of The Proposed 18% Levy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ipl 2025 History Mukesh Kumar Bowls Maiden Over Against Royal Challengers Bangalore

Apr 11, 2025

Ipl 2025 History Mukesh Kumar Bowls Maiden Over Against Royal Challengers Bangalore

Apr 11, 2025 -

Aaron Rais Equipment Choices The Story Behind The Two Gloves And Iron Covers

Apr 11, 2025

Aaron Rais Equipment Choices The Story Behind The Two Gloves And Iron Covers

Apr 11, 2025 -

Rune Crash 60 Liquidity Drop On Thor Chain Impacts Price

Apr 11, 2025

Rune Crash 60 Liquidity Drop On Thor Chain Impacts Price

Apr 11, 2025 -

Pi Network Pi Price Consolidates Whats Next For Investors

Apr 11, 2025

Pi Network Pi Price Consolidates Whats Next For Investors

Apr 11, 2025 -

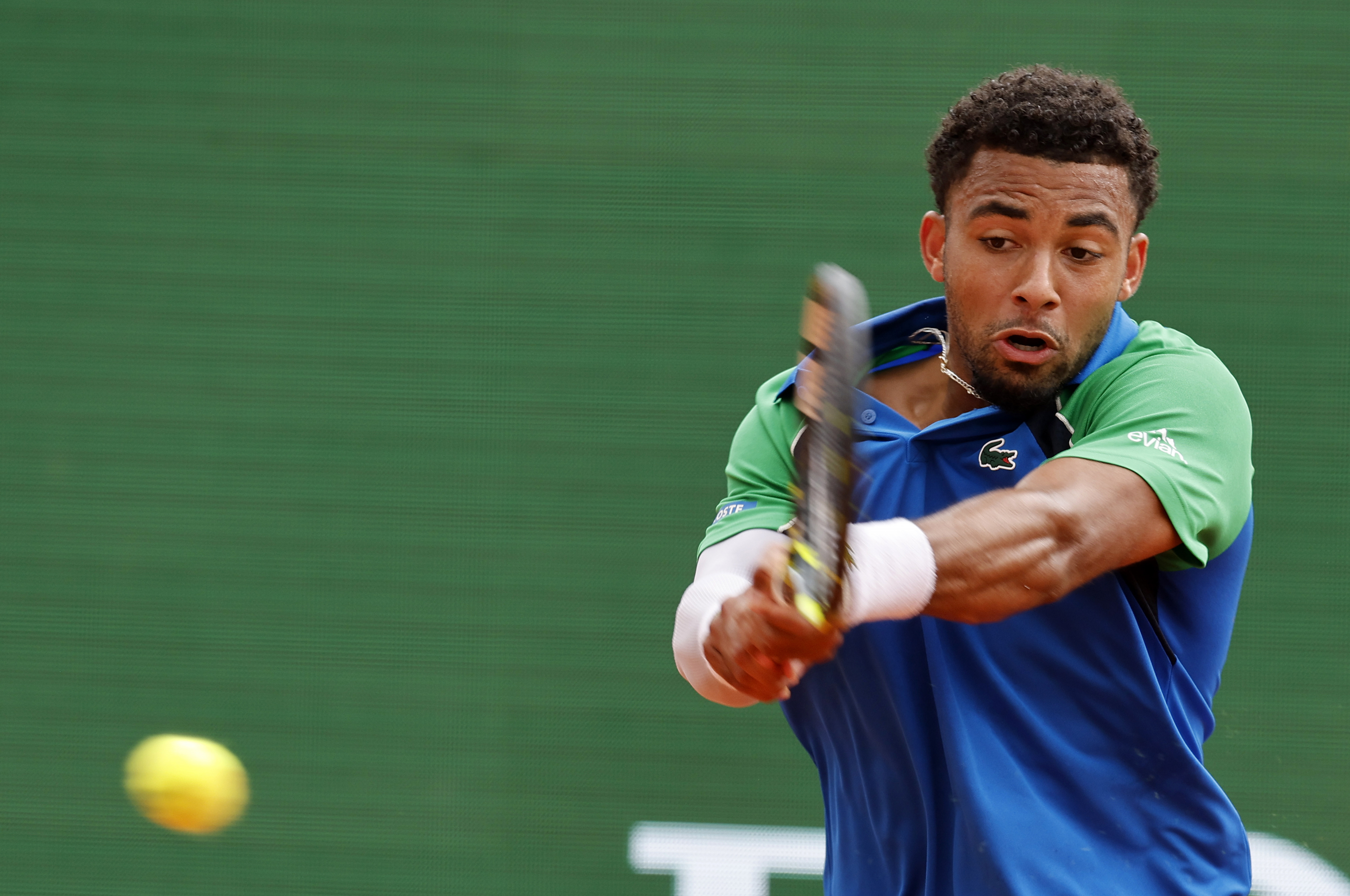

Masters 1000 Montecarlo Alcaraz Remonta Y Asegura Presencia Espanola En La Final

Apr 11, 2025

Masters 1000 Montecarlo Alcaraz Remonta Y Asegura Presencia Espanola En La Final

Apr 11, 2025