Deadline Passed? Reclaiming Your $1400 Stimulus Money

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deadline Passed? Reclaiming Your $1400 Stimulus Money

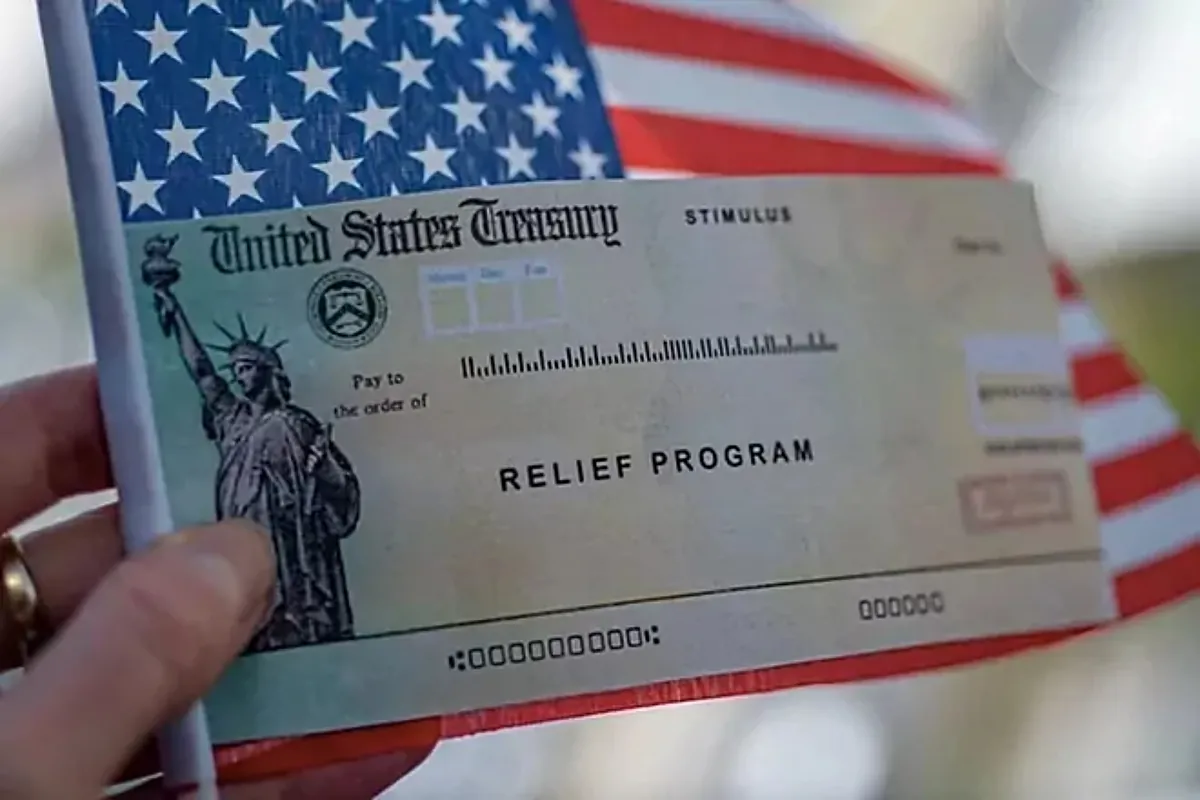

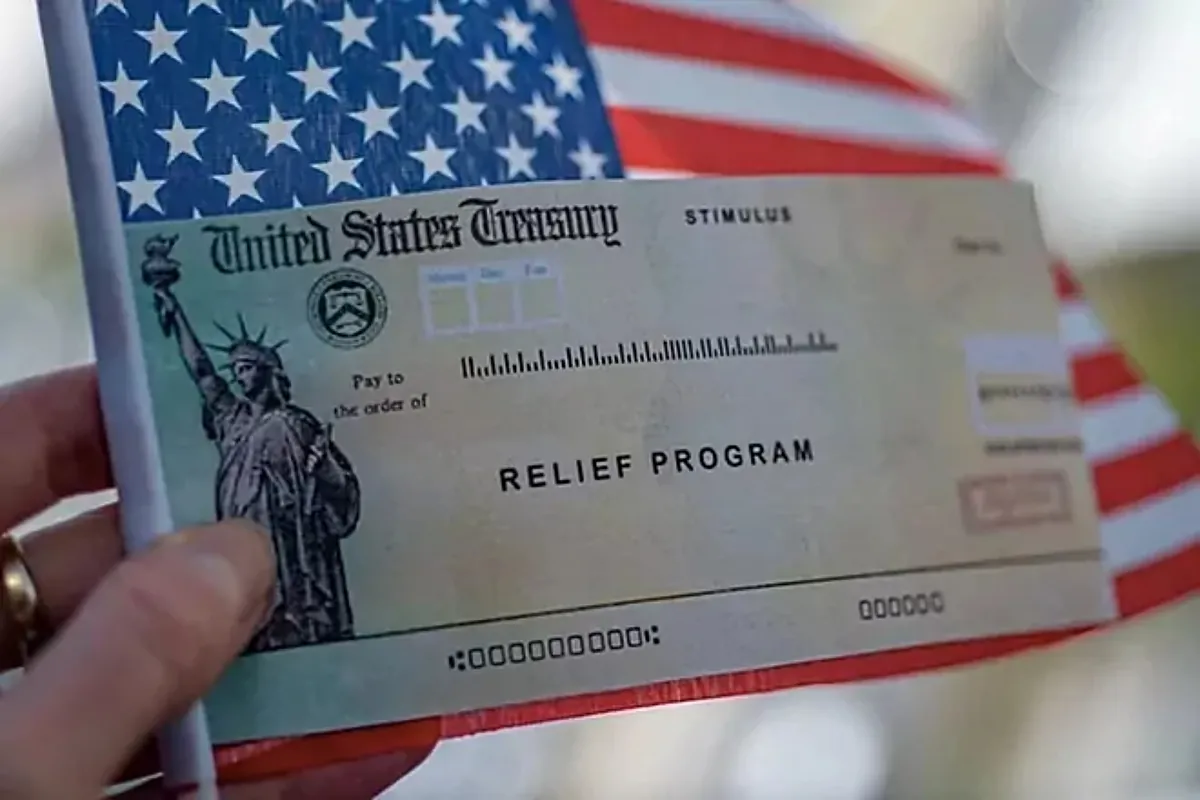

Millions of Americans missed the deadline to claim their Economic Impact Payment (EIP) stimulus checks. Don't despair! While the initial deadline has passed, there are still avenues to recover your $1400 stimulus payment. This guide outlines the steps you can take to reclaim your money.

Understanding the Stimulus Payment Deadline

The initial deadline for claiming the third stimulus check, part of the American Rescue Plan Act of 2021, has passed. This meant that if you hadn't filed your 2020 or 2021 taxes by a certain date, you might have missed out on receiving your payment. However, this doesn't necessarily mean you're out of luck. The IRS has provisions in place to help those who missed the initial window.

How to Claim Your Missing $1400 Stimulus Check

There are several ways to claim your missing stimulus payment, even if you missed the initial deadline:

1. File Your Tax Return: If you haven't filed your 2020 or 2021 tax return, this is the most crucial step. The IRS uses your tax information to determine your eligibility and the amount you're owed. Filing your return as soon as possible is vital. You can file online through various tax preparation software or with the help of a tax professional.

2. Use the IRS Non-Filers Tool: If you don't typically file taxes (because your income is below the filing threshold, for example), you may have missed the opportunity to receive the payment automatically. The IRS Non-Filers tool allows eligible individuals to register and receive their stimulus payment. Check the IRS website to see if you qualify.

3. Contact the IRS Directly: If you've filed your taxes and still haven't received your payment, contact the IRS directly. You can reach them by phone or through their website. Be prepared to provide your personal information and tax details. Expect potential wait times, as they are likely experiencing high call volumes.

4. Check the IRS's Get My Payment Tool: This online tool allows you to track the status of your stimulus payment. Even if you missed the deadline, checking this tool may provide valuable information about your payment's status or highlight any issues preventing its delivery.

What to Do if You've Already Filed Your Taxes

If you've already filed your taxes and believe you are eligible but haven't received your payment, you should:

- Review your tax return: Double-check your filing status and ensure all information is accurate.

- Check for IRS notices: Look for any letters or notices from the IRS regarding your stimulus payment.

- Contact your tax preparer: If you used a tax professional, contact them to see if they can assist in tracking down your payment.

Key Considerations and Frequently Asked Questions

- What if I moved? Ensure the IRS has your current address on file. Update your information through their online portal if necessary.

- What if I didn't receive the full amount? The amount you receive depends on your income and filing status. Review the IRS guidelines to determine the correct amount.

- Is there a statute of limitations? There is a deadline for claiming the stimulus payment. While the specific timeframe isn't publicly stated, prompt action is highly recommended.

Don't give up on your $1400! Take action today to claim your Economic Impact Payment. The IRS resources mentioned above can help you navigate the process and potentially recover the money you're entitled to. Remember to act swiftly, as time is of the essence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Deadline Passed? Reclaiming Your $1400 Stimulus Money. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Record Breaking Gore Final Destination Bloodlines Review

May 08, 2025

Record Breaking Gore Final Destination Bloodlines Review

May 08, 2025 -

India And Pakistan Understanding The Current Crisis

May 08, 2025

India And Pakistan Understanding The Current Crisis

May 08, 2025 -

Official Musa Of Kano Pillars Joins Super Eagles Unity Cup Squad

May 08, 2025

Official Musa Of Kano Pillars Joins Super Eagles Unity Cup Squad

May 08, 2025 -

Multi Year Partnership Extension Announced Ticketmaster And Crown Resorts

May 08, 2025

Multi Year Partnership Extension Announced Ticketmaster And Crown Resorts

May 08, 2025 -

International Pressure Mounts Fight For Release Of Imprisoned Georgetown Researcher

May 08, 2025

International Pressure Mounts Fight For Release Of Imprisoned Georgetown Researcher

May 08, 2025

Latest Posts

-

Final Destination Bloodlines The Goriest Horror Sequel Ever Made

May 08, 2025

Final Destination Bloodlines The Goriest Horror Sequel Ever Made

May 08, 2025 -

Steph Currys Injury How Golden State Won Game 1 Against Minnesota

May 08, 2025

Steph Currys Injury How Golden State Won Game 1 Against Minnesota

May 08, 2025 -

Is War Imminent The Delicate India Pakistan Situation Explained

May 08, 2025

Is War Imminent The Delicate India Pakistan Situation Explained

May 08, 2025 -

New Horror Film Sets Record For Most Specific Gore Element

May 08, 2025

New Horror Film Sets Record For Most Specific Gore Element

May 08, 2025 -

Game 3 Preview Abbotsford Canucks Look To Lekkerimaeki Against Coachella Valley

May 08, 2025

Game 3 Preview Abbotsford Canucks Look To Lekkerimaeki Against Coachella Valley

May 08, 2025