Double Trouble For OKX: $500M US Penalty Followed By $1.2M Malta Fine For AML Issues

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Double Trouble for OKX: $500M US Penalty Followed by $1.2M Malta Fine for AML Issues

Cryptocurrency exchange OKX is facing a significant double blow, hit with a hefty $500 million penalty in the US and a further €1.2 million fine in Malta, both stemming from alleged Anti-Money Laundering (AML) violations. This escalating regulatory scrutiny highlights the increasing pressure on crypto exchanges to strengthen their compliance measures and underscores the global reach of financial crime investigations.

The Office of Foreign Assets Control (OFAC) of the US Department of the Treasury levied the staggering $500 million penalty against OKX for allegedly processing transactions involving sanctioned individuals and entities. This represents one of the largest ever penalties imposed by OFAC on a cryptocurrency exchange, demonstrating the seriousness with which the US government is tackling illicit financial activities within the digital asset space. The penalty underscores the critical importance of robust Know Your Customer (KYC) and AML compliance programs for businesses operating in this rapidly evolving sector.

OFAC's Accusations and OKX's Response

OFAC's announcement detailed numerous instances where OKX allegedly facilitated transactions on behalf of individuals and entities subject to US sanctions. The accusations include processing transactions linked to individuals and entities involved in activities such as terrorism financing and proliferation of weapons of mass destruction. While OKX has not yet publicly admitted guilt, the sheer size of the penalty suggests a significant acknowledgement of regulatory shortcomings. A statement released by OKX is expected to address the OFAC findings and outline the company’s plan for future compliance improvements. This is crucial for regaining investor trust and demonstrating a commitment to upholding international AML standards.

Malta's Additional Fine Amplifies Concerns

Adding insult to injury, the Malta Gaming Authority (MGA) concurrently issued a separate €1.2 million fine to OKX for AML failings within its operations within Malta. This fine further emphasizes the global nature of regulatory investigations into OKX's practices. The MGA's action underscores the growing international cooperation in combating financial crime in the cryptocurrency market and reinforces the need for consistent compliance across jurisdictions. The simultaneous fines highlight the potential for significant financial repercussions for exchanges that fail to prioritize AML compliance.

Implications for the Crypto Industry

The dual penalties against OKX send a strong message to the broader cryptocurrency industry. It reinforces the expectation that exchanges must implement robust and effective AML/KYC programs, rigorously screening users and transactions to prevent the misuse of their platforms for illicit activities. The incident serves as a cautionary tale, highlighting the potential for severe financial penalties and reputational damage for those failing to meet stringent regulatory requirements.

Key Takeaways:

- Increased Regulatory Scrutiny: The cryptocurrency industry is facing increased regulatory scrutiny globally.

- Strengthened AML/KYC Measures: Exchanges must prioritize robust AML/KYC programs to prevent sanctions violations.

- Global Cooperation: International cooperation in combating financial crime is intensifying.

- Significant Financial Penalties: Non-compliance can result in severe financial penalties and reputational damage.

- Investor Trust: Maintaining investor trust requires demonstrable commitment to regulatory compliance.

The OKX case serves as a stark reminder that operating in the cryptocurrency space requires meticulous adherence to international AML regulations. The significant fines levied against OKX underscore the seriousness of the consequences for non-compliance and highlight the urgent need for the entire industry to prioritize and invest in robust AML and KYC measures. The coming weeks will be crucial in observing OKX's response and its future steps towards rectifying these compliance issues.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Double Trouble For OKX: $500M US Penalty Followed By $1.2M Malta Fine For AML Issues. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adelaide Crows Robbed Afl Admits Umpire Error In Heartbreaking Loss

Apr 07, 2025

Adelaide Crows Robbed Afl Admits Umpire Error In Heartbreaking Loss

Apr 07, 2025 -

Saturday Night Live Kenan Thompson Considers A Forever Role

Apr 07, 2025

Saturday Night Live Kenan Thompson Considers A Forever Role

Apr 07, 2025 -

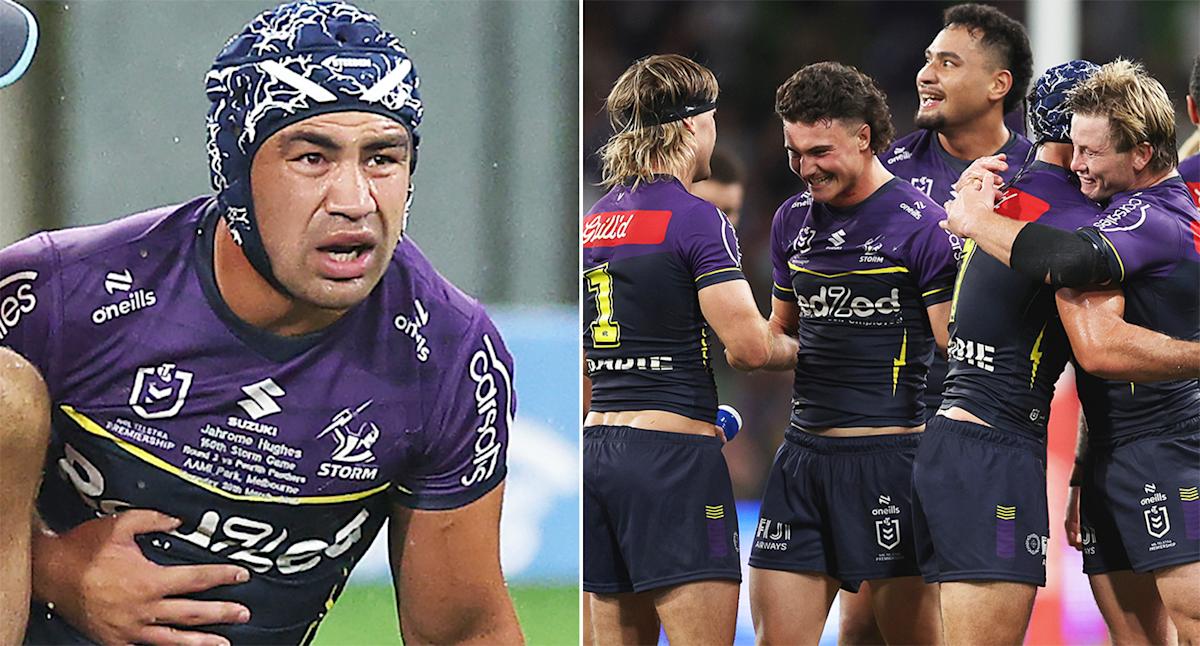

Crushing Blow Melbourne Storms Playmaker Sidelined For Extended Period

Apr 07, 2025

Crushing Blow Melbourne Storms Playmaker Sidelined For Extended Period

Apr 07, 2025 -

3 Tech Stocks To Buy Before The Next Bull Market

Apr 07, 2025

3 Tech Stocks To Buy Before The Next Bull Market

Apr 07, 2025 -

Bitcoin Btc Price Prediction Trade Tensions Dampen Bullish Momentum

Apr 07, 2025

Bitcoin Btc Price Prediction Trade Tensions Dampen Bullish Momentum

Apr 07, 2025