Dow Futures Continue Freefall Amidst Broader Market Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dow Futures Continue Freefall Amidst Broader Market Sell-Off: Investors Grapple with Uncertainty

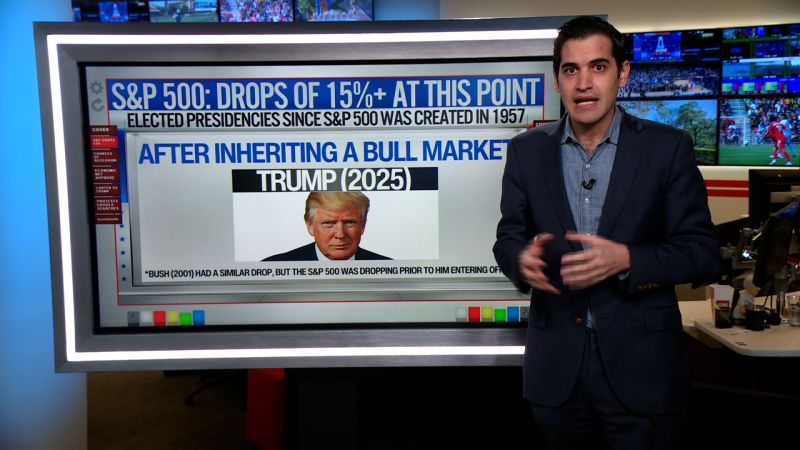

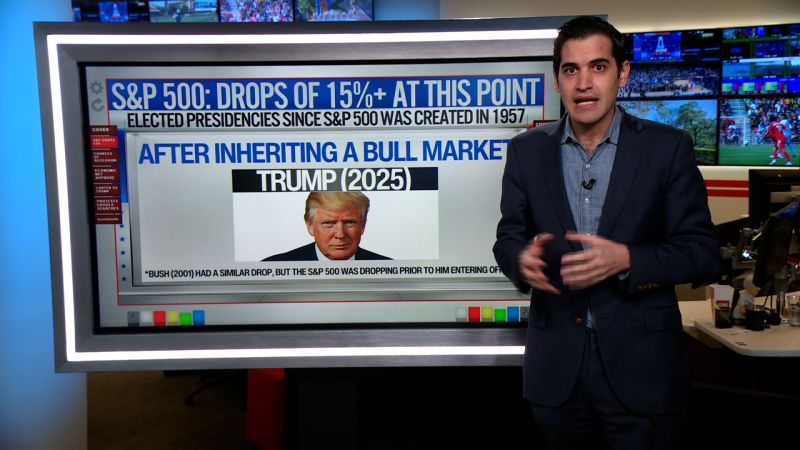

Wall Street shuddered overnight as Dow futures plunged, mirroring a broader market sell-off fueled by escalating concerns over inflation, rising interest rates, and geopolitical instability. The dramatic downturn continues a trend of increasing volatility, leaving investors grappling with uncertainty and prompting questions about the future trajectory of the market.

The pre-market slump paints a grim picture for what promises to be another turbulent day of trading. The sheer magnitude of the drop in Dow futures suggests a significant loss of investor confidence, with ripple effects likely felt across various sectors. This follows a week of already significant losses, raising fears of a deeper market correction.

What's driving the sell-off?

Several factors are contributing to this market freefall:

-

Persistent Inflation: Stubbornly high inflation continues to be a major headwind, forcing central banks to maintain aggressive interest rate hikes. This increases borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate earnings. The recent inflation data releases have only exacerbated these concerns.

-

Rising Interest Rates: The Federal Reserve's ongoing commitment to combating inflation through interest rate increases is dampening investor sentiment. Higher rates make borrowing more expensive, impacting investment decisions and potentially triggering a recession.

-

Geopolitical Uncertainty: The ongoing war in Ukraine and escalating tensions in other global hotspots contribute to market volatility. These geopolitical risks create uncertainty, prompting investors to seek safer havens and reducing appetite for riskier assets.

-

Tech Sector Weakness: The technology sector, a significant driver of recent market gains, has experienced a considerable downturn. This weakness is attributed to several factors, including rising interest rates impacting growth stocks and concerns over future earnings.

What does this mean for investors?

The continued freefall in Dow futures highlights the need for investors to adopt a cautious approach. Now is the time for careful portfolio management and a reassessment of risk tolerance. Some strategies to consider include:

-

Diversification: Spreading investments across different asset classes can help mitigate risk during periods of market volatility.

-

Defensive Positioning: Shifting towards more defensive investments, such as government bonds or high-quality dividend-paying stocks, can provide stability during a downturn.

-

Long-Term Perspective: Maintaining a long-term investment horizon is crucial, as short-term market fluctuations are a normal part of the investment cycle. Panic selling can lead to significant losses.

Looking Ahead:

The market's direction remains uncertain. While some analysts predict a potential bottoming out, others warn of further declines. Close monitoring of economic data, interest rate decisions, and geopolitical developments will be crucial in navigating this period of market turbulence. Investors should consult with financial advisors to develop personalized strategies based on their individual risk profiles and financial goals. The current situation underscores the importance of informed decision-making and a well-defined investment plan in the face of market uncertainty. The coming days and weeks will be critical in determining the market's trajectory and investors’ next steps.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Continue Freefall Amidst Broader Market Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Japanese Grand Prix Qualifying 2025 Live Updates Results And Radio

Apr 07, 2025

Japanese Grand Prix Qualifying 2025 Live Updates Results And Radio

Apr 07, 2025 -

Rockets Alperen Senguen Dominates With Impressive Double Double Performance

Apr 07, 2025

Rockets Alperen Senguen Dominates With Impressive Double Double Performance

Apr 07, 2025 -

Rockets Upset Warriors In Convincing 106 96 Win

Apr 07, 2025

Rockets Upset Warriors In Convincing 106 96 Win

Apr 07, 2025 -

Market In Freefall 1300 Point Dow Drop Amidst Trump Tariff Crisis

Apr 07, 2025

Market In Freefall 1300 Point Dow Drop Amidst Trump Tariff Crisis

Apr 07, 2025 -

Major Crypto Exchange Bitget Obtains El Salvador Operating License

Apr 07, 2025

Major Crypto Exchange Bitget Obtains El Salvador Operating License

Apr 07, 2025