Dow Futures Deep In Red As Broad Market Sell-Off Persists

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

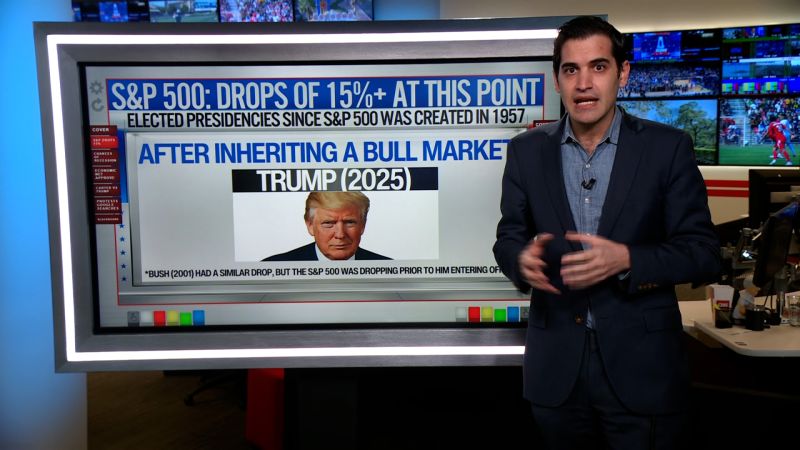

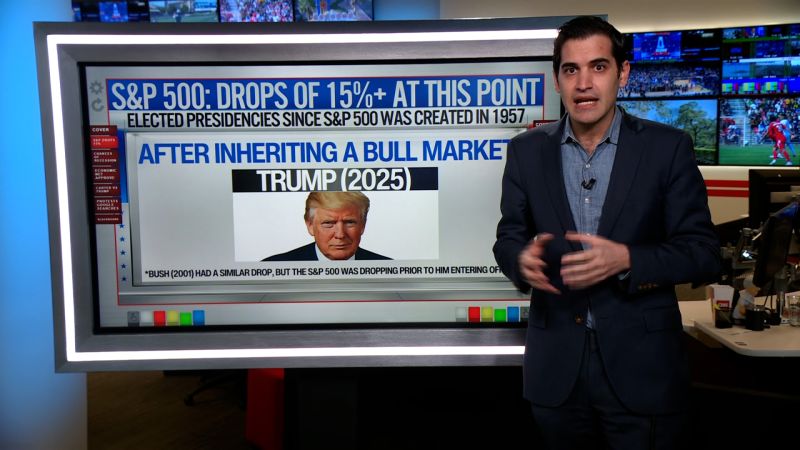

Dow Futures Plunge: Broad Market Sell-Off Deepens, Investor Anxiety Mounts

Wall Street braces for another tumultuous day as Dow futures plummet, signaling a continuation of the widespread market sell-off that has gripped investors this week. Fears of persistent inflation, rising interest rates, and a potential recession are fueling the ongoing decline, leaving investors on edge. The sharp downturn in pre-market trading suggests a challenging day ahead for equities.

This morning's pre-market activity paints a grim picture. Dow futures are sharply lower, indicating a significant drop at the opening bell. This follows several days of heavy losses across major indices, reflecting a growing sense of unease within the investment community. The broad-based nature of the sell-off underscores the severity of the situation, impacting various sectors and market capitalization levels.

What's Driving the Market Down?

Several interconnected factors are contributing to this persistent market downturn:

-

Inflationary Pressures: Stubbornly high inflation continues to be a major headwind. Despite recent efforts by central banks to curb price increases through interest rate hikes, inflation remains elevated, raising concerns about the longer-term economic outlook. The fear is that persistent inflation will necessitate even more aggressive monetary tightening, potentially triggering a recession.

-

Rising Interest Rates: The Federal Reserve's (and other central banks') aggressive interest rate hikes, aimed at combating inflation, are also contributing to the sell-off. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profitability. This makes investors less willing to take on risk, leading to a decline in asset prices.

-

Recession Fears: The combination of high inflation and rising interest rates has fueled growing concerns about a potential recession. Economic indicators are mixed, but the possibility of a significant economic slowdown is weighing heavily on investor sentiment, prompting a flight to safety and contributing to the market sell-off.

-

Geopolitical Uncertainty: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other parts of the world, further adds to market uncertainty and contributes to the risk-off sentiment among investors.

What Should Investors Do?

The current market volatility presents a challenging environment for investors. There's no single "right" answer, as individual investment strategies should align with personal risk tolerance and long-term financial goals. However, several key considerations are crucial:

-

Diversification: Maintaining a well-diversified portfolio is critical to mitigating risk during periods of market turmoil. Spreading investments across different asset classes can help cushion the impact of losses in any single sector.

-

Long-Term Perspective: It's crucial to remember that market fluctuations are a normal part of the investment cycle. Investors with a long-term horizon should avoid making impulsive decisions based on short-term market movements.

-

Professional Advice: Seeking guidance from a qualified financial advisor can be invaluable during times of uncertainty. A financial advisor can help investors assess their risk tolerance, adjust their portfolio accordingly, and develop a long-term investment strategy tailored to their individual circumstances.

The Road Ahead: Uncertainty Remains

The current market sell-off highlights the inherent risks in investing. While the short-term outlook remains uncertain, analysts are closely monitoring economic data and central bank actions for clues about the direction of the market. The coming days and weeks will likely bring further volatility, underscoring the importance of a well-defined investment strategy and a long-term perspective. Investors should remain vigilant and prepared for potential further market corrections. The situation warrants close monitoring of economic indicators and news related to inflation, interest rates, and geopolitical events.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dow Futures Deep In Red As Broad Market Sell-Off Persists. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hamilton And Leclerc Pressure Ferrari For Crucial Sf 25 Upgrades

Apr 07, 2025

Hamilton And Leclerc Pressure Ferrari For Crucial Sf 25 Upgrades

Apr 07, 2025 -

Trouts Third Home Run In Three Games A Historic Streak

Apr 07, 2025

Trouts Third Home Run In Three Games A Historic Streak

Apr 07, 2025 -

Bahrain Victorious Strategy For The Itzulia Basque Country

Apr 07, 2025

Bahrain Victorious Strategy For The Itzulia Basque Country

Apr 07, 2025 -

Irs Announces Recall Of Probationary Employees Mid April Deadline

Apr 07, 2025

Irs Announces Recall Of Probationary Employees Mid April Deadline

Apr 07, 2025 -

Tariff Fears Trigger Hong Kong Stock Markets Sharpest Fall Since Asian Financial Crisis

Apr 07, 2025

Tariff Fears Trigger Hong Kong Stock Markets Sharpest Fall Since Asian Financial Crisis

Apr 07, 2025