Enhancing Bank Liquidity And Deposits Through Stablecoin Adoption

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Enhancing Bank Liquidity and Deposits Through Stablecoin Adoption: A New Era for Financial Institutions?

The global financial landscape is undergoing a seismic shift, driven by technological advancements and evolving customer expectations. One of the most promising innovations poised to reshape the banking sector is the integration of stablecoins. While still nascent, the potential of stablecoins to enhance bank liquidity and attract new deposits is undeniable, offering a compelling solution to long-standing challenges faced by financial institutions. This article delves into the ways stablecoins can revolutionize banking practices.

H2: Understanding the Liquidity Crunch and the Role of Stablecoins

Banks constantly grapple with managing liquidity – ensuring they have enough readily available funds to meet customer demands and regulatory requirements. Traditional methods, like borrowing from central banks or other institutions, can be expensive and complex. Stablecoins, pegged to a stable asset like the US dollar, offer a potential solution by providing a readily available and easily transferable form of digital cash. Their inherent stability minimizes the risk associated with volatile cryptocurrencies, making them an attractive option for banks looking to bolster their reserves.

H2: Attracting Deposits with Stablecoin-Based Savings Accounts

The integration of stablecoins can significantly enhance a bank's ability to attract deposits, particularly from a younger, tech-savvy demographic. Offering stablecoin-based savings accounts allows banks to:

- Increase competitiveness: By offering higher interest rates or innovative features tied to stablecoin accounts, banks can differentiate themselves from competitors and lure customers seeking better returns.

- Expand reach: Stablecoins facilitate seamless cross-border transactions, opening up new markets and attracting international deposits.

- Improve customer experience: The speed and efficiency of stablecoin transactions offer a vastly superior customer experience compared to traditional banking methods. This improved user experience leads to increased customer satisfaction and loyalty.

H3: Addressing Regulatory Concerns and Risks

While the potential benefits are significant, the adoption of stablecoins also presents regulatory challenges. Concerns regarding money laundering, terrorist financing, and systemic risk require careful consideration and proactive regulatory frameworks. Robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols are crucial to mitigate these risks and build trust in the system. Furthermore, the inherent volatility of the underlying assets backing some stablecoins poses a significant risk that needs to be carefully managed. Therefore, banks must carefully select stablecoins backed by robust reserves and audited regularly.

H2: The Future of Banking: A Hybrid Model

The future of banking likely involves a hybrid model, integrating traditional financial systems with innovative technologies like stablecoins. This integration will not only enhance liquidity and attract deposits but also streamline processes, reduce costs, and improve the overall customer experience. Banks that embrace this evolution and proactively adapt to the changing landscape will be better positioned for success in the increasingly competitive financial market.

H2: Conclusion: Embracing Innovation for Growth

Stablecoin adoption represents a significant opportunity for banks to address long-standing liquidity challenges and attract new deposits. By carefully managing the risks and collaborating with regulators, financial institutions can leverage this innovative technology to enhance their operational efficiency, expand their reach, and solidify their position in the evolving financial ecosystem. The successful integration of stablecoins promises a future of more efficient, inclusive, and customer-centric banking. This evolution is not just about technology; it’s about embracing innovation for sustainable growth and a stronger, more resilient financial system.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Enhancing Bank Liquidity And Deposits Through Stablecoin Adoption. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Virat Kohli And Kl Rahuls Heated Exchange An Ex Rcb Coachs Account

Apr 29, 2025

Virat Kohli And Kl Rahuls Heated Exchange An Ex Rcb Coachs Account

Apr 29, 2025 -

Income Allianz Deal Opposition Leaders Stance Ahead Of Ge 2025

Apr 29, 2025

Income Allianz Deal Opposition Leaders Stance Ahead Of Ge 2025

Apr 29, 2025 -

Improving Web Development Workflow Exploring Googles Claybrook Ai Model For Ui Ux

Apr 29, 2025

Improving Web Development Workflow Exploring Googles Claybrook Ai Model For Ui Ux

Apr 29, 2025 -

Before Suicide Squad Will Smith And Margot Robbies 2015 Box Office Flop

Apr 29, 2025

Before Suicide Squad Will Smith And Margot Robbies 2015 Box Office Flop

Apr 29, 2025 -

Direct Ligue Des Champions Arsenal Affronte Le Psg Compos Officielles Et Enjeux De La Demi Finale

Apr 29, 2025

Direct Ligue Des Champions Arsenal Affronte Le Psg Compos Officielles Et Enjeux De La Demi Finale

Apr 29, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

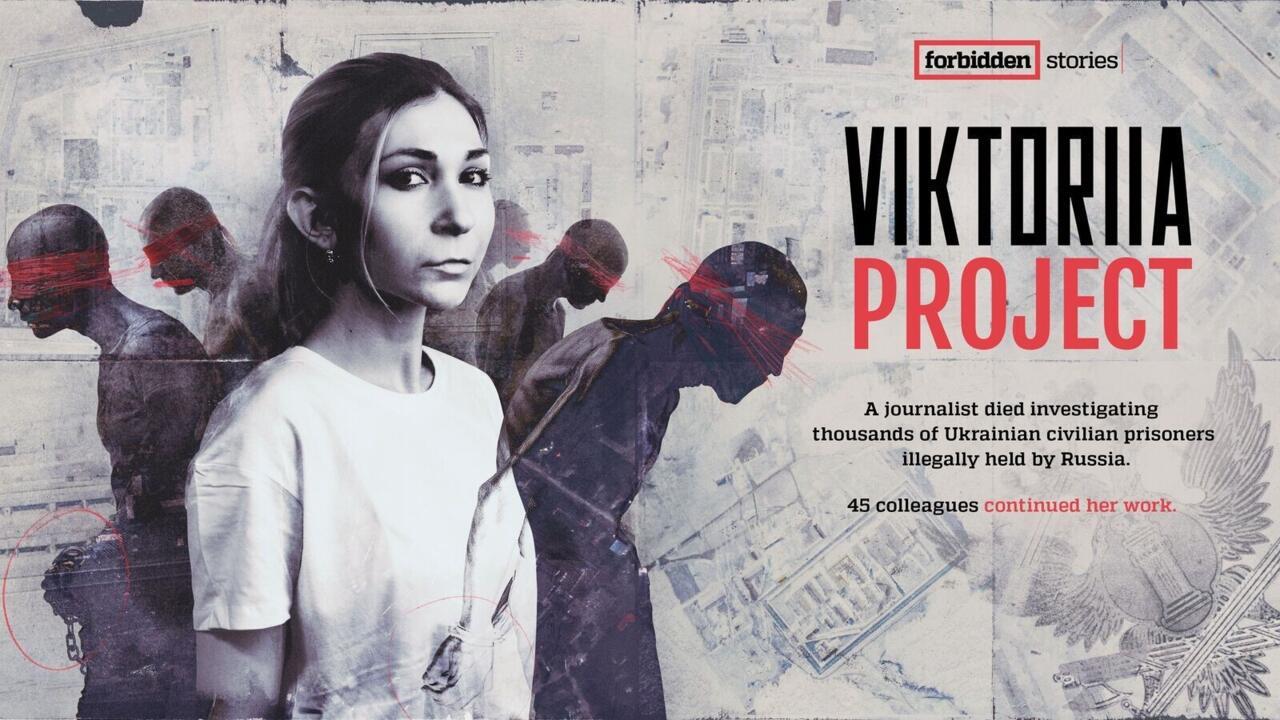

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025