Ethereum Price Crash: 11% Drop — Crucial Support Levels Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Price Crash: 11% Drop — Crucial Support Levels Analyzed

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, experienced a significant price crash today, plummeting by over 11% in a single day. This dramatic downturn has sent shockwaves through the crypto market and left investors wondering what the future holds for ETH. This article analyzes the reasons behind the crash and examines the crucial support levels that could determine the future direction of Ethereum's price.

The 11% Plunge: What Triggered the Ethereum Price Crash?

The sharp decline in Ethereum's price isn't attributable to a single event, but rather a confluence of factors. Several key elements contributed to today's volatility:

-

Overall Market Sentiment: The broader cryptocurrency market has been experiencing a period of uncertainty and fear, largely influenced by regulatory concerns and macroeconomic factors like rising interest rates. This negative sentiment has spilled over into Ethereum, exacerbating its price decline.

-

Liquidations: A significant number of leveraged long positions (bets on ETH price increases) were liquidated during the downturn, adding further downward pressure to the price. This cascading effect amplified the initial price drop.

-

Lack of Significant Catalysts: The absence of major bullish catalysts, such as significant network upgrades or institutional investments, left Ethereum vulnerable to negative market forces.

-

Technical Indicators: Several technical indicators, including moving averages and relative strength index (RSI), had already signaled an overbought condition before the crash, suggesting a potential correction was imminent.

Crucial Support Levels to Watch:

The immediate future of Ethereum's price hinges on whether it can hold crucial support levels. Traders and analysts are closely monitoring these key price points:

-

$1,600: This level represents a significant psychological support level and a previous resistance level. Breaking below $1,600 could trigger further selling pressure and lead to a deeper correction.

-

$1,500: This is another major support level. A break below $1,500 would be considered extremely bearish and could signal a more prolonged downturn.

-

$1,400: This represents a strong historical support level. A decisive break below $1,400 could trigger a significant sell-off and potentially lead to further price declines.

What's Next for Ethereum?

The short-term outlook for Ethereum remains uncertain. While the 11% drop is significant, it's important to remember that cryptocurrency markets are highly volatile. A rebound is possible, particularly if broader market sentiment improves or if positive news emerges regarding Ethereum's development.

However, investors should be prepared for continued volatility. The lack of major catalysts and the lingering negative market sentiment suggest that a period of consolidation or further price corrections may be in store before a sustained upward trend can resume. Careful risk management and a long-term investment strategy are crucial for navigating the current market uncertainty.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you could lose some or all of your investment. Always conduct thorough research and consider your own risk tolerance before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Price Crash: 11% Drop — Crucial Support Levels Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

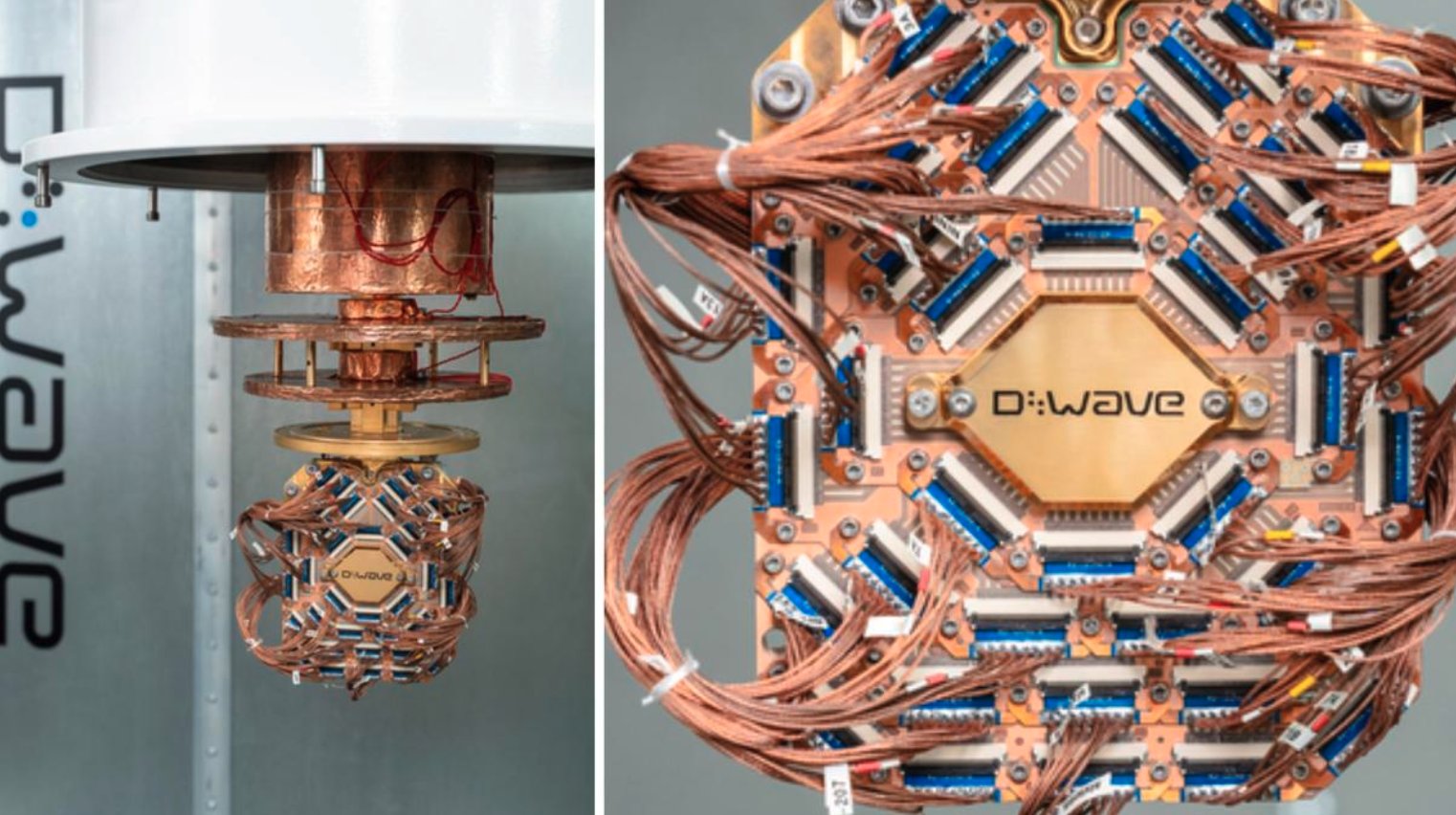

Quantum Leap D Waves Annealer Solves Materials Science Problem Faster Than Supercomputers

Mar 30, 2025

Quantum Leap D Waves Annealer Solves Materials Science Problem Faster Than Supercomputers

Mar 30, 2025 -

Trauer Um Name Fc Bayern Traegt Trauerflor Im Spiel Gegen Gegner

Mar 30, 2025

Trauer Um Name Fc Bayern Traegt Trauerflor Im Spiel Gegen Gegner

Mar 30, 2025 -

Watch Sara Ali Khans Captivating Dance Dedicated To Riyan Parag

Mar 30, 2025

Watch Sara Ali Khans Captivating Dance Dedicated To Riyan Parag

Mar 30, 2025 -

Shifting Sands At Dbs Piyush Guptas Banking Masterplan And Its Demise

Mar 30, 2025

Shifting Sands At Dbs Piyush Guptas Banking Masterplan And Its Demise

Mar 30, 2025 -

Serie A Confirmed Lineups For Inter Milan Vs Udinese

Mar 30, 2025

Serie A Confirmed Lineups For Inter Milan Vs Udinese

Mar 30, 2025