Falling Retail Sales Pressure RBA Into Interest Rate Decision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Falling Retail Sales Pressure RBA into Interest Rate Decision

Australia's Reserve Bank (RBA) faces a crucial decision on interest rates next month, grappling with the weight of disappointing retail sales figures. The latest data reveals a significant slowdown in consumer spending, adding pressure to hold off on further rate hikes and potentially even signaling a shift towards a more dovish monetary policy stance. This development throws the RBA's inflation-fighting strategy into sharper focus, raising questions about the effectiveness of previous rate increases and the potential impact on the broader economy.

Retail Sales Slump Fuels Rate Hike Debate

The unexpected dip in retail sales for [Insert Month and Year, e.g., August 2024] has sent shockwaves through the financial markets. Analysts had predicted modest growth, but the actual figures revealed a [Insert Percentage, e.g., 0.5%] decline – the largest fall in [Insert Time Period, e.g., six months]. This significant drop indicates weakening consumer confidence and spending power, potentially signaling a broader economic slowdown.

Several factors are contributing to this downturn. High inflation, persistent interest rate increases, and the rising cost of living are squeezing household budgets, forcing consumers to cut back on non-essential spending. This is particularly evident in discretionary sectors like [Insert Examples, e.g., electronics, furniture, and clothing], where sales have plummeted.

RBA's Tightrope Walk: Inflation vs. Economic Growth

The RBA is now caught in a difficult position. Its primary mandate is to control inflation, which remains stubbornly high at [Insert Current Inflation Rate, e.g., 7%]. However, the weakening retail sales data suggests that the current monetary policy tightening is starting to bite, potentially pushing the economy into a recession.

The central bank must carefully balance the need to curb inflation with the risk of triggering a sharp economic downturn. Further rate hikes could exacerbate the already fragile consumer sentiment and potentially stifle economic growth further. Conversely, pausing or even cutting rates might fuel inflationary pressures, undoing the progress made so far.

What to Expect from the RBA's Next Move?

The RBA's upcoming interest rate decision in [Insert Month, e.g., October] is highly anticipated. Economists are divided on the likely outcome. Some believe the RBA will maintain its current course, citing persistent inflation as the primary concern. Others argue that the weak retail sales data necessitates a pause, or even a rate cut, to prevent a deeper economic contraction.

- Possible Scenarios:

- Rate Hike: A continued focus on inflation control despite the weakening economy. This scenario could further dampen consumer spending and potentially trigger a recession.

- Rate Pause: A temporary halt to rate increases to assess the impact of previous hikes and the evolving economic landscape. This would provide time to observe the effects on inflation and economic growth.

- Rate Cut: An unexpected but potentially necessary move to stimulate economic activity and boost consumer confidence. This is less likely given the high inflation rate but could be considered if the economic outlook worsens significantly.

The Path Ahead: Uncertainty and Volatility

The current economic climate is characterized by significant uncertainty. The RBA's decision will undoubtedly have a major impact on the Australian economy, influencing consumer confidence, investment decisions, and the overall trajectory of economic growth. Market volatility is likely to persist until the RBA's next announcement, with investors closely watching any indicators of economic weakness or strength. The coming weeks will be crucial in shaping the RBA's policy direction and the future of the Australian economy. The impact on mortgages, savings, and investment strategies will also be significant, prompting careful monitoring of the situation by both businesses and individuals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Falling Retail Sales Pressure RBA Into Interest Rate Decision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New Horror Film Sets Record For Most Creative On Screen Deaths

May 08, 2025

New Horror Film Sets Record For Most Creative On Screen Deaths

May 08, 2025 -

Black Rocks Bitcoin Etf 530 Million Influx Ethereum Funds Remain Unchanged

May 08, 2025

Black Rocks Bitcoin Etf 530 Million Influx Ethereum Funds Remain Unchanged

May 08, 2025 -

Al Ittihad Stages Stunning Comeback To Defeat Al Nassr 3 2

May 08, 2025

Al Ittihad Stages Stunning Comeback To Defeat Al Nassr 3 2

May 08, 2025 -

Kris Bryants Back Ablation Procedure Confirmed

May 08, 2025

Kris Bryants Back Ablation Procedure Confirmed

May 08, 2025 -

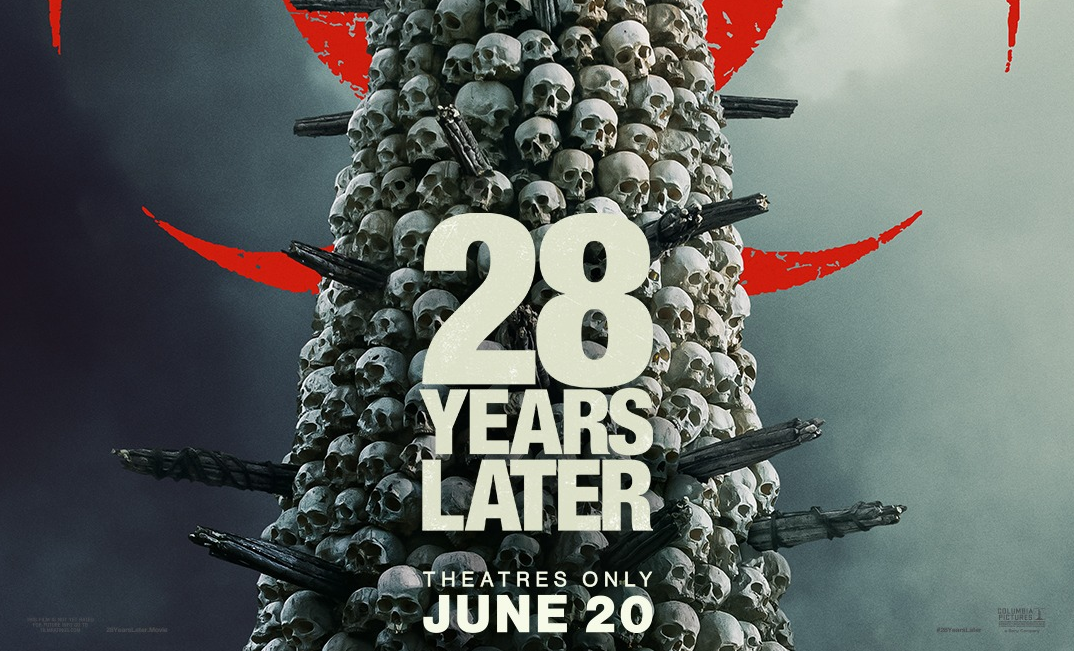

New 28 Years Later Poster Hints At Bone Temples Significance

May 08, 2025

New 28 Years Later Poster Hints At Bone Temples Significance

May 08, 2025

Latest Posts

-

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025

Denver Nuggets Defeat Oklahoma City Thunder May 5 2025 Game Recap

May 08, 2025 -

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025

2025 Nba Season Denver Nuggets Vs Oklahoma City Thunder May 7th Game Report

May 08, 2025 -

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025

Denver Nuggets At Oklahoma City Thunder Game 1 Analysis And Betting Odds

May 08, 2025 -

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025

Fact Check Pakistan Ministers Claim Of No Terror Camps Faces Scrutiny

May 08, 2025 -

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025

35 Unit 42 U Racks A Us Vendors Choice Of Amd Epyc 4005 Mini Pcs For High Density Computing

May 08, 2025