Federal Regulation Of Tokenized RWAs: Robinhood's Call To Action For The SEC

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Urges SEC Action: Clarity Needed on Federal Regulation of Tokenized Real-World Assets (RWAs)

The financial technology landscape is rapidly evolving, with tokenized real-world assets (RWAs) emerging as a significant player. However, the regulatory landscape remains murky, prompting calls for clearer guidelines from industry leaders. Robinhood, the popular investing app, has recently added its voice to the chorus, urging the Securities and Exchange Commission (SEC) to establish a comprehensive federal regulatory framework for these innovative financial instruments. This lack of clarity, Robinhood argues, is hindering innovation and potentially exposing investors to unnecessary risk.

What are Tokenized RWAs?

Tokenized RWAs represent fractional ownership of real-world assets, such as real estate, art, commodities, or even intellectual property, encoded on a blockchain. This digitization offers several advantages, including increased liquidity, fractional ownership accessibility, and streamlined trading processes. However, the very nature of these assets – bridging the traditional financial world with the decentralized world of blockchain – creates complex regulatory challenges.

Robinhood's Concerns and Proposed Solutions:

Robinhood's call to action highlights several key concerns regarding the current regulatory vacuum surrounding tokenized RWAs:

- Investor Protection: Without clear guidelines, investors are vulnerable to fraud and manipulation. Robust regulations are crucial to safeguard investor interests and build trust in this emerging market.

- Innovation Stifling: Uncertainty surrounding regulatory compliance discourages innovation and prevents the development of potentially beneficial financial products and services. A clear regulatory path fosters responsible growth.

- Competitive Disadvantage: The lack of a cohesive federal framework puts U.S. firms at a competitive disadvantage against international players operating in less regulated markets.

Robinhood advocates for the SEC to:

- Develop a comprehensive regulatory framework: This framework should address the unique characteristics of tokenized RWAs while balancing innovation with investor protection.

- Clarify the definition of securities: The SEC needs to provide clear guidance on which tokenized RWAs qualify as securities under existing laws. This will prevent unintentional violations and promote legal certainty.

- Foster collaboration: The SEC should collaborate with other regulatory bodies and industry stakeholders to ensure a coordinated and effective regulatory approach.

The SEC's Response and Future Outlook:

The SEC has yet to formally respond to Robinhood's call to action. However, the agency has signaled its intention to carefully scrutinize the growing tokenized RWA market. Several ongoing SEC investigations and enforcement actions demonstrate the agency's commitment to addressing potential risks. The future of this sector hinges on the development of a balanced regulatory framework that fosters innovation while mitigating risks.

The Importance of Clear Regulation for the Future of Finance:

The successful integration of tokenized RWAs into the mainstream financial system requires a clear and consistent regulatory approach. Robinhood's proactive stance underlines the urgency of addressing this issue. The potential benefits of tokenized RWAs are substantial, but these benefits can only be fully realized with a regulatory environment that encourages responsible innovation and safeguards investors. The SEC's actions in the coming months will be crucial in shaping the future of this transformative technology. The industry awaits the agency’s response with bated breath, hoping for a pragmatic and forward-thinking regulatory solution.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Regulation Of Tokenized RWAs: Robinhood's Call To Action For The SEC. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Longtime Indianapolis Colts Owner Jim Irsay Dies At 65

May 23, 2025

Longtime Indianapolis Colts Owner Jim Irsay Dies At 65

May 23, 2025 -

Gta 6 Interactive Map Plan Your Heists Now

May 23, 2025

Gta 6 Interactive Map Plan Your Heists Now

May 23, 2025 -

Predicting The Knicks Pacers Series The Impact Of The Towns Turner Center Matchup

May 23, 2025

Predicting The Knicks Pacers Series The Impact Of The Towns Turner Center Matchup

May 23, 2025 -

Security Risks And Ethical Questions Surrounding Trumps Use Of Qatari Jet

May 23, 2025

Security Risks And Ethical Questions Surrounding Trumps Use Of Qatari Jet

May 23, 2025 -

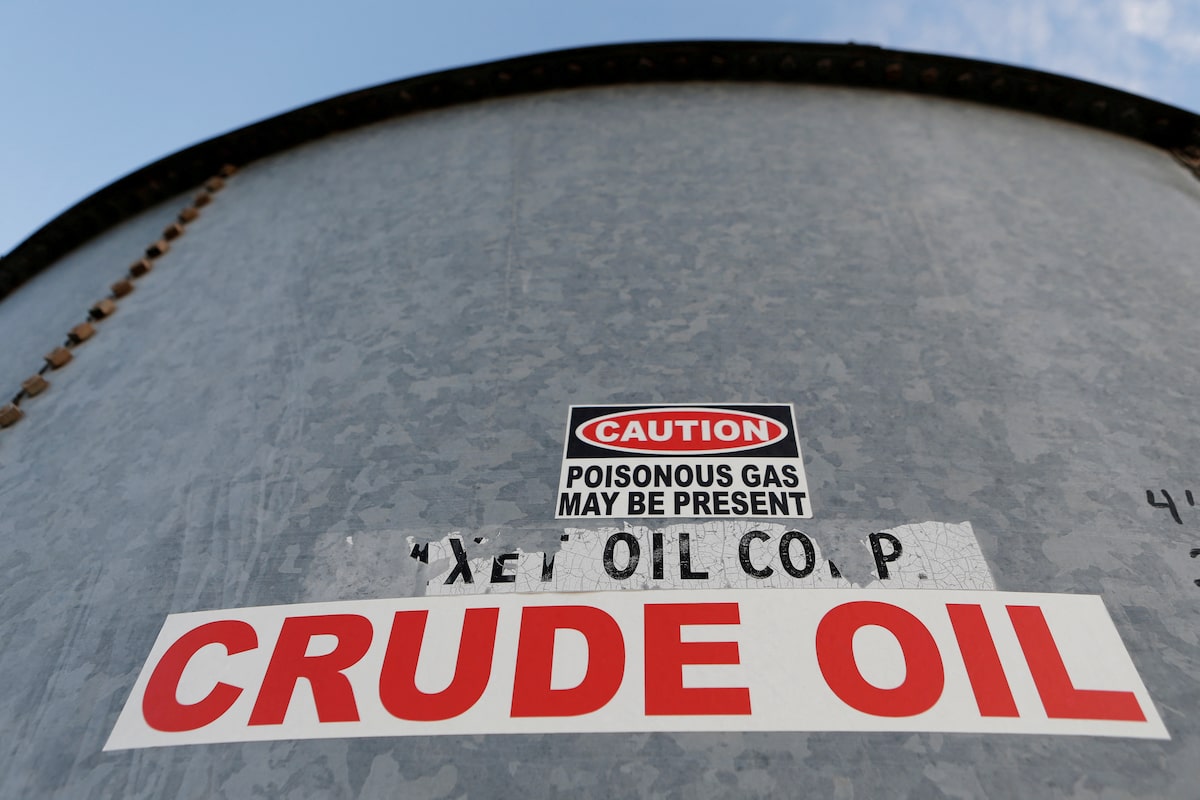

U S Energy Reserves Rise Eia Data Shows Unexpected Build In Crude And Fuel Inventories

May 23, 2025

U S Energy Reserves Rise Eia Data Shows Unexpected Build In Crude And Fuel Inventories

May 23, 2025

Latest Posts

-

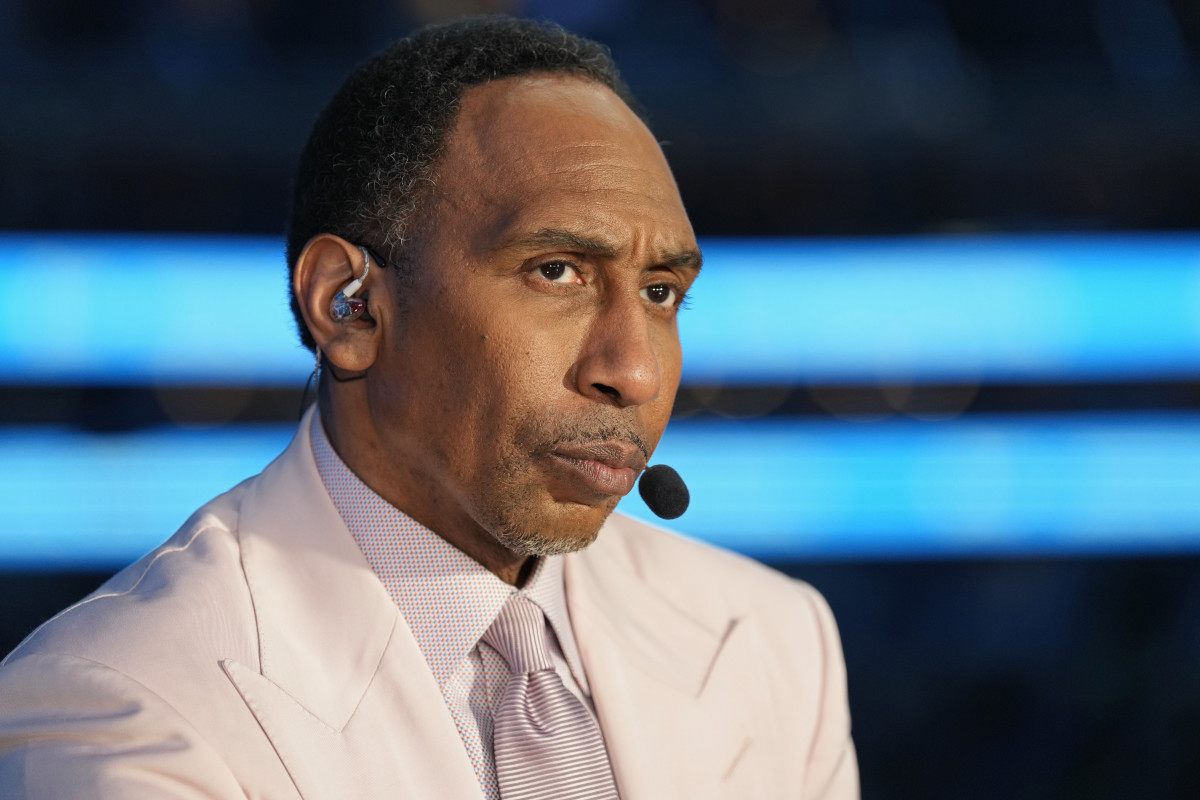

Stephen A Smith Condemns Cnn Anchors On Air Conduct

May 23, 2025

Stephen A Smith Condemns Cnn Anchors On Air Conduct

May 23, 2025 -

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025

Google Gemini Volvos Pioneering In Car Ai Technology

May 23, 2025 -

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025

Bitcoin Surges Past 106 K Institutional Investors Drive Market Rally

May 23, 2025 -

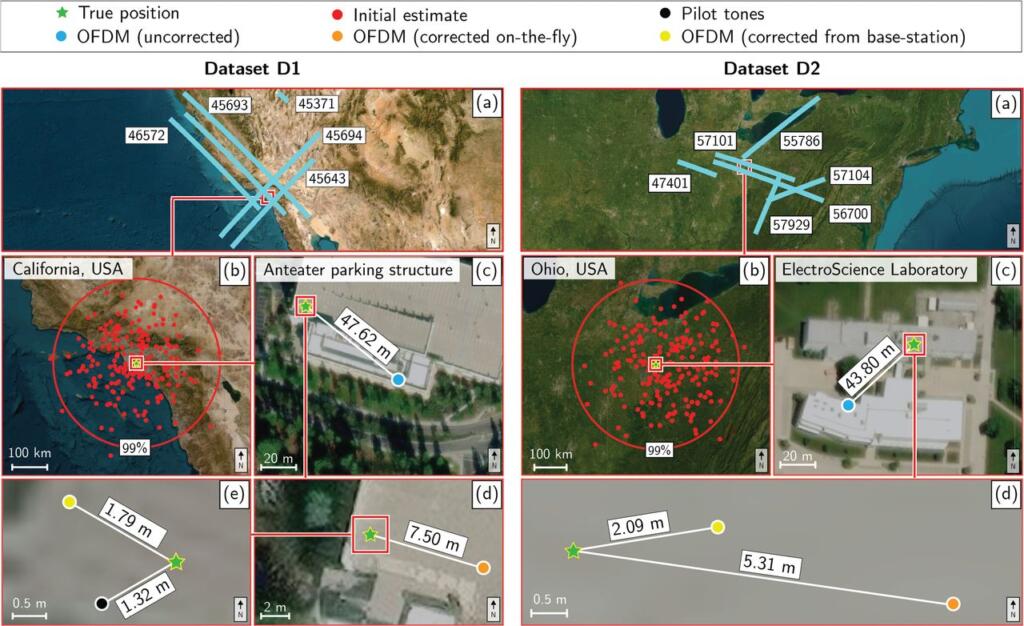

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025

Could Starlinks Gps Be The Future Space X Seeks Fcc Approval For Spectrum Access

May 23, 2025 -

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025

Nba Mvp Shai Gilgeous Alexanders Historic Season

May 23, 2025