Financial Markets Crash: Why You Shouldn't Panic Sell

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Markets Crash: Why You Shouldn't Panic Sell

Financial markets are inherently volatile. While periods of growth and stability are the norm, periodic crashes, like the one we may be witnessing now, are an inevitable part of the economic cycle. Fear and uncertainty grip investors during these times, leading many to consider – or even execute – panic selling. But before you succumb to the pressure, understand this: panic selling is almost always a disastrous strategy. This article will explore why you should resist the urge to sell your assets during a market downturn and outline a more reasoned approach to navigating financial uncertainty.

Understanding Market Crashes: A Necessary Perspective

Market crashes are characterized by a sharp and rapid decline in asset values, often driven by a confluence of factors. These can include macroeconomic events (like inflation, recessionary fears, or geopolitical instability), unexpected economic news, or even shifts in investor sentiment fueled by speculation and fear. While the immediate impact can be unsettling, historically, these crashes have been followed by periods of recovery and even substantial growth.

Why Panic Selling is Detrimental

Panic selling is the act of selling investments rapidly and irrationally in response to fear, often at the worst possible time. This behavior is driven by emotion rather than logic and can have several negative consequences:

- Crystallizing Losses: Selling low locks in your losses. You effectively confirm the market's temporary negativity, missing out on potential future gains.

- Missing Out on Recovery: Market rebounds are often swift and dramatic. By selling at the bottom, you forfeit the opportunity to participate in the recovery and potentially recoup your losses.

- Emotional Decision-Making: Fear is a terrible financial advisor. Rational investment strategies should be based on long-term goals, not short-term market fluctuations.

- Tax Implications: Depending on your jurisdiction and the type of investment, selling assets during a downturn could trigger capital gains taxes, exacerbating your losses.

A More Strategic Approach: Ride Out the Storm

Instead of panicking, consider these strategies during a market downturn:

- Review Your Financial Plan: Refer back to your long-term financial goals. Does the current market volatility significantly impact your long-term objectives? If not, consider staying the course.

- Diversify Your Portfolio: A well-diversified portfolio, including a mix of asset classes, can help mitigate risk. Don't put all your eggs in one basket.

- Dollar-Cost Averaging: If you have additional funds to invest, consider using dollar-cost averaging to gradually buy more assets at lower prices.

- Consult a Financial Advisor: Seek professional advice from a qualified financial advisor. They can provide personalized guidance based on your specific circumstances and risk tolerance.

- Focus on the Long Term: Remember that market fluctuations are normal. Focus on your long-term investment goals and avoid making impulsive decisions based on short-term market noise.

Conclusion: Patience and Perspective are Key

Market crashes are daunting, but they are not unprecedented. Panic selling is rarely a sound investment strategy. By adopting a rational, long-term perspective, reviewing your financial plan, and potentially seeking professional advice, you can navigate these challenging times and position yourself for future growth. Remember, investing is a marathon, not a sprint. Stay informed, stay disciplined, and stay calm. The market will eventually recover.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Markets Crash: Why You Shouldn't Panic Sell. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Tariffs Trigger China Retaliation Sending Stock Markets Into Freefall

Apr 07, 2025

Trump Tariffs Trigger China Retaliation Sending Stock Markets Into Freefall

Apr 07, 2025 -

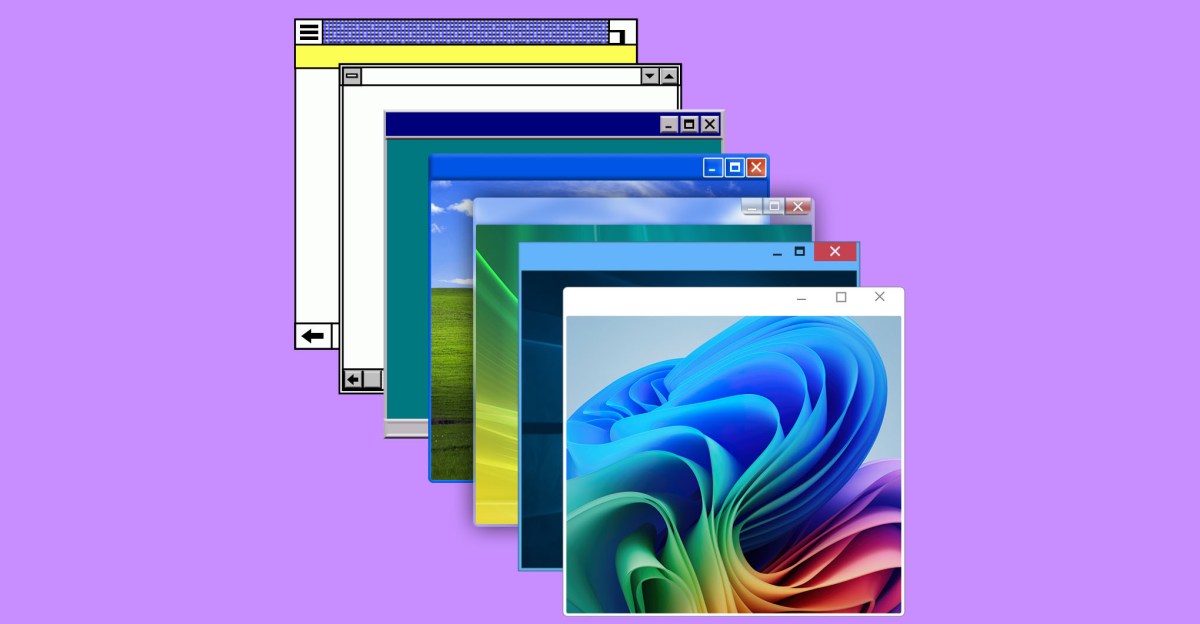

50 Years Of Microsoft A Retrospective On Leadership And Technological Advancement

Apr 07, 2025

50 Years Of Microsoft A Retrospective On Leadership And Technological Advancement

Apr 07, 2025 -

Bulldogs Unexpected Coaching Change Shakes Up College Football

Apr 07, 2025

Bulldogs Unexpected Coaching Change Shakes Up College Football

Apr 07, 2025 -

Buffett Defends Then Deploys The Evolution Of His Cash Position

Apr 07, 2025

Buffett Defends Then Deploys The Evolution Of His Cash Position

Apr 07, 2025 -

Bursa Saham Hong Kong Di Ambang Bencana Kebijakan Trump Sebabkan Kerugian Besar

Apr 07, 2025

Bursa Saham Hong Kong Di Ambang Bencana Kebijakan Trump Sebabkan Kerugian Besar

Apr 07, 2025