Financial Strategies For A Budget-Neutral US Bitcoin Reserve

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Strategies for a Budget-Neutral US Bitcoin Reserve

The idea of a U.S. Bitcoin reserve, while controversial, is gaining traction in certain political and financial circles. But how could such a reserve be established without impacting the federal budget? This article explores potential financial strategies for creating a budget-neutral Bitcoin reserve for the United States.

The Challenge: Acquiring Bitcoin Without Budgetary Strain

The primary hurdle in establishing a U.S. Bitcoin reserve is the significant financial commitment. Direct government purchase of Bitcoin would require substantial budget allocation, potentially facing opposition from lawmakers concerned about fiscal responsibility. A budget-neutral approach is crucial for gaining widespread support.

Strategies for a Budget-Neutral Bitcoin Reserve:

Several financial strategies could enable the creation of a Bitcoin reserve without increasing the national debt or diverting funds from other essential programs. These include:

-

Seigniorage Profits: The U.S. Mint generates profit from the difference between the face value of coins and the cost of production. A portion of these seigniorage profits could be allocated towards Bitcoin acquisition. While this approach provides a consistent, albeit limited, income stream, it's unlikely to fund a large-scale Bitcoin reserve quickly.

-

Tax Revenue Allocation: Designating a portion of existing tax revenues—perhaps from capital gains taxes or a new cryptocurrency tax—to fund Bitcoin purchases could provide a more substantial and consistent funding source. This strategy requires legislative changes and public acceptance of the initiative. Transparency and clear guidelines for the allocation of these funds would be crucial to ensure public trust.

-

Private Sector Partnerships: Collaborating with private sector entities—through public-private partnerships (PPPs) or other innovative models—could help acquire Bitcoin without direct government spending. This could involve arrangements where private companies contribute Bitcoin in exchange for certain government benefits or incentives. Such partnerships must be carefully structured to prevent conflicts of interest and ensure accountability.

-

International Cryptocurrency Exchange: The US could leverage its position in global finance to establish a regulated, national cryptocurrency exchange. Profits from exchange fees could be used to purchase Bitcoin for the reserve. This approach necessitates robust regulatory frameworks to protect investors and maintain market integrity.

Mitigating Risks and Ensuring Transparency

Establishing a Bitcoin reserve involves significant risks, including volatility in the cryptocurrency market. To mitigate these risks, several measures should be considered:

-

Diversification: Instead of solely investing in Bitcoin, the reserve could diversify its holdings across multiple cryptocurrencies or other assets to reduce exposure to any single market.

-

Gradual Acquisition: A phased approach, acquiring Bitcoin over time, would lessen the impact of market fluctuations.

-

Robust Security Measures: Protecting the reserve's Bitcoin holdings from theft or hacking requires robust cybersecurity measures and a clear chain of custody.

-

Complete Transparency: Regular public reporting on the reserve's holdings, acquisitions, and performance is vital to build public trust and ensure accountability.

Conclusion:

Creating a budget-neutral U.S. Bitcoin reserve is a complex undertaking requiring innovative financial strategies, robust risk management, and transparent governance. While challenges exist, the strategies outlined above offer potential pathways to explore this novel approach to national financial policy. Further research and public debate are essential to determine the feasibility and desirability of such an initiative. The long-term implications of a national Bitcoin reserve, both positive and negative, warrant careful consideration by policymakers and the public alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Strategies For A Budget-Neutral US Bitcoin Reserve. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

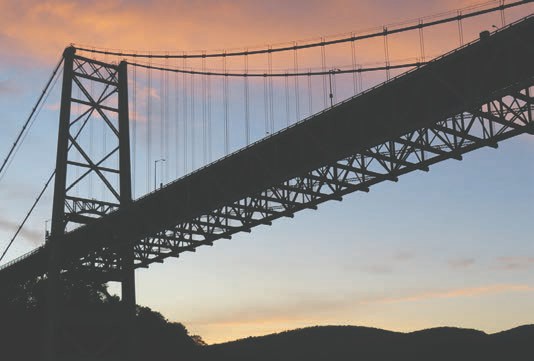

Increased Security Measures Anti Climb Fencing Eyed For Bear Mountain Bridge

Mar 18, 2025

Increased Security Measures Anti Climb Fencing Eyed For Bear Mountain Bridge

Mar 18, 2025 -

Emiten Kapitalisasi Besar Deretan Perusahaan Yang Segera Bagikan Dividen

Mar 18, 2025

Emiten Kapitalisasi Besar Deretan Perusahaan Yang Segera Bagikan Dividen

Mar 18, 2025 -

Panduan Membeli Emas Batangan Perbandingan Harga Antam Dan Pegadaian

Mar 18, 2025

Panduan Membeli Emas Batangan Perbandingan Harga Antam Dan Pegadaian

Mar 18, 2025 -

Las Vegas Strip Charity Event Head Shaving For A 350 000 Cause

Mar 18, 2025

Las Vegas Strip Charity Event Head Shaving For A 350 000 Cause

Mar 18, 2025 -

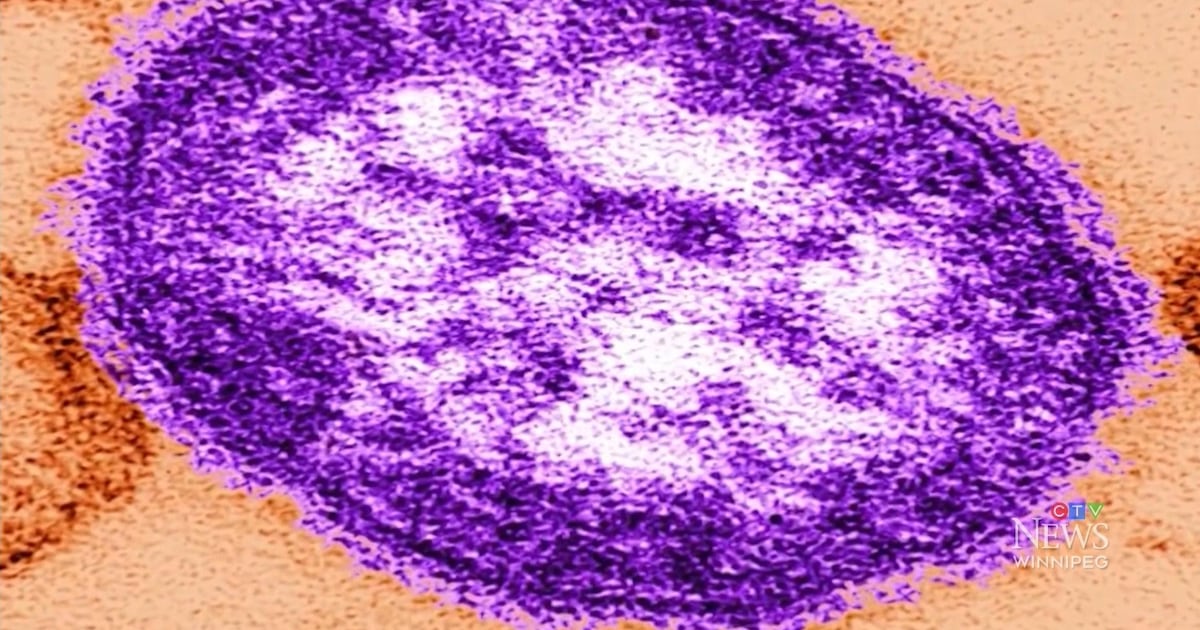

Edmonton Measles Outbreak Two Cases Prompt Health Alert

Mar 18, 2025

Edmonton Measles Outbreak Two Cases Prompt Health Alert

Mar 18, 2025

Latest Posts

-

Meta Xr Headset Release Late 2024 Launch Predicted Outpacing Apple

Apr 30, 2025

Meta Xr Headset Release Late 2024 Launch Predicted Outpacing Apple

Apr 30, 2025 -

I Phone App Store Monopoly Challenged The Epic Games Stores Android Success

Apr 30, 2025

I Phone App Store Monopoly Challenged The Epic Games Stores Android Success

Apr 30, 2025 -

Tennis Star Daniil Medvedev Offers Scathing Criticism Of Carlos Alcarazs Netflix Show

Apr 30, 2025

Tennis Star Daniil Medvedev Offers Scathing Criticism Of Carlos Alcarazs Netflix Show

Apr 30, 2025 -

Nvidia H20 Export Ban Huaweis New Ai Chip And The Question Of Timing

Apr 30, 2025

Nvidia H20 Export Ban Huaweis New Ai Chip And The Question Of Timing

Apr 30, 2025 -

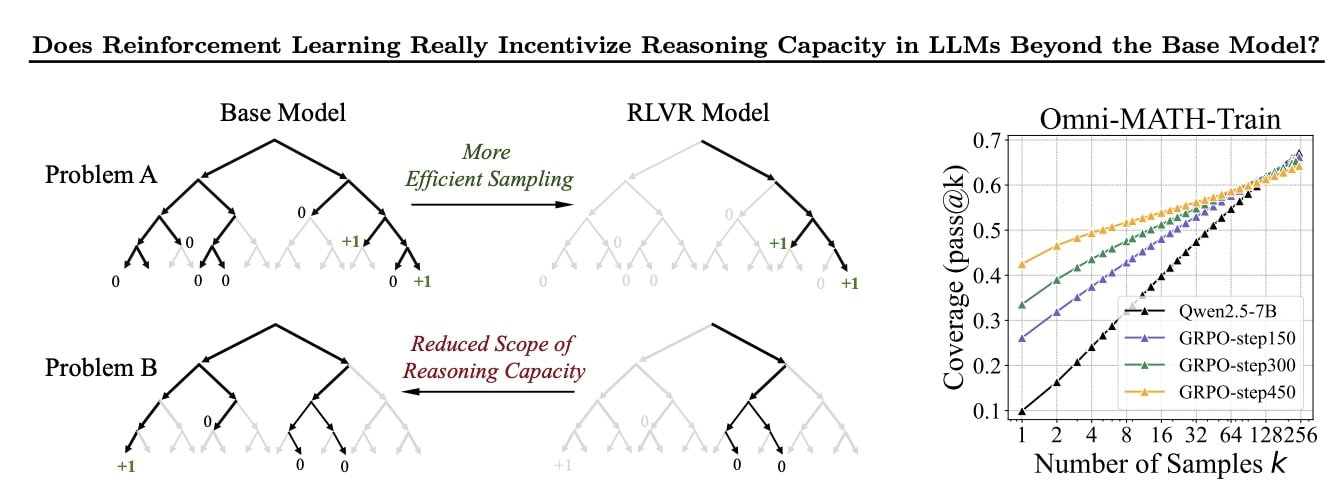

Does Reinforcement Learning Truly Enhance Ai A Critical Analysis

Apr 30, 2025

Does Reinforcement Learning Truly Enhance Ai A Critical Analysis

Apr 30, 2025