Geopolitical Risks And Defence Stocks: Investing In HAL, BEL, Or Mazagon Dock Shipbuilders

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Geopolitical Risks and Defence Stocks: Should You Invest in HAL, BEL, or Mazagon Dock Shipbuilders?

The global geopolitical landscape is increasingly volatile, marked by escalating tensions and unpredictable shifts in power dynamics. This uncertainty creates both challenges and opportunities for investors, particularly in sectors perceived as crucial for national security. The defense sector, often seen as a safe haven during times of instability, is attracting considerable attention, with investors eyeing Indian defense Public Sector Undertakings (PSUs) like Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), and Mazagon Dock Shipbuilders Limited (MDL). But is investing in these stocks a smart move? Let's delve into the potential benefits and risks.

The Allure of Defence Stocks in a Turbulent World

Rising geopolitical tensions, regional conflicts, and the ongoing modernization of armed forces worldwide are fueling demand for defense equipment and services. This translates into robust growth prospects for companies like HAL, BEL, and MDL, all major players in India's burgeoning defense industry. India's strategic location and its commitment to strengthening its military capabilities further bolster the appeal of these stocks. The government's push for "Atmanirbhar Bharat" (self-reliant India), emphasizing domestic manufacturing of defense equipment, presents a significant tailwind for these PSUs.

HAL: Taking Flight?

Hindustan Aeronautics Limited (HAL) is a leading aerospace and defense company, manufacturing aircraft, helicopters, and other defense equipment for the Indian armed forces and export markets. While HAL enjoys a strong order book and benefits from government initiatives, investors should consider potential challenges:

- Operational Efficiency: HAL has faced criticism regarding its production timelines and operational efficiency in the past.

- Competition: Increased competition from both domestic and international players could impact market share.

BEL: A Reliable Radar?

Bharat Electronics Limited (BEL) is a major player in the electronics and defense sector, specializing in radar systems, communication equipment, and other defense electronics. BEL benefits from:

- Diversified Product Portfolio: This reduces reliance on any single product or customer.

- Strong Government Support: Consistent government orders provide a stable revenue stream.

However, investors should note:

- Technological Advancements: Keeping pace with rapid technological advancements in the defense electronics sector is crucial for long-term success.

MDL: Sailing Towards Growth?

Mazagon Dock Shipbuilders Limited (MDL) is a leading shipyard building warships and submarines for the Indian Navy. Key advantages include:

- Strategic Importance: MDL's role in strengthening India's naval capabilities ensures consistent demand for its services.

- Modernization Initiatives: Investments in modernizing its facilities enhance production capacity and efficiency.

Potential risks include:

- Long Project Cycles: Shipbuilding projects often span several years, impacting short-term profitability.

- Geopolitical Uncertainty: International relations can impact orders and project timelines.

Investing Wisely in the Defence Sector

While the Indian defense sector presents significant growth potential, investing in HAL, BEL, or MDL requires careful consideration of several factors:

- Market Volatility: Defence stocks can be susceptible to market fluctuations, influenced by global events and geopolitical developments.

- Government Policies: Changes in government policies and defense procurement procedures could significantly impact the profitability of these companies.

- Financial Performance: Thorough due diligence, including an analysis of the companies' financial statements and future projections, is crucial before investing.

- Diversification: Diversifying your investment portfolio is always recommended to mitigate risk.

Conclusion:

Investing in Indian defense PSUs like HAL, BEL, and MDL offers exposure to a sector experiencing significant growth. However, understanding the specific risks and opportunities associated with each company is paramount. Conduct thorough research and consider consulting a financial advisor before making any investment decisions. The volatile nature of the geopolitical landscape underscores the importance of a well-informed and strategic investment approach.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Geopolitical Risks And Defence Stocks: Investing In HAL, BEL, Or Mazagon Dock Shipbuilders. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ceasefire In Yemen Trumps Announcement Following Houthi Alleged Surrender

May 13, 2025

Ceasefire In Yemen Trumps Announcement Following Houthi Alleged Surrender

May 13, 2025 -

Inflacao Ipca Copom E O Desempenho Industrial Brasileiro Uma Perspectiva Semanal

May 13, 2025

Inflacao Ipca Copom E O Desempenho Industrial Brasileiro Uma Perspectiva Semanal

May 13, 2025 -

I Thought Chris Brown Was In Love With Me A Heartbreaking Experience

May 13, 2025

I Thought Chris Brown Was In Love With Me A Heartbreaking Experience

May 13, 2025 -

Nba Playoffs Pacers Blowout Win Overshadowed By Mitchells Ankle Injury

May 13, 2025

Nba Playoffs Pacers Blowout Win Overshadowed By Mitchells Ankle Injury

May 13, 2025 -

Virat Kohli Announces Test Retirement After 14 Glorious Years

May 13, 2025

Virat Kohli Announces Test Retirement After 14 Glorious Years

May 13, 2025

Latest Posts

-

Ai Semiconductor Stock Poised For Growth Following May 28th Announcement

May 13, 2025

Ai Semiconductor Stock Poised For Growth Following May 28th Announcement

May 13, 2025 -

Where Will Nvidia Nvda Stock Be In 5 Years A Realistic Forecast

May 13, 2025

Where Will Nvidia Nvda Stock Be In 5 Years A Realistic Forecast

May 13, 2025 -

India Pakistan Ceasefire Boosts Indian Stock Markets Sensex And Nifty Surge

May 13, 2025

India Pakistan Ceasefire Boosts Indian Stock Markets Sensex And Nifty Surge

May 13, 2025 -

Post Draw Analysis Can Napoli Hold Off Inter Milan In The Serie A Race

May 13, 2025

Post Draw Analysis Can Napoli Hold Off Inter Milan In The Serie A Race

May 13, 2025 -

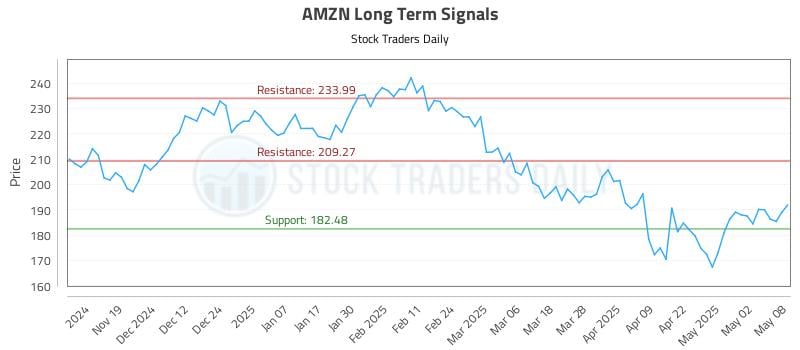

2024 Amzn Investment Report Key Financial Metrics And Forecasts

May 13, 2025

2024 Amzn Investment Report Key Financial Metrics And Forecasts

May 13, 2025