Gold Price Climb Continues: Investment Implications And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Price Climb Continues: Investment Implications and Analysis

Gold prices continue their upward trajectory, leaving investors wondering about the implications and the best course of action. This persistent climb isn't just market fluctuation; it reflects a confluence of global economic factors influencing safe-haven asset demand. Understanding these factors is crucial for navigating the current investment landscape.

Why is Gold Climbing? A Multi-Factor Analysis

Several key factors contribute to the ongoing gold price surge:

-

Inflationary Pressures: Persistent inflation remains a major driver. As the cost of living rises, investors seek assets that historically hold their value against inflation, making gold an attractive hedge. Central bank actions aimed at controlling inflation, while necessary, can also create market volatility, further boosting gold's appeal.

-

Geopolitical Uncertainty: Global instability, including ongoing conflicts and trade tensions, fuels demand for safe-haven assets. Gold, traditionally viewed as a safe haven during times of uncertainty, benefits significantly from this increased demand. Investors often flock to gold as a way to preserve capital during periods of geopolitical risk.

-

Weakening Dollar: The relative strength of the US dollar often inversely correlates with gold prices. A weakening dollar makes gold more affordable for investors holding other currencies, driving up demand. Current economic trends suggest a continued potential for dollar weakness, further supporting gold prices.

-

Interest Rate Hikes: While interest rate hikes are usually aimed at combating inflation, they can also impact gold prices in complex ways. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. However, if inflation remains stubbornly high, the appeal of gold as an inflation hedge can outweigh this cost, resulting in sustained price increases.

Investment Implications: Should You Buy Gold Now?

The ongoing gold price climb presents a compelling case for investors considering adding gold to their portfolios. However, it's crucial to consider your individual risk tolerance and investment goals before making any decisions.

-

Diversification: Gold is a valuable tool for portfolio diversification, acting as a hedge against market downturns and inflation. Including gold can help reduce overall portfolio volatility.

-

Long-Term Strategy: Gold is often viewed as a long-term investment. While short-term fluctuations are expected, a long-term perspective is usually recommended.

-

Consider Your Risk Tolerance: Gold's price can fluctuate significantly. Investors with a low-risk tolerance should carefully consider their allocation. Consult a financial advisor before making substantial investments.

-

Different Investment Vehicles: Investing in gold involves various options, including physical gold, gold ETFs (Exchange Traded Funds), and gold mining stocks. Each carries its own set of risks and rewards. Research the options thoroughly before making a choice.

Looking Ahead: Gold Price Predictions and Future Outlook

Predicting future gold prices is inherently challenging, influenced by numerous interacting factors. While some analysts predict continued growth, others anticipate a potential correction. Monitoring key economic indicators, such as inflation rates, interest rates, and geopolitical developments, is crucial for staying informed. The current trend suggests strong potential for further growth, but maintaining a balanced perspective and a diversified investment strategy is paramount.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Price Climb Continues: Investment Implications And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mk Stalin Provides Ar Rahman Health Update After Doctor Consultation

Mar 18, 2025

Mk Stalin Provides Ar Rahman Health Update After Doctor Consultation

Mar 18, 2025 -

Jordan Goodwins Future Reavess Strong Endorsement For Nba Contract

Mar 18, 2025

Jordan Goodwins Future Reavess Strong Endorsement For Nba Contract

Mar 18, 2025 -

Meteorological Mystery Two Tornadoes Identical Paths Minutes Apart

Mar 18, 2025

Meteorological Mystery Two Tornadoes Identical Paths Minutes Apart

Mar 18, 2025 -

Village Roadshows 1 Billion Bankruptcy Implications For Australian Businesses

Mar 18, 2025

Village Roadshows 1 Billion Bankruptcy Implications For Australian Businesses

Mar 18, 2025 -

Construction Ahead Bear Mountain Bridge Upgrade Project Announced

Mar 18, 2025

Construction Ahead Bear Mountain Bridge Upgrade Project Announced

Mar 18, 2025

Latest Posts

-

Ge 2025 Recent Government Missteps Damage Public Confidence Claims Psp

Apr 29, 2025

Ge 2025 Recent Government Missteps Damage Public Confidence Claims Psp

Apr 29, 2025 -

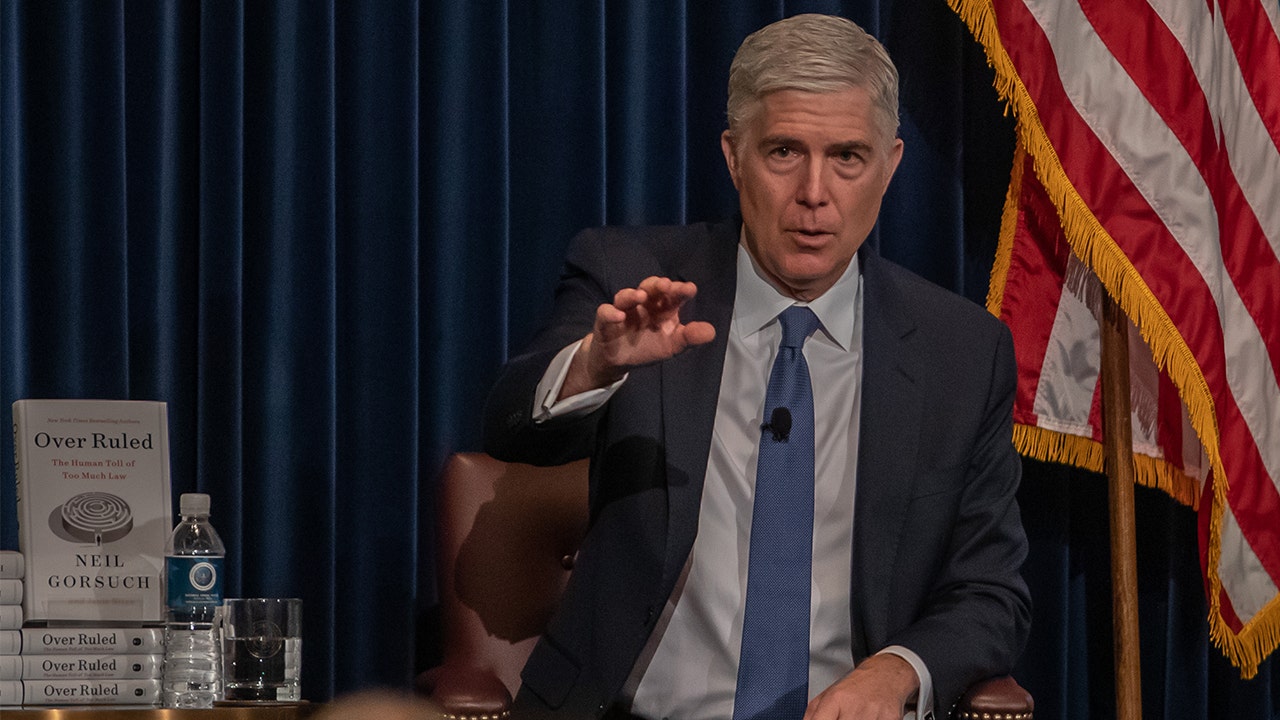

Heated Exchange Erupts Justice Gorsuch Scolds Supreme Court Litigator

Apr 29, 2025

Heated Exchange Erupts Justice Gorsuch Scolds Supreme Court Litigator

Apr 29, 2025 -

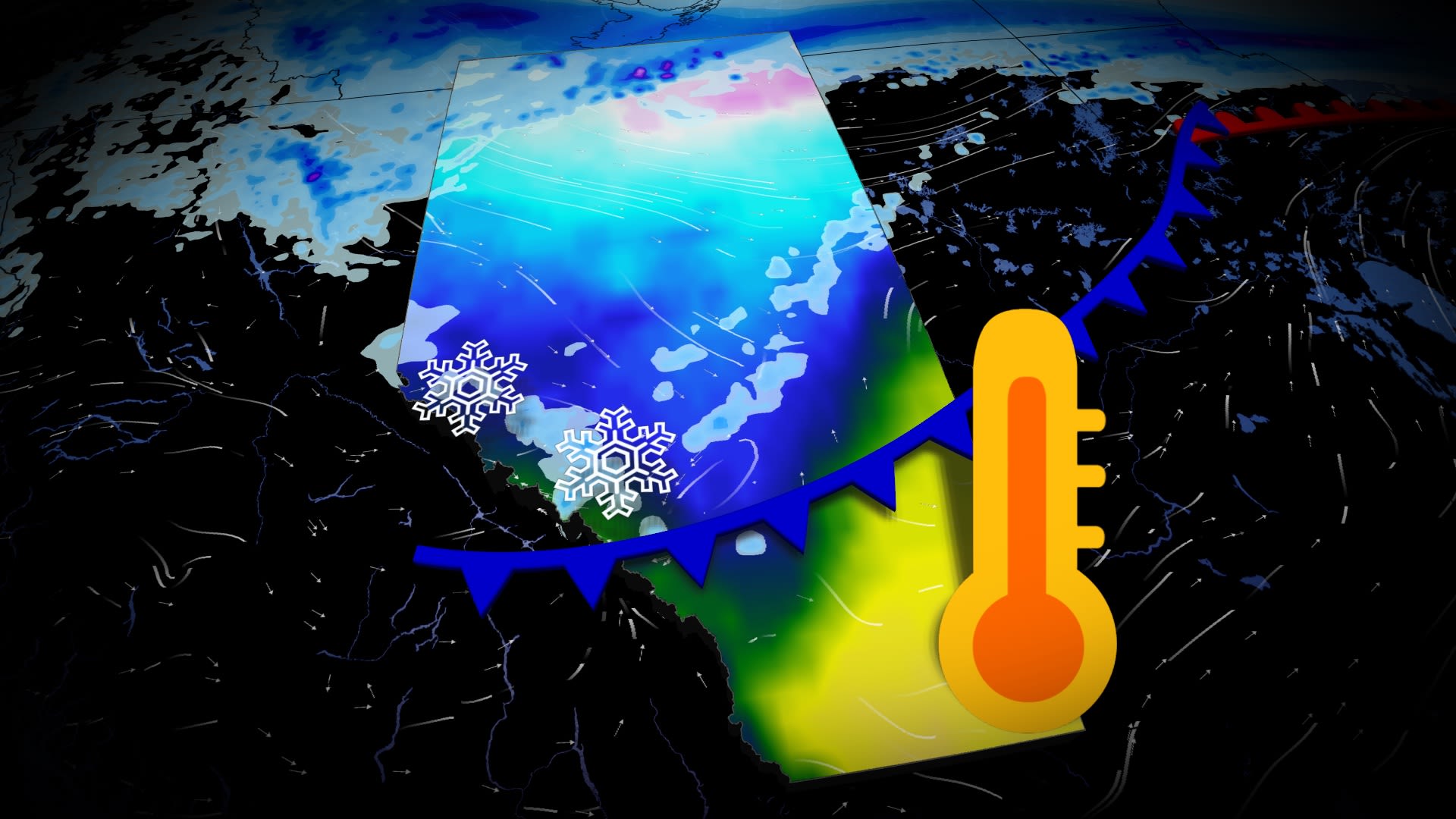

Albertas Warm Spell Ends Abruptly Significant Temperature Drop Imminent

Apr 29, 2025

Albertas Warm Spell Ends Abruptly Significant Temperature Drop Imminent

Apr 29, 2025 -

Jeremy Renner On Deaths Door Snowplow Accident Details Emerge

Apr 29, 2025

Jeremy Renner On Deaths Door Snowplow Accident Details Emerge

Apr 29, 2025 -

Oscar Contender Dwayne Johnsons The Smashing Machine Trailer Debuts

Apr 29, 2025

Oscar Contender Dwayne Johnsons The Smashing Machine Trailer Debuts

Apr 29, 2025