Gold Price Forecast: How Will New China Tariffs Influence MCX?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Price Forecast: How Will New China Tariffs Influence MCX?

The recent imposition of new tariffs by China has sent ripples through global markets, leaving investors questioning the future trajectory of gold prices and their impact on the Multi Commodity Exchange of India (MCX). This uncertainty presents both challenges and opportunities for traders and investors alike. Understanding the potential influence of these tariffs on the MCX gold market is crucial for navigating this volatile landscape.

China's Tariffs: A Global Impact

China's strategic implementation of tariffs, often in response to geopolitical tensions or trade disputes, significantly affects global commodity markets. Gold, a safe-haven asset, typically sees increased demand during periods of economic uncertainty. The latest tariffs are likely to exacerbate existing anxieties surrounding global trade and economic growth, potentially boosting gold's appeal as a hedge against risk.

The MCX and its Sensitivity to Global Events

The Multi Commodity Exchange of India (MCX) is a prominent platform for trading various commodities, including gold. Given India's significant role in global gold consumption and the MCX's substantial market share, it's highly susceptible to fluctuations in international gold prices. Therefore, the impact of China's new tariffs on global gold prices will directly translate into price movements on the MCX.

Potential Scenarios and Their Impact on MCX Gold Prices:

Several scenarios could unfold following the introduction of these tariffs:

-

Scenario 1: Increased Global Uncertainty: If the new tariffs escalate trade tensions and fuel global uncertainty, we can expect a surge in gold demand. This would likely lead to an increase in MCX gold prices. Investors seeking refuge from market volatility will flock to gold, driving up prices across global exchanges, including the MCX.

-

Scenario 2: Limited Impact on Global Markets: If the impact of the tariffs is relatively contained and global markets remain stable, the influence on MCX gold prices might be minimal. Gold prices could experience moderate fluctuations, but a significant surge is less probable.

-

Scenario 3: Currency Fluctuations: The impact of tariffs could also influence currency exchange rates. A weakening Indian Rupee against the US dollar (USD), in which gold is typically priced, could increase the price of gold in Indian Rupees on the MCX, even if USD-denominated gold prices remain relatively stable.

Factors Beyond Tariffs Influencing MCX Gold:

While the China tariffs are a significant factor, other elements also influence MCX gold prices:

- Indian Rupee Volatility: The INR's strength or weakness against the USD plays a crucial role.

- Domestic Demand: India's robust gold consumption patterns significantly impact MCX prices. Festive seasons and wedding demand often drive up prices.

- Global Inflationary Pressures: High inflation globally can boost gold's appeal as an inflation hedge.

- Interest Rates: Changes in interest rates influence the attractiveness of gold versus other investment options.

What to Watch For:

Investors and traders monitoring the MCX should closely watch:

- Global Market Reactions: Pay close attention to how global markets react to the new tariffs.

- Currency Exchange Rates: Track INR-USD movements.

- Geopolitical Developments: Stay informed about any further escalation of trade tensions.

- Indian Domestic Demand: Monitor the trends in Indian gold consumption.

Conclusion:

The new China tariffs present a complex scenario with potential implications for MCX gold prices. While an increase in global uncertainty is likely to boost gold prices on the MCX, other factors could either amplify or mitigate this effect. Careful analysis of global market dynamics, currency fluctuations, and domestic demand is crucial for making informed trading decisions on the MCX. This situation underscores the importance of staying well-informed and adapting strategies based on evolving market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Price Forecast: How Will New China Tariffs Influence MCX?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

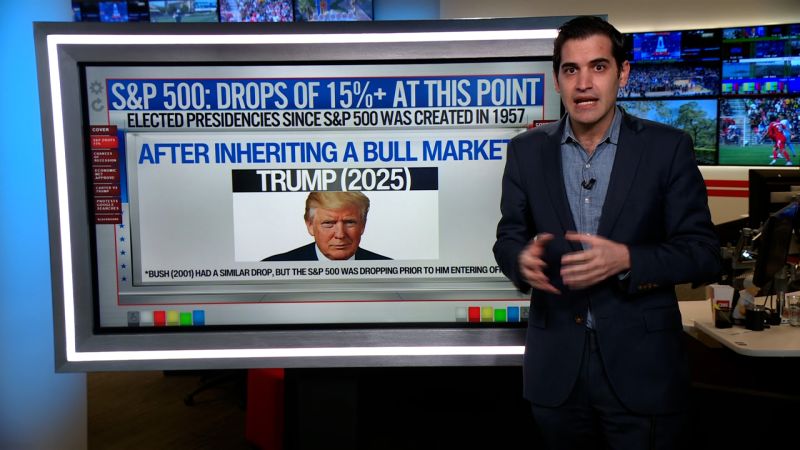

Bear Market Incoming Dow Futures Tumble 1300 Points Amid Tariff Chaos

Apr 07, 2025

Bear Market Incoming Dow Futures Tumble 1300 Points Amid Tariff Chaos

Apr 07, 2025 -

Chuvas Intensas No Rs 75 Mortes Crise De Agua E Energia

Apr 07, 2025

Chuvas Intensas No Rs 75 Mortes Crise De Agua E Energia

Apr 07, 2025 -

Resepsi Lamaran Harris Vriza Dan Haviza Devi Di Medan Suasana Romantis Dan Meriah

Apr 07, 2025

Resepsi Lamaran Harris Vriza Dan Haviza Devi Di Medan Suasana Romantis Dan Meriah

Apr 07, 2025 -

Stock Market Crash Fears Grow As Dow Futures Tumble

Apr 07, 2025

Stock Market Crash Fears Grow As Dow Futures Tumble

Apr 07, 2025 -

Real Madrids Champions League Dominance Under Pressure

Apr 07, 2025

Real Madrids Champions League Dominance Under Pressure

Apr 07, 2025