India Gold Market Update: Prices Dip Following Global Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

India Gold Market Update: Prices Dip Following Global Sell-Off

India's gold market experienced a downturn today, mirroring a global trend of falling prices. The precious metal, a traditional safe haven investment, saw a significant dip, impacting both investors and consumers. This decline follows a broader sell-off in global markets, driven by a confluence of factors including rising interest rates and a stronger US dollar. Understanding the current situation is crucial for anyone invested in or considering investing in gold in India.

Global Factors Fueling the Price Drop

The primary driver behind the recent gold price decline is the strengthening US dollar. A stronger dollar makes gold, priced in USD, more expensive for buyers using other currencies, thus reducing demand. This is exacerbated by rising interest rates in major economies. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, encouraging investors to shift towards interest-bearing instruments.

Furthermore, recent positive economic data from some key global economies has also contributed to the sell-off. Investors are becoming less risk-averse, reducing the appeal of gold as a safe haven asset. This shift in sentiment away from perceived safe havens and towards riskier assets has directly impacted gold's performance globally, and India is inevitably affected.

Impact on the Indian Gold Market

The Indian gold market, one of the largest globally, is acutely sensitive to international price fluctuations. Today's dip reflects this direct correlation. This price drop is likely to impact several sectors:

- Jewellery Retailers: Lower gold prices could potentially stimulate demand in the short term, as consumers find gold jewellery more affordable. However, retailers may also face pressure on profit margins if they haven't adjusted their pricing strategies quickly enough.

- Investors: While a price drop can seem negative, long-term investors often view this as an opportunity to buy gold at a lower price, anticipating future price appreciation.

- Import and Export: Fluctuations in global prices directly impact India's gold imports and exports, impacting the country's balance of payments.

Should You Buy or Sell?

The question on many investors' minds is whether this dip presents a buying opportunity or a signal to sell. There's no simple answer, as it depends heavily on individual investment strategies and risk tolerance.

Factors to consider:

- Your Investment Horizon: Long-term investors may see this as a chance to accumulate gold at a lower price. Short-term investors might prefer to wait for more market stability.

- Market Sentiment: Keep an eye on global economic indicators and market sentiment to gauge future price movements.

- Diversification: Gold is often part of a diversified portfolio, so consider its role within your overall investment strategy.

Expert Advice: It's always advisable to consult with a qualified financial advisor before making any significant investment decisions, especially in volatile markets like the current gold market.

Looking Ahead: Predictions and Analysis

Predicting gold prices with certainty is impossible. However, analysts are closely monitoring various factors, including inflation rates, geopolitical events, and central bank policies, to assess potential future price movements. The interplay of these factors will determine whether the current dip is a temporary correction or the start of a more significant downward trend. Further updates on the Indian gold market will be provided as the situation unfolds. Stay tuned for further analysis and insights.

Keywords: India gold price, gold market update, gold price dip, global gold market, India gold investment, gold price prediction, Indian gold market analysis, gold jewellery, US dollar, interest rates, safe haven asset, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on India Gold Market Update: Prices Dip Following Global Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

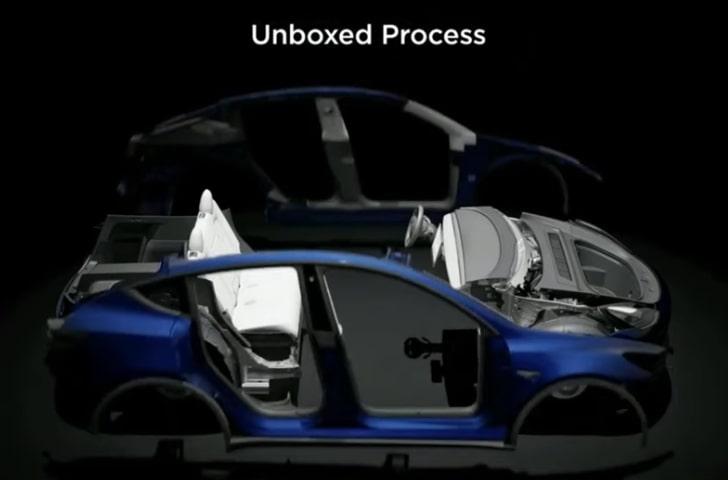

The Technological Leap In Tesla Cybercab Production A Space X Starship Analogy

Apr 07, 2025

The Technological Leap In Tesla Cybercab Production A Space X Starship Analogy

Apr 07, 2025 -

Saturday Night Live The Full Story Behind Morgan Wallens Unexpected Exit

Apr 07, 2025

Saturday Night Live The Full Story Behind Morgan Wallens Unexpected Exit

Apr 07, 2025 -

Top Oems Offer Ge Force Rtx 5060 5060 Ti Pre Built Gaming Pcs Prices And Specs

Apr 07, 2025

Top Oems Offer Ge Force Rtx 5060 5060 Ti Pre Built Gaming Pcs Prices And Specs

Apr 07, 2025 -

Ais Impact On The Future A Comprehensive Analysis Of Technological Advancements And Societal Implications

Apr 07, 2025

Ais Impact On The Future A Comprehensive Analysis Of Technological Advancements And Societal Implications

Apr 07, 2025 -

2023 Formula 1 Japanese Gp Analysis Of The Starting Grid

Apr 07, 2025

2023 Formula 1 Japanese Gp Analysis Of The Starting Grid

Apr 07, 2025