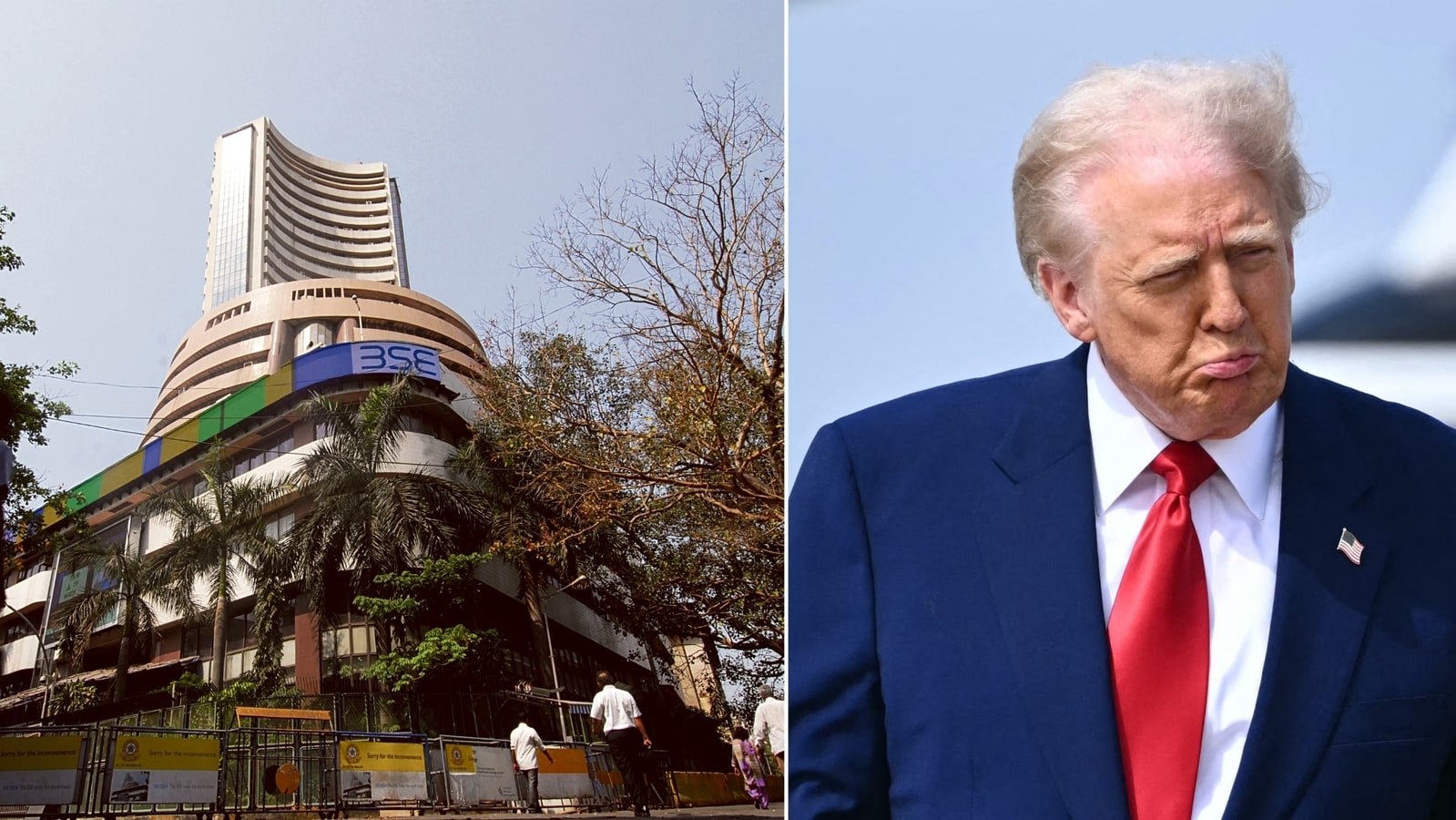

Indian Market Crash Today: Sensex And Nifty Plunge – Reasons Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Indian Market Crash Today: Sensex and Nifty Plunge – Reasons Explained

Indian stock markets experienced a significant downturn today, with the Sensex and Nifty plunging sharply. This dramatic fall has left investors worried and sparked intense speculation about the underlying causes. Understanding the reasons behind this market crash is crucial for navigating the current volatility and making informed investment decisions. Let's delve into the key factors contributing to today's dramatic plunge.

The Magnitude of the Fall:

The Sensex and Nifty, India's two major stock market indices, witnessed a considerable decline today, erasing billions of rupees in market capitalization. The percentage drop, while significant, needs to be contextualized within the broader market trends and recent global events. Precise figures will vary depending on the closing time and data source, but the impact on investor sentiment is undeniable.

Key Reasons Behind the Market Crash:

Several factors likely contributed to this sharp market correction. It's important to remember these factors often intertwine and amplify each other's effects.

1. Global Economic Uncertainty:

- Inflationary pressures: Persistent global inflation continues to weigh heavily on market sentiment. Rising interest rates by central banks worldwide, aimed at curbing inflation, are impacting economic growth and corporate profitability. This uncertainty spills over into emerging markets like India.

- Geopolitical tensions: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other regions, contributes to investor risk aversion. These uncertainties create a volatile global investment climate.

- US Federal Reserve's monetary policy: The decisions of the US Federal Reserve regarding interest rates heavily influence global markets. Any perceived hawkish stance can trigger sell-offs in emerging markets like India.

2. Domestic Concerns:

- Rupee depreciation: A weakening Indian Rupee against the US dollar can negatively impact investor confidence and lead to capital outflows. This is because imported goods become more expensive, impacting inflation and corporate profits.

- Rising interest rates in India: The Reserve Bank of India (RBI)'s own monetary policy tightening, while aimed at controlling inflation, can also dampen economic growth and affect corporate earnings.

- Sector-specific headwinds: Specific sectors within the Indian economy might be facing unique challenges. For example, a downturn in a major sector like IT or real estate could contribute to a broader market correction.

3. Technical Factors:

- Profit-booking: After a period of market gains, some investors might have engaged in profit-booking, leading to increased selling pressure.

- Algorithm-driven trading: Algorithmic trading strategies can amplify market swings, potentially exacerbating a downward trend.

What Investors Should Do:

Navigating market volatility requires a measured approach. Investors should:

- Avoid panic selling: Emotional decisions often lead to poor investment outcomes. A well-diversified portfolio can help mitigate risk.

- Re-evaluate investment strategy: This is a time to review your long-term investment strategy and ensure it aligns with your risk tolerance and financial goals.

- Seek professional advice: Consult with a qualified financial advisor for personalized guidance based on your individual circumstances.

Conclusion:

Today's market crash in India highlights the interconnectedness of global and domestic economic factors. While the immediate cause might be a confluence of events, understanding the underlying reasons is crucial for investors to make informed decisions and navigate this period of uncertainty. Long-term investors should maintain a balanced perspective and avoid making rash decisions based on short-term market fluctuations. Staying informed about economic developments and seeking professional advice are crucial strategies for weathering market storms.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Indian Market Crash Today: Sensex And Nifty Plunge – Reasons Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Multi Billion Indian Conglomerate Invests In 10 B Indian Semiconductor Fab

Apr 07, 2025

Multi Billion Indian Conglomerate Invests In 10 B Indian Semiconductor Fab

Apr 07, 2025 -

Irs Announces Significant Tax Law Changes Before Tax Day Deadline

Apr 07, 2025

Irs Announces Significant Tax Law Changes Before Tax Day Deadline

Apr 07, 2025 -

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025

Mobile Legends Pembagian Grup Resmi Turnamen Esl Sps Mobile Masters 2025

Apr 07, 2025 -

Are Financial Markets Tanking Maintaining A Calm Investment Strategy

Apr 07, 2025

Are Financial Markets Tanking Maintaining A Calm Investment Strategy

Apr 07, 2025 -

Increased Production Of Semiconductor Packaging Material By Ajinomoto

Apr 07, 2025

Increased Production Of Semiconductor Packaging Material By Ajinomoto

Apr 07, 2025