Investor Fear Grips Markets: Dow Futures Reflect Ongoing Sell-Off

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investor Fear Grips Markets: Dow Futures Reflect Ongoing Sell-Off

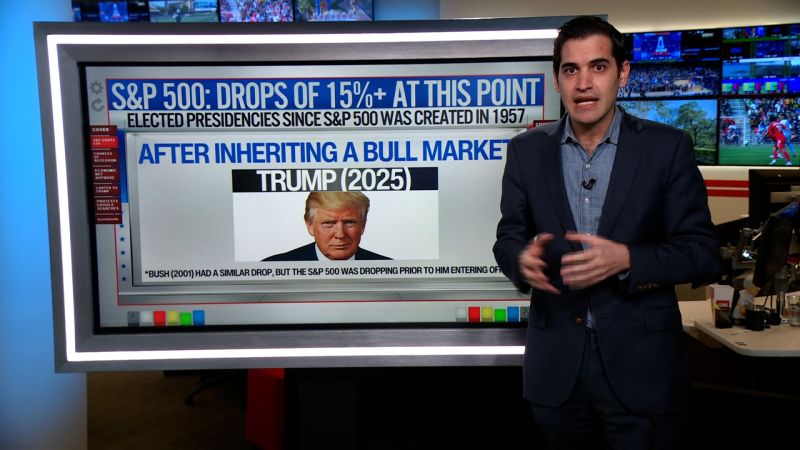

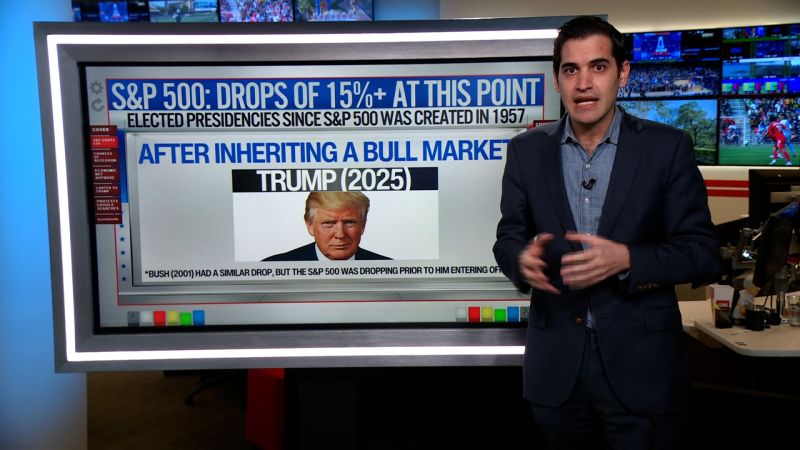

Investor anxiety is gripping global markets, with Dow futures pointing to a further sell-off following a tumultuous week. Concerns over rising interest rates, persistent inflation, and geopolitical instability are fueling this ongoing market downturn, leaving investors on edge. This widespread fear is manifesting in plummeting stock prices and a flight to safety, as investors seek refuge in less volatile assets.

Rising Interest Rates Fuel the Fire

The primary driver behind this market turmoil is the Federal Reserve's aggressive interest rate hikes. While aimed at curbing inflation, these increases are also slowing economic growth, raising fears of a potential recession. Higher interest rates increase borrowing costs for businesses, impacting investment and potentially leading to job losses. This uncertainty is prompting investors to reassess their portfolios and adopt a more cautious approach. The market is keenly watching for any indication of a shift in the Fed's monetary policy, but for now, the trend remains upward.

Inflation Remains a Persistent Threat

Stubbornly high inflation continues to erode purchasing power and fuel uncertainty. While recent data showed a slight easing in inflation, it remains significantly above the Federal Reserve's target, indicating that more aggressive measures may be needed. This persistent inflationary pressure weighs heavily on consumer sentiment and business investment, further contributing to the pessimistic outlook. The market is anxiously awaiting further economic data releases to gauge the effectiveness of current policies and predict future trends.

Geopolitical Instability Adds to the Pressure

Adding to the existing economic woes is the ongoing geopolitical instability. The war in Ukraine, coupled with escalating tensions in other regions, creates significant uncertainty for global markets. These geopolitical risks disrupt supply chains, increase commodity prices, and contribute to overall economic uncertainty, further fueling investor fear and prompting a sell-off. Market analysts are closely monitoring these developments, acknowledging their potential for significant market impact.

What's Next for Investors?

The current market volatility presents significant challenges for investors. Many are adopting a more defensive posture, shifting their portfolios towards less risky assets such as government bonds and precious metals. Diversification remains crucial, and investors should carefully consider their risk tolerance and investment goals before making any significant changes. Seeking professional financial advice is highly recommended during these turbulent times.

Key Takeaways:

- Dow futures reflect a continuing sell-off, indicating widespread investor fear.

- Rising interest rates, persistent inflation, and geopolitical instability are the main contributing factors.

- Investors are adopting a more cautious approach, shifting towards less volatile assets.

- Diversification and professional financial advice are crucial during this period of market uncertainty.

- Closely monitoring economic data and geopolitical developments is essential for informed investment decisions.

The current market downturn is a stark reminder of the inherent risks associated with investing. While the short-term outlook remains uncertain, history shows that markets eventually recover. However, navigating this volatility requires careful planning, informed decision-making, and a clear understanding of one's risk tolerance. Staying informed and seeking expert advice are key to weathering this storm and emerging stronger on the other side.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investor Fear Grips Markets: Dow Futures Reflect Ongoing Sell-Off. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Semiconductor Packaging Ajinomoto Ramps Up Production

Apr 07, 2025

Semiconductor Packaging Ajinomoto Ramps Up Production

Apr 07, 2025 -

Real Madrid And Psg Can European Giants Conquer English Opposition

Apr 07, 2025

Real Madrid And Psg Can European Giants Conquer English Opposition

Apr 07, 2025 -

Verstappen Secures Pole Position At Japanese Grand Prix Qualifying

Apr 07, 2025

Verstappen Secures Pole Position At Japanese Grand Prix Qualifying

Apr 07, 2025 -

Australian Dollar Forecast Navigating The Us China Trade War Uncertainty

Apr 07, 2025

Australian Dollar Forecast Navigating The Us China Trade War Uncertainty

Apr 07, 2025 -

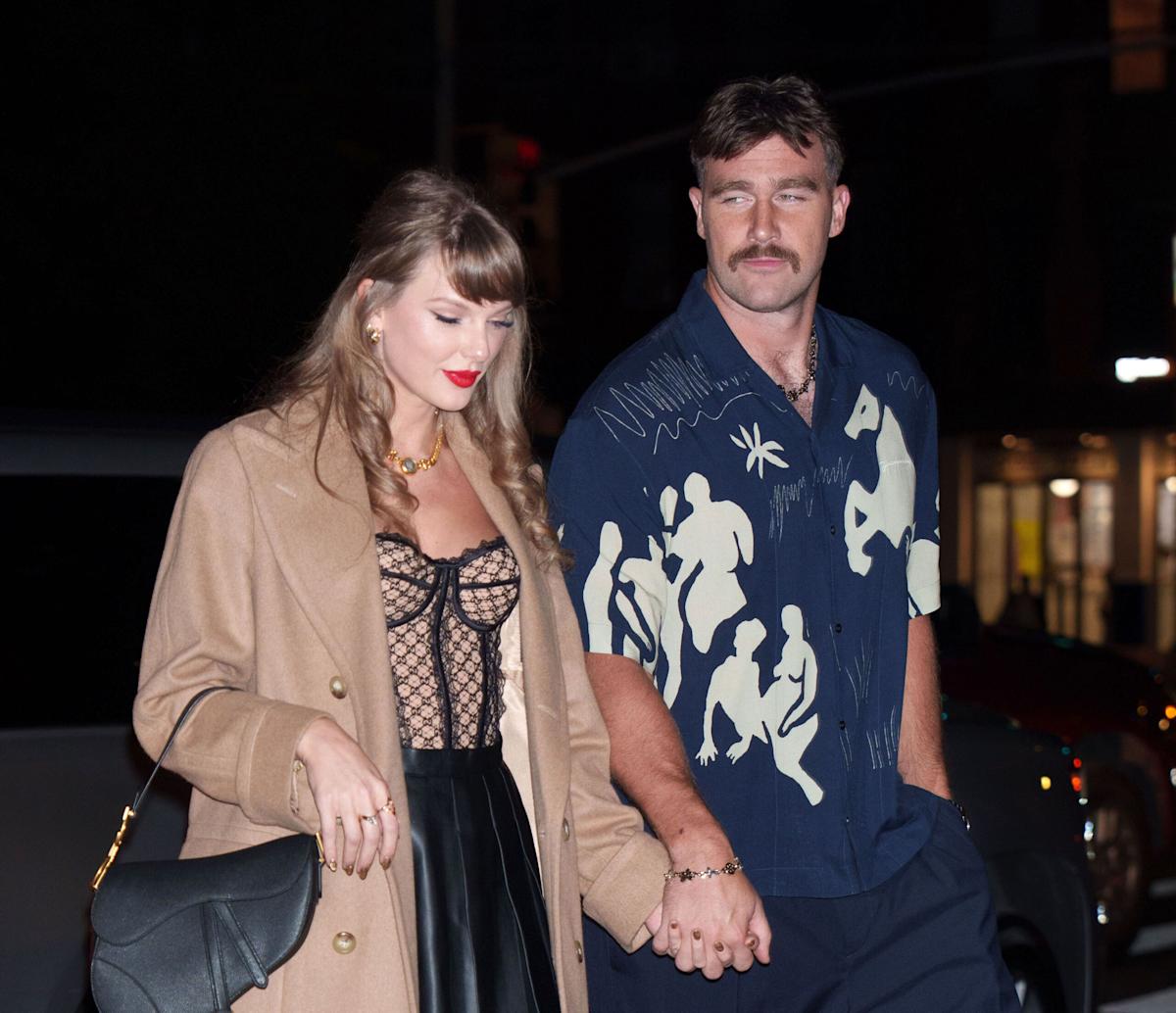

Are Taylor Swift And Travis Kelce Separated Exploring The Latest Reports

Apr 07, 2025

Are Taylor Swift And Travis Kelce Separated Exploring The Latest Reports

Apr 07, 2025