Is MicroStrategy Stock (MSTR) A Better Investment Than Bitcoin (BTC)? A 2025 Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is MicroStrategy Stock (MSTR) a Better Investment Than Bitcoin (BTC)? A 2025 Perspective

The volatile cryptocurrency market and the fluctuating fortunes of publicly traded companies often leave investors grappling with tough choices. One such dilemma: is MicroStrategy (MSTR) stock, a company heavily invested in Bitcoin, a safer bet than holding Bitcoin (BTC) directly? Looking ahead to 2025, the answer is far from straightforward, but a careful analysis reveals some compelling insights.

MicroStrategy's Bitcoin Strategy: A Double-Edged Sword

MicroStrategy's aggressive Bitcoin accumulation strategy, spearheaded by CEO Michael Saylor, has made it a darling (and sometimes a punching bag) of the crypto world. The company's substantial Bitcoin holdings represent a significant portion of its overall market capitalization, creating both immense potential and considerable risk. While a surge in Bitcoin's price directly boosts MSTR's valuation, a downturn can inflict significant losses. This inherent volatility is a key factor to consider when comparing it to a direct Bitcoin investment.

Bitcoin's Volatility vs. MSTR's Diversification (Sort Of)

Bitcoin's price is notoriously volatile, susceptible to market sentiment, regulatory changes, and technological advancements. While this volatility offers the potential for substantial gains, it also presents significant downside risk. MSTR, on the other hand, offers a degree of diversification, albeit limited. As a publicly traded company, it's subject to the broader market forces impacting technology stocks. However, its dependence on Bitcoin's performance significantly reduces its diversification benefits.

The 2025 Outlook: Weighing the Probabilities

Predicting the future of both Bitcoin and MSTR in 2025 is inherently speculative. However, we can consider some factors likely to influence their trajectory:

-

Bitcoin's Adoption and Regulation: Widespread institutional adoption and clearer regulatory frameworks could drive Bitcoin's price upwards. Conversely, tighter regulations or negative press could trigger a significant decline.

-

MicroStrategy's Business Performance: MSTR's success isn't solely reliant on Bitcoin's price. Its core business performance, including software sales and cloud services, will play a crucial role in its overall valuation. Strong business fundamentals could provide a cushion against Bitcoin-related losses.

-

Macroeconomic Factors: Global economic conditions, inflation rates, and interest rate policies will undoubtedly influence both Bitcoin and MSTR's performance.

Which is the Better Investment? A nuanced answer.

There's no simple answer to whether MSTR or BTC is a better investment for 2025. It depends heavily on your risk tolerance and investment goals.

-

Higher Risk, Higher Reward: Investing directly in Bitcoin offers potentially higher returns but comes with significantly greater risk.

-

Mitigated Risk, Mitigated Reward: Investing in MSTR offers some mitigation against pure Bitcoin volatility, as its business operations offer a degree of diversification. However, the potential upside is likely capped compared to a direct Bitcoin investment.

Conclusion: Diversify Your Portfolio

Instead of choosing one over the other, a diversified approach might be the most prudent strategy. Allocating a portion of your investment portfolio to both Bitcoin and MSTR (or other Bitcoin-related stocks) could offer a balanced exposure to the cryptocurrency market while minimizing overall risk. Remember to conduct thorough research, consult financial advisors, and only invest what you can afford to lose. The future is uncertain, and smart investing involves careful consideration of risk and reward.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is MicroStrategy Stock (MSTR) A Better Investment Than Bitcoin (BTC)? A 2025 Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

P A Reprend La Route Decision Confirmee Nouvelle Tournee Annoncee

May 23, 2025

P A Reprend La Route Decision Confirmee Nouvelle Tournee Annoncee

May 23, 2025 -

Applying Warren Buffetts Principles To Cryptocurrency Investing

May 23, 2025

Applying Warren Buffetts Principles To Cryptocurrency Investing

May 23, 2025 -

Same Skinner Different Year Comparing His Postseason Success

May 23, 2025

Same Skinner Different Year Comparing His Postseason Success

May 23, 2025 -

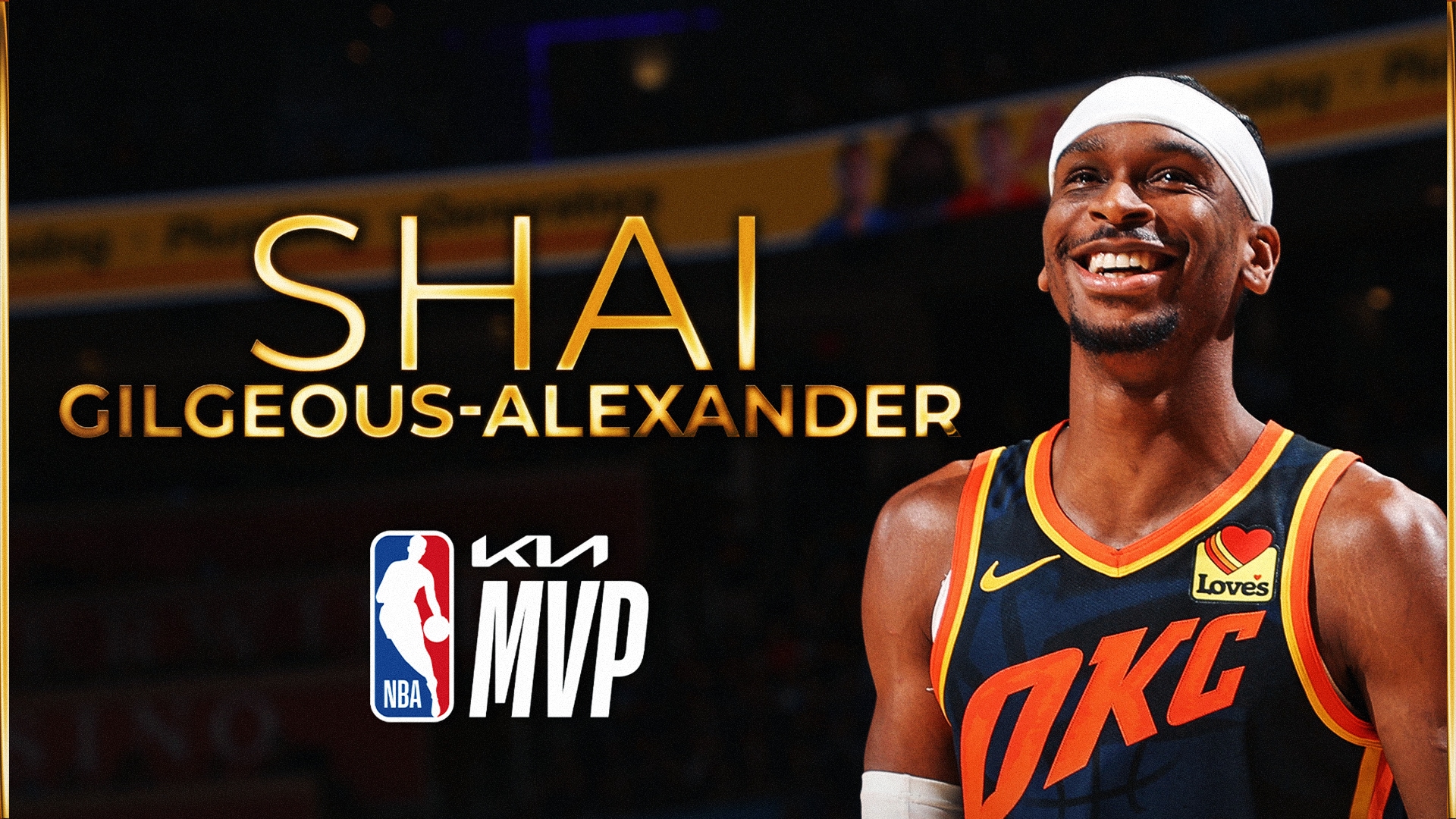

Gilgeous Alexanders Historic Nba Mvp Win For Oklahoma City

May 23, 2025

Gilgeous Alexanders Historic Nba Mvp Win For Oklahoma City

May 23, 2025 -

Btc Price Explodes Understanding The Implications Of The New High

May 23, 2025

Btc Price Explodes Understanding The Implications Of The New High

May 23, 2025

Latest Posts

-

Excruciating Pain Miley Cyrus Reveals Details Of Recent Health Battle

May 24, 2025

Excruciating Pain Miley Cyrus Reveals Details Of Recent Health Battle

May 24, 2025 -

Evaluating Game Of Thrones Kingsroad An Ongoing Review

May 24, 2025

Evaluating Game Of Thrones Kingsroad An Ongoing Review

May 24, 2025 -

The Internets Obsession Tom Cruise And His Unique Popcorn Style

May 24, 2025

The Internets Obsession Tom Cruise And His Unique Popcorn Style

May 24, 2025 -

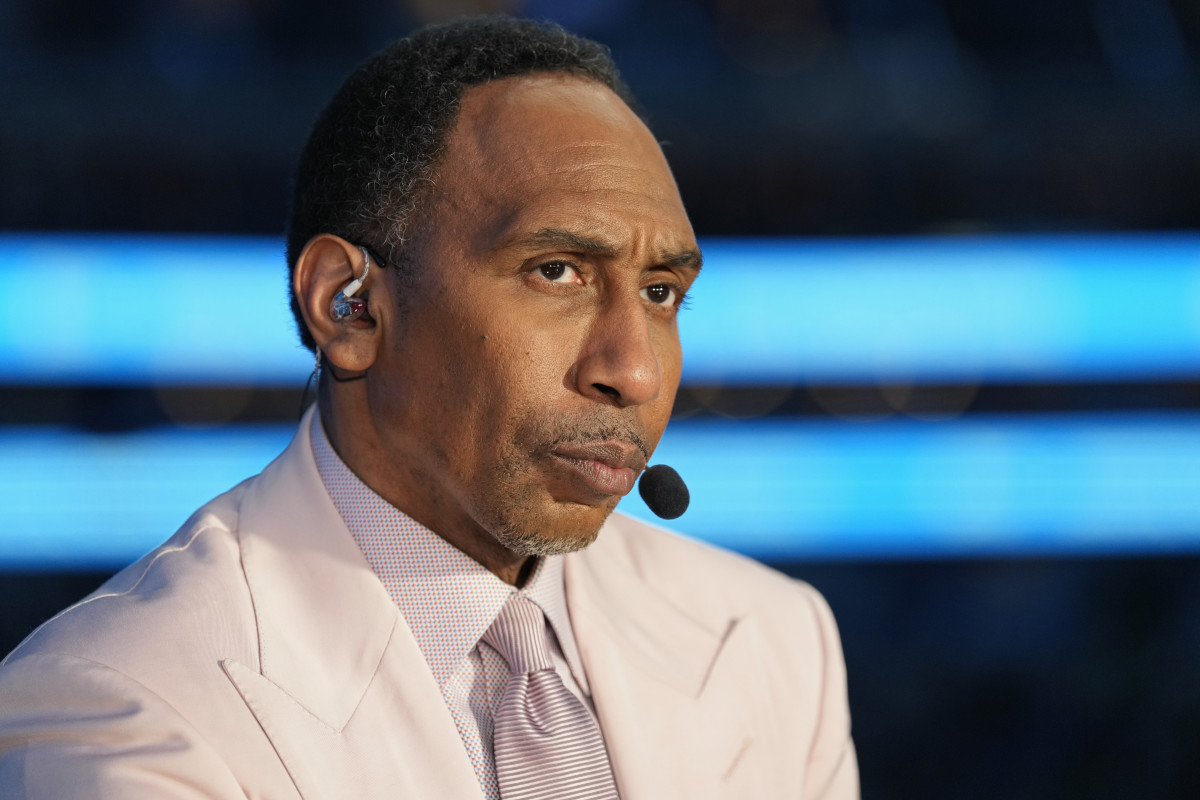

Heated Exchange Stephen A Smith Slams Cnn Personality

May 24, 2025

Heated Exchange Stephen A Smith Slams Cnn Personality

May 24, 2025 -

Upset In Denver Shai Gilgeous Alexander Named Nba Mvp

May 24, 2025

Upset In Denver Shai Gilgeous Alexander Named Nba Mvp

May 24, 2025