Is Realty Income (O) A Buy? Jim Cramer Weighs In On Dividend Potential

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Realty Income (O) a Buy? Jim Cramer Weighs In on Dividend Potential

Realty Income Corporation (O), the self-proclaimed "Monthly Dividend Company," has long been a favorite among income-seeking investors. But with market volatility and rising interest rates, the question on many investors' minds is: is Realty Income still a buy? Renowned financial commentator Jim Cramer recently shared his perspective, adding fuel to the ongoing debate. Let's delve into the arguments surrounding Realty Income's investment potential and examine Cramer's take.

Cramer's Stance and the Rationale Behind It

Jim Cramer, known for his outspoken views and often contrarian opinions, has generally expressed a positive outlook on Realty Income. His assessment centers around the company's impressive dividend history and its resilient business model. He often highlights Realty Income's consistent monthly dividend payouts, a key attraction for investors seeking stable income streams. However, it's crucial to understand the nuances of Cramer's perspective, as his opinions are not always a definitive buy or sell signal. His analysis typically considers macroeconomic factors, competitive landscape, and the company's overall financial health.

Realty Income's Strengths: A Deep Dive

Realty Income's appeal stems from several key factors:

- Monthly Dividend Payments: The consistent monthly dividend is a significant draw for income investors, providing predictable cash flow. This feature sets Realty Income apart from many other REITs that pay dividends quarterly.

- Diversified Portfolio: Realty Income owns a vast and geographically diverse portfolio of properties, reducing reliance on any single tenant or location. This diversification mitigates risk and enhances stability.

- Strong Tenant Base: The company boasts a robust tenant base, including many investment-grade companies, ensuring consistent rental income. This reduces the risk of vacancies and rental defaults.

- Long-Term Lease Agreements: Realty Income's properties are primarily leased under long-term agreements, providing predictable revenue streams for years to come. This long-term visibility makes financial planning easier for investors.

- Inflation Hedge Potential: Real estate often acts as an inflation hedge, as rental income can increase with inflation. This is particularly relevant in the current economic climate.

Potential Risks and Considerations

Despite its strengths, investors should consider potential risks:

- Interest Rate Sensitivity: As a REIT, Realty Income is sensitive to interest rate changes. Rising interest rates can increase borrowing costs and potentially impact profitability.

- Economic Downturn Risk: While Realty Income's diversified portfolio offers protection, a significant economic downturn could still impact tenant occupancy and rental income.

- Competition: The REIT sector is competitive, with several other companies vying for investor attention and capital.

Should You Buy Realty Income? A Balanced Perspective

Whether Realty Income is a "buy" depends heavily on your individual investment goals, risk tolerance, and overall portfolio diversification. While Jim Cramer's positive outlook is noteworthy, it shouldn't be the sole basis for your investment decision. Thorough due diligence, including a review of the company's financial statements, current market conditions, and your own risk profile, is crucial.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Realty Income, O, REIT, Dividend, Monthly Dividend, Jim Cramer, Stock Market, Investment, Income Investing, Real Estate Investment Trust, Dividend Stock, Stock Analysis, Investment Strategy, Risk Tolerance, Portfolio Diversification, Interest Rates, Inflation Hedge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Realty Income (O) A Buy? Jim Cramer Weighs In On Dividend Potential. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Update On A R Rahmans Condition After Hospitalization

Mar 18, 2025

Update On A R Rahmans Condition After Hospitalization

Mar 18, 2025 -

Nuggets Notes In Depth Look At Gordon Murray Watson And Others

Mar 18, 2025

Nuggets Notes In Depth Look At Gordon Murray Watson And Others

Mar 18, 2025 -

Break The Mold Lady Gaga Offers Groundbreaking Advice To Aspiring Artists

Mar 18, 2025

Break The Mold Lady Gaga Offers Groundbreaking Advice To Aspiring Artists

Mar 18, 2025 -

100 Year Old Hudson Valley Bridge A Revitalization Project Begins

Mar 18, 2025

100 Year Old Hudson Valley Bridge A Revitalization Project Begins

Mar 18, 2025 -

Byd Unveils Groundbreaking Supercharger Technology Plans Nationwide Charging Network Across China

Mar 18, 2025

Byd Unveils Groundbreaking Supercharger Technology Plans Nationwide Charging Network Across China

Mar 18, 2025

Latest Posts

-

2025 Canadian Election A Deep Dive Into Brampton Centres Results

Apr 29, 2025

2025 Canadian Election A Deep Dive Into Brampton Centres Results

Apr 29, 2025 -

Limitations Of Reinforcement Learning In Boosting Ai Performance

Apr 29, 2025

Limitations Of Reinforcement Learning In Boosting Ai Performance

Apr 29, 2025 -

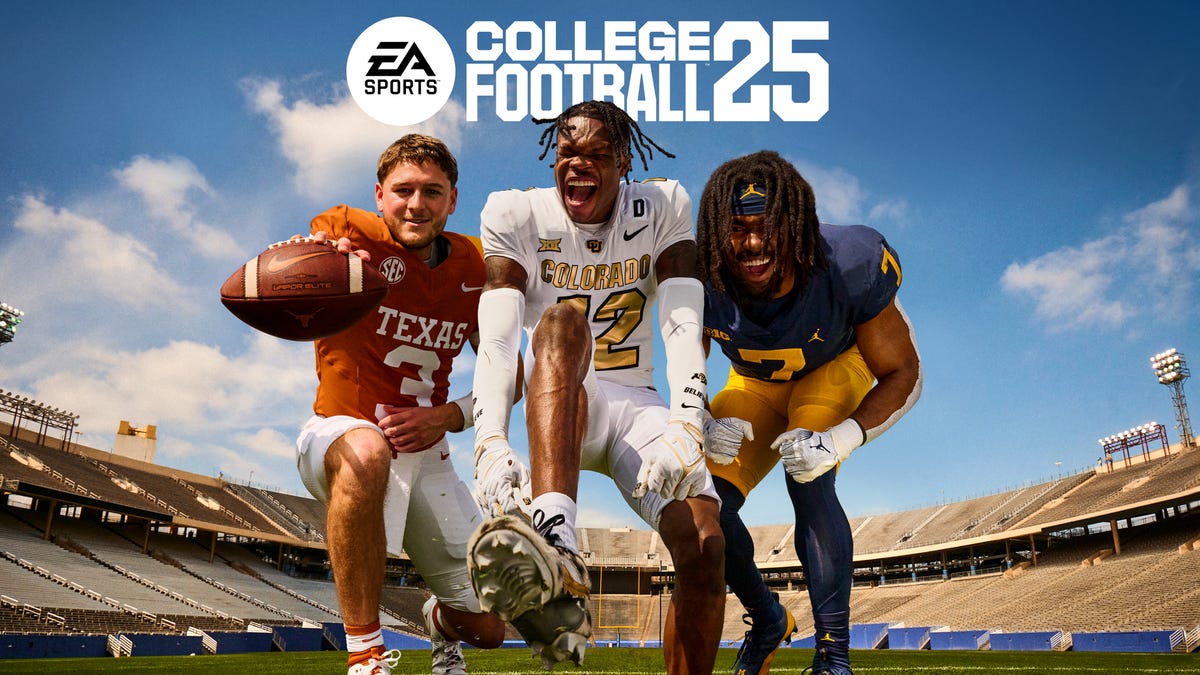

Eas College Football 26 Release Date Madden 26 Bundle And Everything We Know

Apr 29, 2025

Eas College Football 26 Release Date Madden 26 Bundle And Everything We Know

Apr 29, 2025 -

Criminal Case Dropped Against Matt Petgrave In Adam Johnson Case

Apr 29, 2025

Criminal Case Dropped Against Matt Petgrave In Adam Johnson Case

Apr 29, 2025 -

Qantas International Flight Sale Flights From 499

Apr 29, 2025

Qantas International Flight Sale Flights From 499

Apr 29, 2025