Is The Bitcoin Bull Run Over? Expert Predictions And BTC Price Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is the Bitcoin Bull Run Over? Expert Predictions and BTC Price Analysis

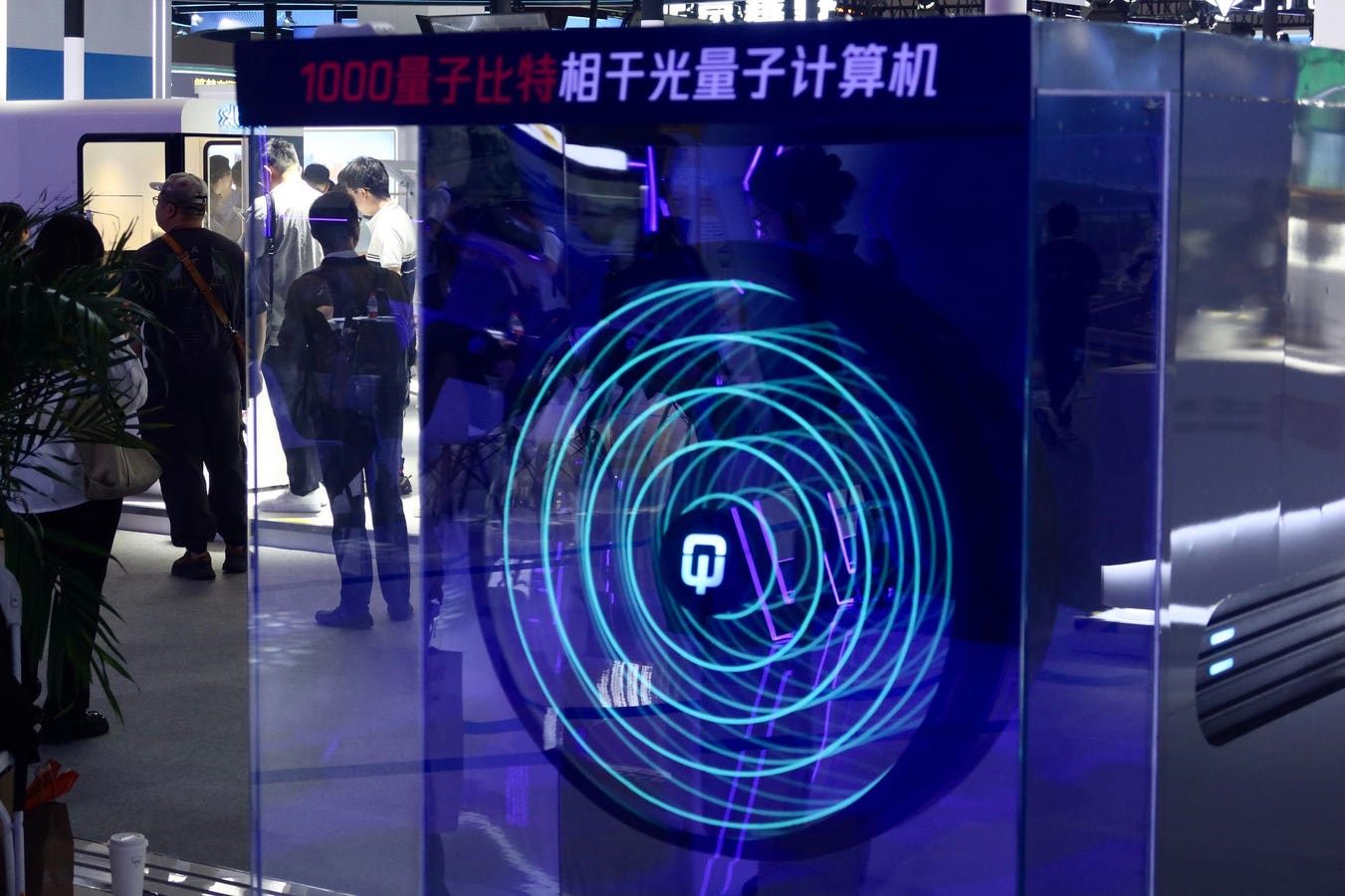

Bitcoin's price has experienced significant volatility in recent months, leaving many investors wondering: is the bull run over? After a period of impressive growth, the cryptocurrency has seen a correction, sparking debates and diverse predictions among experts. This article delves into the current state of the Bitcoin market, analyzing price trends and expert opinions to shed light on the future trajectory of BTC.

Bitcoin Price: A Rollercoaster Ride

Bitcoin's price has historically been known for its dramatic fluctuations. After reaching an all-time high in [Insert most recent ATH date and price], it experienced a significant downturn, prompting concerns about a potential market reversal. While the recent correction is noteworthy, it's crucial to analyze the situation within a broader context. Factors such as macroeconomic conditions, regulatory developments, and overall market sentiment all play crucial roles in shaping Bitcoin's price.

What are the Experts Saying?

The crypto community is buzzing with varying opinions regarding the future of Bitcoin. Some analysts remain bullish, citing long-term adoption and technological advancements as reasons for continued growth. They highlight the increasing institutional investment in Bitcoin and the growing acceptance of cryptocurrencies as a legitimate asset class. These analysts often point to the scarcity of Bitcoin, with only 21 million coins ever to be mined, as a key factor underpinning its long-term value.

Conversely, other experts express caution, pointing to the current macroeconomic climate, including high inflation and potential interest rate hikes, as factors that could negatively impact Bitcoin's price. They also highlight the increased regulatory scrutiny surrounding cryptocurrencies in various jurisdictions as a potential headwind.

Technical Analysis: Deciphering the Charts

Technical analysis of Bitcoin's price charts provides further insights. Looking at key indicators such as moving averages, support and resistance levels, and trading volume can help identify potential trends and predict future price movements. [Mention specific technical indicators and their implications, referencing charts if possible. Avoid overly technical jargon, explaining concepts clearly for a wider audience]. However, it's important to remember that technical analysis is not an exact science and should be considered alongside fundamental analysis and expert opinions.

Factors Influencing Bitcoin's Future:

Several factors beyond price action will significantly influence Bitcoin's future trajectory:

- Regulatory Landscape: Government regulations regarding cryptocurrencies will play a crucial role. Clearer and more consistent regulations could boost investor confidence, while overly restrictive measures could stifle growth.

- Institutional Adoption: Continued adoption of Bitcoin by institutional investors, such as hedge funds and corporations, will significantly impact its price.

- Technological Developments: Advancements in the Bitcoin network, such as the Lightning Network, could improve scalability and transaction speeds, potentially increasing adoption.

- Macroeconomic Conditions: Global economic factors, such as inflation and interest rates, will influence investor sentiment and capital flows into the cryptocurrency market.

Conclusion: Is the Bull Run Over?

Determining whether the Bitcoin bull run is definitively over remains challenging. While a correction was expected after a period of rapid growth, the long-term outlook for Bitcoin remains subject to a number of interconnected variables. The cryptocurrency’s future depends on a confluence of factors, including regulatory clarity, technological advancements, institutional adoption, and macroeconomic conditions. Investors should carefully consider these factors, conduct their own research, and manage their risk accordingly. The current market volatility underscores the importance of a diversified investment strategy and a long-term perspective. The journey of Bitcoin is far from over, and its ultimate fate remains to be seen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is The Bitcoin Bull Run Over? Expert Predictions And BTC Price Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

T Mobiles Champ Connections Get To Know Max Homa

May 17, 2025

T Mobiles Champ Connections Get To Know Max Homa

May 17, 2025 -

41 Year Old Suffers Brain Hemorrhage In Uber Drivers Swift Response Is Life Saving

May 17, 2025

41 Year Old Suffers Brain Hemorrhage In Uber Drivers Swift Response Is Life Saving

May 17, 2025 -

Should You Buy Or Sell Qubt Stock Ahead Of Its Upcoming Earnings Report

May 17, 2025

Should You Buy Or Sell Qubt Stock Ahead Of Its Upcoming Earnings Report

May 17, 2025 -

Popular Energy Drink Additive Linked To Blood Cancer What You Need To Know

May 17, 2025

Popular Energy Drink Additive Linked To Blood Cancer What You Need To Know

May 17, 2025 -

Western United Vs Melbourne City Match Preview Standings And Key Stats May 16th 9 35 Am

May 17, 2025

Western United Vs Melbourne City Match Preview Standings And Key Stats May 16th 9 35 Am

May 17, 2025