Is This Bitcoin Metric Giving A False Buy Signal? Proceed With Caution.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is This Bitcoin Metric Giving a False Buy Signal? Proceed With Caution.

Bitcoin's price has been on a rollercoaster ride lately, leaving investors questioning the next move. One popular metric, the Mayer Multiple, is currently flashing a potential buy signal, but experienced traders are urging caution. Is this a genuine opportunity, or a deceptive trap for the unwary? Let's delve into the details.

Understanding the Mayer Multiple

The Mayer Multiple is a simple yet effective tool used to gauge Bitcoin's valuation relative to its 200-day moving average (MA). It's calculated by dividing the current Bitcoin price by its 200-day MA. Historically, readings below 2.0 have often coincided with buying opportunities, while readings above 2.0 suggest overvaluation. Currently, the Mayer Multiple is hovering near historically low levels, sparking renewed interest among some investors.

The Allure of a "Buy" Signal:

A low Mayer Multiple suggests that Bitcoin is trading significantly below its 200-day MA, indicating a potentially attractive entry point for long-term investors. This is particularly tempting given the recent market volatility and the ongoing debate surrounding Bitcoin's future. The simplicity of the metric makes it appealing to both seasoned traders and newcomers alike. The historical correlation between low Mayer Multiples and subsequent price increases adds to its allure.

Reasons for Caution:

While historically reliable to some degree, relying solely on the Mayer Multiple is risky. Several factors warrant caution:

-

Market Sentiment: While the metric suggests undervaluation, overall market sentiment remains uncertain. Factors like regulatory uncertainty, macroeconomic conditions, and competing cryptocurrencies can significantly impact Bitcoin's price, regardless of technical indicators.

-

False Signals: Past performance is not indicative of future results. The Mayer Multiple has occasionally given false buy signals, leading to further price drops before any significant recovery. Blindly following this metric without considering other factors could lead to substantial losses.

-

Context is Crucial: The Mayer Multiple should be used in conjunction with other technical and fundamental analysis tools. Considering factors like on-chain metrics, trading volume, and overall market trends provides a more comprehensive picture.

-

Macroeconomic Factors: Global inflation, interest rate hikes, and recessionary fears are impacting all asset classes, including Bitcoin. Ignoring these macroeconomic headwinds when interpreting the Mayer Multiple could be a critical error.

What Should Investors Do?

The current low Mayer Multiple reading is certainly noteworthy, but it shouldn't be the sole factor driving investment decisions. A prudent approach involves:

-

Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio to mitigate risk.

-

Thorough Research: Conduct in-depth research, considering both technical and fundamental factors before making any investment decisions.

-

Risk Management: Implement a robust risk management strategy, including setting stop-loss orders to limit potential losses.

-

Long-Term Perspective: Bitcoin is a volatile asset. A long-term investment horizon is crucial for weathering market fluctuations.

Conclusion:

The low Mayer Multiple presents an interesting opportunity, but it's crucial to approach it with caution. This metric should be viewed as one piece of the puzzle, not the entire picture. Thorough research, diversification, and a robust risk management strategy are essential for navigating the complexities of the Bitcoin market. Remember, the cryptocurrency market is inherently risky, and no indicator guarantees future price movements. Proceed with caution.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is This Bitcoin Metric Giving A False Buy Signal? Proceed With Caution.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Space X Confirms Super Heavy Booster 14 For Starship Flight 9 Relaunch

Apr 08, 2025

Space X Confirms Super Heavy Booster 14 For Starship Flight 9 Relaunch

Apr 08, 2025 -

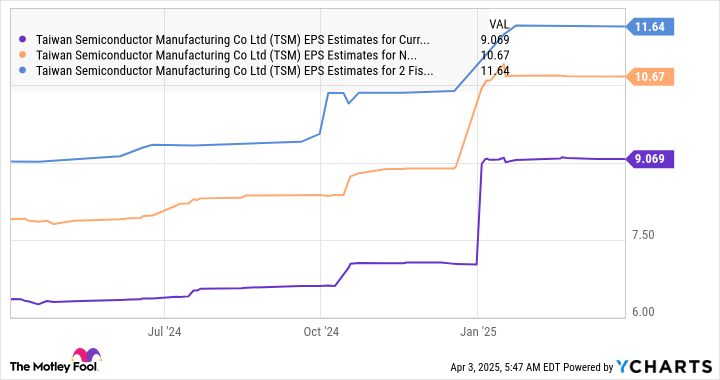

Is This Top Ai Stock A Bargain After A 25 Drop

Apr 08, 2025

Is This Top Ai Stock A Bargain After A 25 Drop

Apr 08, 2025 -

Is Rachel Reeves Economic Policy Driving Uk Emigration To Italy

Apr 08, 2025

Is Rachel Reeves Economic Policy Driving Uk Emigration To Italy

Apr 08, 2025 -

Efl Predictions Stoke Citys Tuesday Fixture And Enhanced Survival Odds

Apr 08, 2025

Efl Predictions Stoke Citys Tuesday Fixture And Enhanced Survival Odds

Apr 08, 2025 -

Crest Accreditation And Cmmc Level 1 Compliance Secure Ideas Commitment To Security

Apr 08, 2025

Crest Accreditation And Cmmc Level 1 Compliance Secure Ideas Commitment To Security

Apr 08, 2025