Konglomerat Indonesia: Obligasi Rp 1 Triliun Dengan Bunga 9,3%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Konglomerat Indonesia: Obligasi Rp 1 Triliun dengan Bunga 9,3% - Investasi Menarik atau Risiko Tertutup?

Indonesia's business landscape is buzzing with the news of a major Indonesian conglomerate issuing Rp 1 trillion (approximately US$66 million) worth of bonds, offering a compelling interest rate of 9.3%. This significant move has sparked considerable interest among investors, but is it a lucrative opportunity or a hidden risk? This article delves into the details, examining the potential benefits and drawbacks for those considering investing in these bonds.

Understanding the Bond Offering

The issuance of Rp 1 trillion in bonds by this unnamed Indonesian conglomerate represents a substantial injection of capital into the market. The 9.3% interest rate is significantly higher than many other comparable investment options currently available, making it an attractive proposition for those seeking higher returns. This high yield, however, often comes with increased risk. The specific details regarding the bond's maturity date, credit rating, and other key terms are crucial for potential investors to assess the level of risk involved. Unfortunately, without specifying the conglomerate, concrete details remain limited at this time. We will update this article as soon as more information becomes available.

Attractive Interest Rate: A Double-Edged Sword

A 9.3% interest rate is undoubtedly enticing. In a market where interest rates are generally lower, this high yield offers the potential for substantial returns. For investors seeking to bolster their portfolio's income stream, these bonds could represent a significant opportunity. However, it's crucial to remember the correlation between risk and return. A high interest rate often reflects a higher perceived risk associated with the investment.

Potential Risks to Consider

Before considering an investment, potential investors should carefully analyze the following risk factors:

-

Credit Risk: The most significant risk is the creditworthiness of the issuing conglomerate. A lower credit rating increases the probability of default, meaning the investor might not receive the promised interest payments or principal repayment. Thorough due diligence is essential to assess the financial health and stability of the company.

-

Interest Rate Risk: Changes in prevailing interest rates can impact the value of the bond. If interest rates rise, the value of the existing bond with a fixed 9.3% interest rate may decrease.

-

Liquidity Risk: The ability to easily sell the bond before maturity can be a concern. If the bond is illiquid, finding a buyer might be difficult, potentially impacting the investor's ability to access their capital.

-

Inflation Risk: High inflation can erode the real value of the returns, even with a 9.3% interest rate.

Due Diligence is Paramount

For any potential investor, conducting thorough due diligence is crucial. This includes:

-

Investigating the Issuer: Understanding the conglomerate's financial history, current financial position, and future prospects is paramount.

-

Reviewing the Bond Prospectus: The prospectus will contain detailed information on the bond's terms and conditions, including the maturity date, repayment schedule, and any associated risks.

-

Seeking Professional Advice: Consulting with a financial advisor can provide valuable insights and help investors make informed decisions based on their individual risk tolerance and investment goals.

Conclusion: Proceed with Caution

The offer of a Rp 1 trillion bond issuance with a 9.3% interest rate by an Indonesian conglomerate presents a potentially lucrative opportunity, but it's crucial to approach it with caution. The high interest rate reflects a higher level of risk. Thorough due diligence, careful consideration of the risks involved, and seeking professional financial advice are essential steps before making any investment decisions. As more information becomes available regarding the specific conglomerate and the bond's details, this article will be updated to provide a more comprehensive analysis. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Konglomerat Indonesia: Obligasi Rp 1 Triliun Dengan Bunga 9,3%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Como Usufruir De Uma Casa Na Praia Ou No Campo Sem O Peso Da Compra Total

Mar 18, 2025

Como Usufruir De Uma Casa Na Praia Ou No Campo Sem O Peso Da Compra Total

Mar 18, 2025 -

Cricket Nsws Hopes Dwindle After Tasmanias Impressive Innings

Mar 18, 2025

Cricket Nsws Hopes Dwindle After Tasmanias Impressive Innings

Mar 18, 2025 -

Will John Collins Join The Warriors Hield Trade Rumors Heat Up

Mar 18, 2025

Will John Collins Join The Warriors Hield Trade Rumors Heat Up

Mar 18, 2025 -

Are You Affected Understanding The Implications Of Welfare Cuts On Pip

Mar 18, 2025

Are You Affected Understanding The Implications Of Welfare Cuts On Pip

Mar 18, 2025 -

Nine Months In Space Nasa Astronauts Aboard Boeing Capsule Return Home

Mar 18, 2025

Nine Months In Space Nasa Astronauts Aboard Boeing Capsule Return Home

Mar 18, 2025

Latest Posts

-

Asuss Innovative Gpu Sag Solution A Necessary Improvement For All Graphics Cards

Apr 30, 2025

Asuss Innovative Gpu Sag Solution A Necessary Improvement For All Graphics Cards

Apr 30, 2025 -

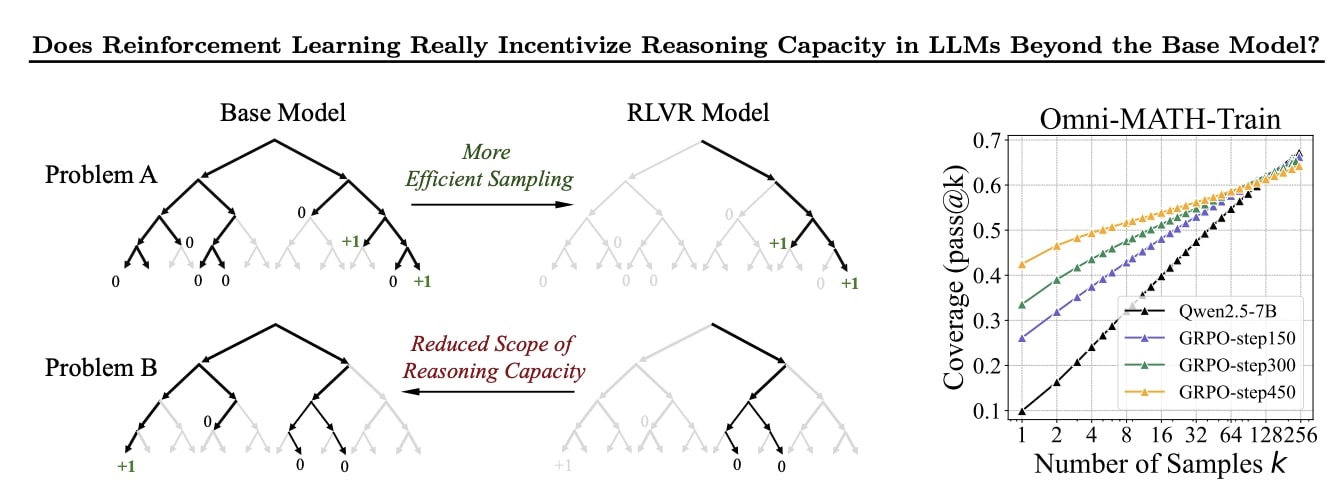

Debunking The Hype Reinforcement Learnings Impact On Ai Models

Apr 30, 2025

Debunking The Hype Reinforcement Learnings Impact On Ai Models

Apr 30, 2025 -

My Left Eye With My Right Eye Jeremy Renners Account Of His 2023 Accident

Apr 30, 2025

My Left Eye With My Right Eye Jeremy Renners Account Of His 2023 Accident

Apr 30, 2025 -

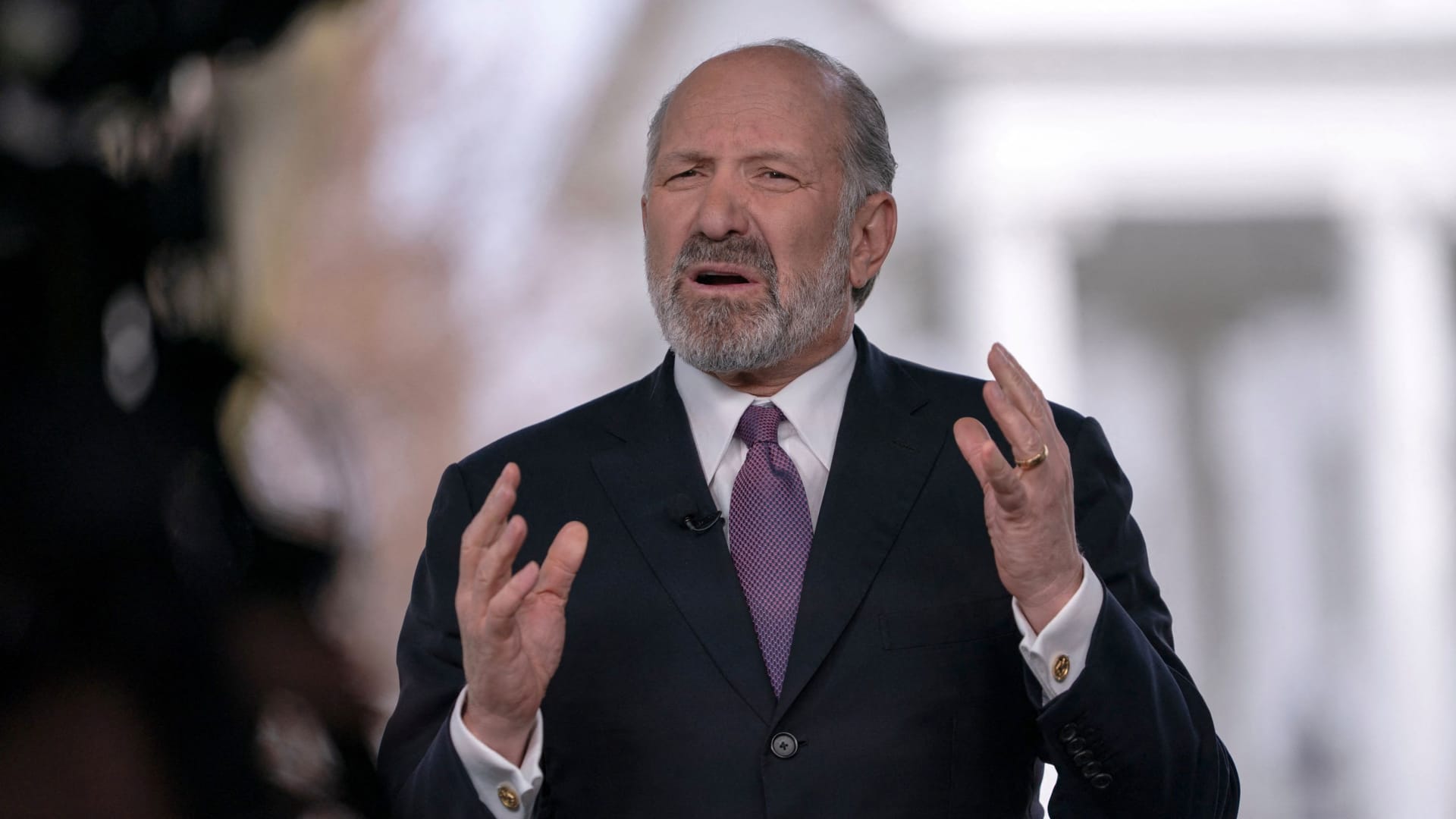

Unnamed Country Holds Up Trade Deal Commerce Secretarys Statement

Apr 30, 2025

Unnamed Country Holds Up Trade Deal Commerce Secretarys Statement

Apr 30, 2025 -

Trump Tariffs And The Pending Trade Deal Awaiting Uk Government Action

Apr 30, 2025

Trump Tariffs And The Pending Trade Deal Awaiting Uk Government Action

Apr 30, 2025