Market Crash? SSE Composite Index Suffers 6.06% Fall: Expert Commentary

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Crash? SSE Composite Index Suffers 6.06% Fall: Expert Commentary

The Shanghai Stock Exchange Composite Index (SSE Composite) plummeted by a staggering 6.06% on [Date of crash], sending shockwaves through global markets and sparking concerns of a potential market crash. This dramatic fall marks the index's [describe significance, e.g., worst single-day drop in X months/years] and has left investors reeling, prompting urgent questions about the underlying causes and the potential for further declines.

The sudden and sharp drop in the SSE Composite raises serious questions about the health of the Chinese economy and its global implications. Experts are scrambling to understand the factors contributing to this significant market downturn, with a range of potential culprits being debated.

Factors Contributing to the SSE Composite Index Crash:

Several factors are likely contributing to the sharp decline in the SSE Composite. These include:

-

Regulatory Uncertainty: Increased regulatory scrutiny in key sectors, particularly technology and real estate, has created uncertainty and spooked investors. Recent crackdowns on monopolistic practices and data security have significantly impacted the valuations of many prominent Chinese companies.

-

Economic Slowdown: Concerns about a slowing Chinese economy are fueling investor anxiety. Recent economic data, including [mention specific economic indicators like GDP growth, inflation rates, etc.], has pointed to a less robust recovery than initially anticipated.

-

Global Market Sentiment: The broader global economic outlook is also playing a role. Rising inflation in many developed economies, coupled with potential interest rate hikes, is contributing to a risk-off sentiment in global markets, impacting investor confidence in emerging markets like China.

-

Evergrande Fallout: The lingering impact of the Evergrande crisis continues to cast a shadow over the Chinese real estate sector and investor confidence. While the immediate crisis may have subsided, the long-term consequences are still unfolding.

-

Geopolitical Tensions: Escalating geopolitical tensions, particularly the ongoing US-China trade dispute and broader geopolitical uncertainties, are adding to the overall market volatility.

Expert Commentary: Analyzing the Market's Future

Experts offer diverse opinions on the severity and duration of this market downturn. Some analysts believe this is a temporary correction, a necessary adjustment after a period of rapid growth. They point to the resilience of the Chinese economy and the government's capacity to implement stabilizing measures.

However, other experts express more caution, warning of the potential for a more prolonged period of market volatility. They emphasize the need for a comprehensive analysis of the underlying economic and regulatory challenges facing China.

“[Quote from a prominent financial analyst],” highlighting their perspective on the situation. Another expert stated, “[Quote from a second expert],” offering a contrasting viewpoint.

What Investors Should Do:

The volatility in the SSE Composite Index presents significant challenges for investors. However, experts advise against panic selling. Instead, they recommend:

- Diversification: Maintaining a well-diversified portfolio across different asset classes and geographies is crucial to mitigate risk.

- Long-Term Perspective: Investors should avoid making rash decisions based on short-term market fluctuations and focus on their long-term investment goals.

- Risk Assessment: Carefully assess your risk tolerance and adjust your investment strategy accordingly.

- Professional Advice: Seek advice from a qualified financial advisor to help navigate this challenging market environment.

The sharp decline in the SSE Composite Index is undoubtedly a significant event with potentially far-reaching consequences. While the immediate future remains uncertain, understanding the contributing factors and heeding expert advice is crucial for navigating this volatile market. The coming weeks will be critical in determining whether this is a temporary setback or the start of a more significant market correction. Further updates will be provided as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Crash? SSE Composite Index Suffers 6.06% Fall: Expert Commentary. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

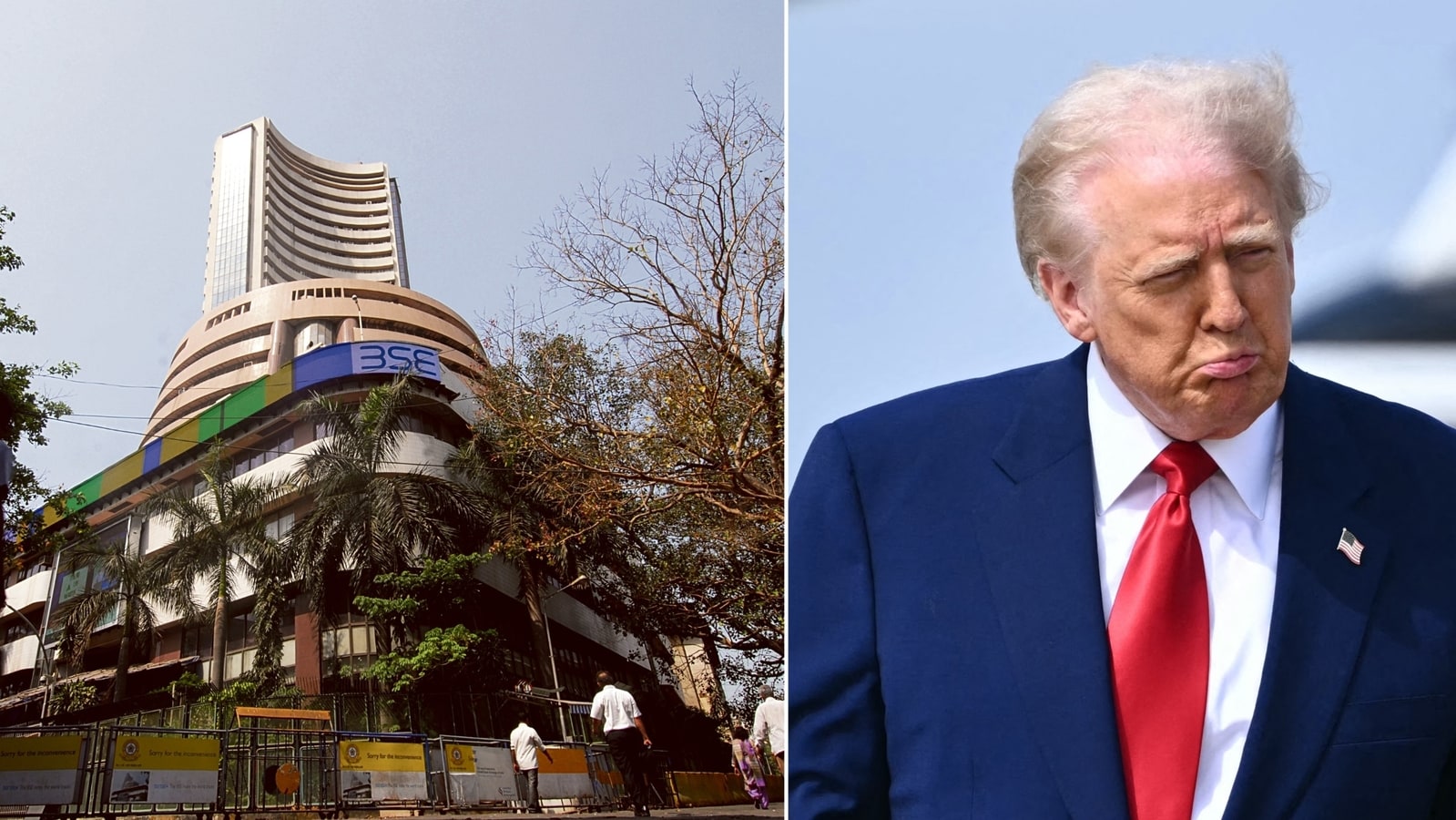

Why Is The Indian Stock Market Crashing Understanding Todays Decline

Apr 08, 2025

Why Is The Indian Stock Market Crashing Understanding Todays Decline

Apr 08, 2025 -

Former Nrl Player Wiliame Takes The Reins As Bulldogs Womens Coach

Apr 08, 2025

Former Nrl Player Wiliame Takes The Reins As Bulldogs Womens Coach

Apr 08, 2025 -

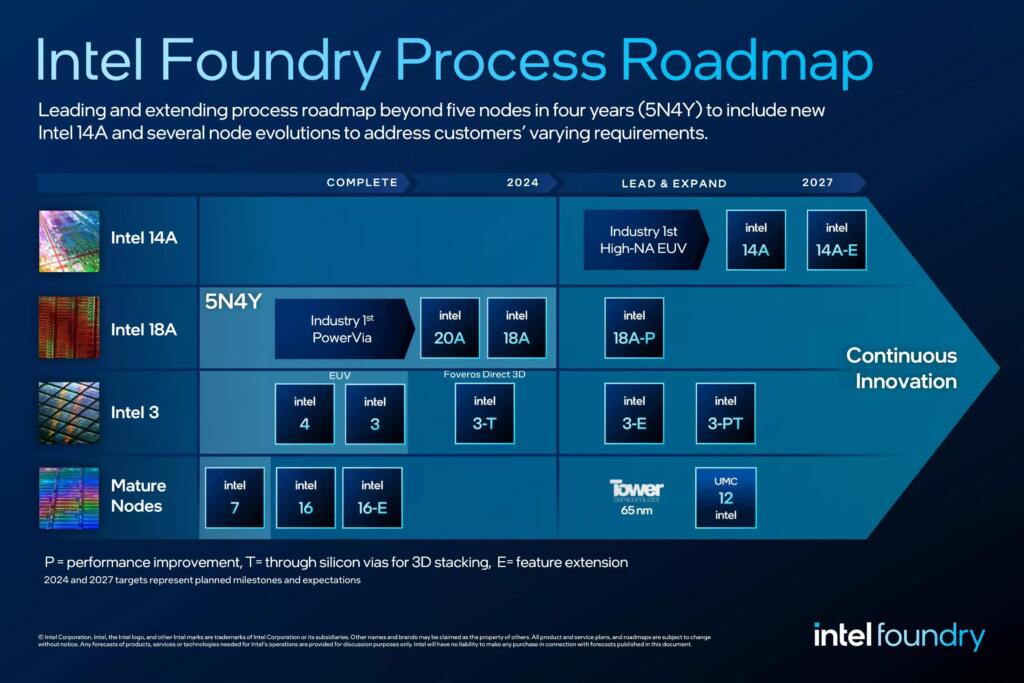

Intel 18 Angstrom A Comeback Story Mass Production On Track For 2025

Apr 08, 2025

Intel 18 Angstrom A Comeback Story Mass Production On Track For 2025

Apr 08, 2025 -

Solutions For Nyt Connections Sports Puzzle April 6th 195

Apr 08, 2025

Solutions For Nyt Connections Sports Puzzle April 6th 195

Apr 08, 2025 -

Jenna Ortegas Death Of A Unicorn A Hilarious Dark Take On Corporate Greed

Apr 08, 2025

Jenna Ortegas Death Of A Unicorn A Hilarious Dark Take On Corporate Greed

Apr 08, 2025