Market Downturn Survival Guide: Lessons From Buffett And A Classic Poem

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Downturn Survival Guide: Lessons from Buffett and a Classic Poem

The stock market's roller coaster ride has left many investors feeling queasy. Recent downturns have underscored the importance of a robust investment strategy, one that can weather the storm and emerge stronger. But where do we find the wisdom to navigate these turbulent times? Surprisingly, the answers can be found in the sage advice of Warren Buffett and the enduring wisdom of a classic poem.

Warren Buffett's Timeless Investment Principles:

The Oracle of Omaha, Warren Buffett, has navigated countless market cycles. His success isn't tied to market timing; instead, it stems from fundamental principles that remain relevant even during market downturns. Key takeaways for surviving a market downturn include:

-

Long-Term Vision: Buffett famously advocates for a long-term investment horizon. He doesn't panic sell during market dips; he views them as opportunities to buy undervalued assets. Don't let short-term market fluctuations dictate your long-term investment strategy.

-

Value Investing: Buffett focuses on identifying undervalued companies with strong fundamentals. He looks beyond short-term market noise and focuses on the intrinsic value of a company. This approach minimizes losses during downturns and positions investors for future growth.

-

Diversification: Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes reduces your overall risk. This strategy helps mitigate losses if one sector underperforms.

-

Emotional Discipline: Fear and greed are powerful emotions that often drive poor investment decisions. Buffett emphasizes the importance of emotional discipline, urging investors to remain calm and rational during market volatility. Avoid impulsive decisions based on fear or panic.

The Unexpected Wisdom of "If"—A Poetic Perspective on Resilience:

Rudyard Kipling's poem, "If," offers surprising parallels to successful investing during market downturns. The poem's emphasis on self-control, perseverance, and resilience mirrors the qualities needed to navigate market volatility:

-

"If you can keep your head when all about you / Are losing theirs and blaming it on you..." This speaks to the importance of maintaining emotional composure during market turmoil. Don't succumb to panic selling just because others are.

-

"...If you can trust yourself when all men doubt you, / But make allowance for their doubting too..." This highlights the need for self-belief and the understanding that market skepticism is part of the cycle. Maintain confidence in your research and strategy, but also be open to reevaluating your approach if necessary.

-

"...If you can dream—and not make dreams your master; / If you can think—and not make thoughts your aim..." This reminds investors to keep their long-term goals in mind, avoiding short-sighted decisions driven by fleeting market trends.

Integrating Buffett's Wisdom and Kipling's Counsel:

By combining the practical investment strategies of Warren Buffett with the resilient mindset championed in Kipling's "If," investors can better prepare themselves for market downturns. This integrated approach emphasizes:

-

Strategic Asset Allocation: A diversified portfolio with a focus on value investing forms the bedrock of a robust investment strategy.

-

Emotional Intelligence: Developing emotional resilience is crucial for weathering market storms and avoiding impulsive decisions.

-

Long-Term Perspective: Maintaining a long-term focus helps investors ride out market fluctuations and capitalize on long-term growth opportunities.

Market downturns are inevitable. However, by learning from the wisdom of investment greats like Warren Buffett and embracing the resilient spirit of classic literature, investors can not only survive but also thrive during periods of market uncertainty. The key is preparation, discipline, and a long-term perspective.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Downturn Survival Guide: Lessons From Buffett And A Classic Poem. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Following Us Fine Okx Faces 1 2 M Penalty In Malta For Aml Non Compliance

Apr 07, 2025

Following Us Fine Okx Faces 1 2 M Penalty In Malta For Aml Non Compliance

Apr 07, 2025 -

Trump Tariffs And Morgan Wallen Snls Controversial Cold Open

Apr 07, 2025

Trump Tariffs And Morgan Wallen Snls Controversial Cold Open

Apr 07, 2025 -

12 Tim Esports Adu Gengsi Di Esl Mobile Masters 2025 Catat Jadwalnya

Apr 07, 2025

12 Tim Esports Adu Gengsi Di Esl Mobile Masters 2025 Catat Jadwalnya

Apr 07, 2025 -

Benarkah Ikn Diserbu Tikus Saat Lebaran Otorita Bantah Klaim Yang Beredar

Apr 07, 2025

Benarkah Ikn Diserbu Tikus Saat Lebaran Otorita Bantah Klaim Yang Beredar

Apr 07, 2025 -

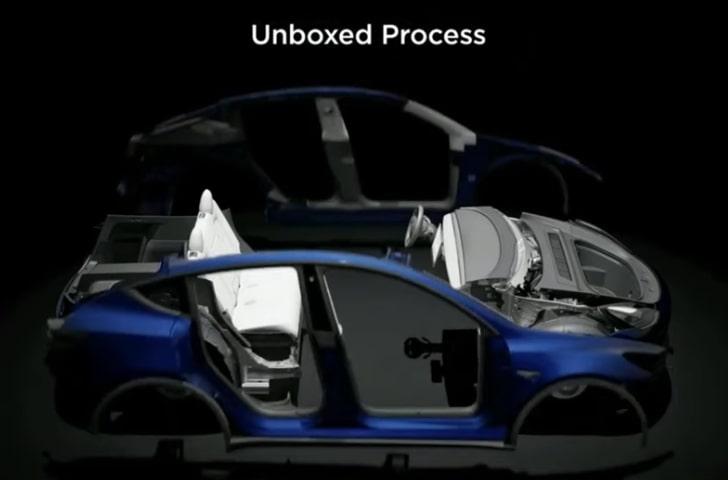

The Technological Leap In Tesla Cybercab Production A Space X Starship Analogy

Apr 07, 2025

The Technological Leap In Tesla Cybercab Production A Space X Starship Analogy

Apr 07, 2025