Market Reaction: Investors Respond Positively To US-China Trade Updates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reaction: Investors Respond Positively to US-China Trade Updates

Positive Sentiment Sweeps Global Markets Following Easing of Trade Tensions

Global markets experienced a surge of optimism this week following a series of positive developments in US-China trade relations. Investors, previously wary of escalating trade wars and economic uncertainty, reacted favorably to news suggesting a potential de-escalation of tensions between the world's two largest economies. This shift in sentiment has led to significant gains across various asset classes, signaling a renewed sense of confidence in the global economic outlook.

Key Developments Fueling the Market Rally:

Several key developments contributed to the positive market reaction. These include:

- Resumption of Trade Talks: Reports emerged of renewed high-level discussions between US and Chinese officials, indicating a willingness from both sides to re-engage in constructive dialogue. This followed a period of stalled negotiations and increased tariffs, which had significantly dampened market sentiment.

- Potential Tariff Rollbacks: Speculation of potential rollbacks or suspensions of existing tariffs further fueled the positive investor response. The possibility of reduced trade barriers promises to alleviate pressures on businesses and consumers alike, boosting economic activity.

- Focus on Cooperation: Statements emphasizing cooperation and mutual benefit in trade relations have helped to alleviate fears of a prolonged trade war. This shift in rhetoric suggests a potential move towards a more stable and predictable trading environment.

Impact on Key Sectors:

The positive market reaction wasn't uniform across all sectors. However, several industries experienced particularly strong gains:

- Technology: Tech stocks, heavily impacted by previous trade tensions, saw significant gains as investors anticipate reduced disruptions to supply chains and increased market access.

- Manufacturing: Manufacturing companies, facing challenges from tariffs and trade uncertainty, benefited from the renewed optimism, with shares experiencing a notable upward trend.

- Agriculture: The agricultural sector, which has been significantly impacted by the trade war, also saw a positive response, reflecting hopes for improved export opportunities.

Analyzing the Long-Term Implications:

While the current market reaction is undeniably positive, it's crucial to approach the situation with a degree of caution. The long-term implications of the recent developments remain uncertain. Sustained progress in US-China trade relations will be essential to maintaining this positive momentum. Factors to watch closely include:

- Concrete Agreement: The market's enthusiasm will likely depend on the extent to which the positive developments translate into concrete agreements and policy changes. Mere discussions are insufficient to guarantee sustained market growth.

- Geopolitical Risks: Other geopolitical risks and uncertainties could still negatively impact global markets, potentially overshadowing the positive effects of improved US-China trade relations.

- Economic Data: Continued strong economic data from both the US and China will be critical for reinforcing the positive sentiment and preventing a potential market correction.

Conclusion:

The recent positive market reaction to the US-China trade updates is a welcome development for global investors. However, sustained progress in trade negotiations and a cautious approach to assessing long-term implications are crucial for ensuring the continued positive momentum. The coming weeks and months will be pivotal in determining whether this optimism translates into a sustained period of economic growth and stability. The situation remains fluid, and continued monitoring of developments is essential for informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reaction: Investors Respond Positively To US-China Trade Updates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

115 Tariff Reduction Historic Us China Trade Agreement Reached

May 12, 2025

115 Tariff Reduction Historic Us China Trade Agreement Reached

May 12, 2025 -

Childhood Obsession A Review Of The Film Despelote

May 12, 2025

Childhood Obsession A Review Of The Film Despelote

May 12, 2025 -

Alexander Arnold To Feyenoord Slots Press Conference Hints At Transfer Plans

May 12, 2025

Alexander Arnold To Feyenoord Slots Press Conference Hints At Transfer Plans

May 12, 2025 -

Introducing An Ai Agent For Automated Web Tasks Browsing And Form Filling

May 12, 2025

Introducing An Ai Agent For Automated Web Tasks Browsing And Form Filling

May 12, 2025 -

Phishing Attacks Expose Employee Data Spy Cloud Analysis Of Fortune 500 Companies

May 12, 2025

Phishing Attacks Expose Employee Data Spy Cloud Analysis Of Fortune 500 Companies

May 12, 2025

Latest Posts

-

Singapore Cricket Mourns Loss Of Arjun Menon Killed In Malawi

May 12, 2025

Singapore Cricket Mourns Loss Of Arjun Menon Killed In Malawi

May 12, 2025 -

Investing In Nvidia A 5 Year Outlook On Stock Performance

May 12, 2025

Investing In Nvidia A 5 Year Outlook On Stock Performance

May 12, 2025 -

Amazons Mini Echo Show A Price Competitive Threat To Googles Smart Display Market

May 12, 2025

Amazons Mini Echo Show A Price Competitive Threat To Googles Smart Display Market

May 12, 2025 -

Tight Serie A Race Inters Victory Narrows Gap On Napoli

May 12, 2025

Tight Serie A Race Inters Victory Narrows Gap On Napoli

May 12, 2025 -

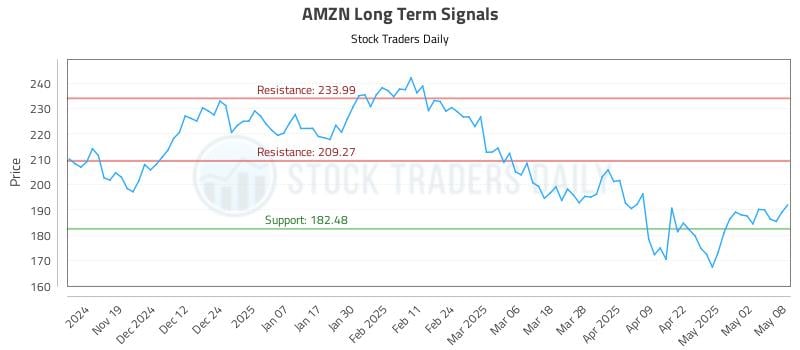

Amzn Stock Investment Report Risks Rewards And Future Projections

May 12, 2025

Amzn Stock Investment Report Risks Rewards And Future Projections

May 12, 2025