Meta (META) Stock Climbs: Understanding The Market Drivers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Meta (META) Stock Climbs: Understanding the Market Drivers

Meta Platforms (META) stock experienced a significant surge recently, leaving investors wondering about the driving forces behind this positive market movement. While short-term market fluctuations are common, several key factors contribute to this sustained climb, offering valuable insights for current and prospective investors.

The Resurgence of Advertising Revenue:

One of the most significant drivers behind Meta's stock climb is the resurgence of its advertising revenue. After a period of uncertainty and decreased ad spending, particularly in the wake of Apple's privacy changes and increased competition, Meta has demonstrated a remarkable recovery. This rebound can be attributed to several factors:

- Improved Ad Targeting: Meta has invested heavily in improving its ad targeting algorithms, leading to better campaign performance and increased return on investment for advertisers. This enhanced efficiency makes Meta's advertising platform more attractive, boosting demand.

- Rebounding Global Economy: A healthier global economy generally translates to increased advertising budgets across various sectors. As businesses see improved prospects, they are more willing to invest in marketing and advertising efforts, directly benefiting Meta's bottom line.

- Focus on Reels and Short-Form Video: Meta's increased emphasis on Reels, its short-form video format, is mimicking the success of TikTok and other platforms. This shift attracts younger demographics and provides new opportunities for advertisers to engage with audiences.

Beyond Advertising: The Metaverse and Innovation:

While advertising remains the primary revenue generator for Meta, the company's long-term vision encompassing the metaverse and ongoing investments in innovative technologies also contribute to investor confidence. Although profitability in these areas is still some time away, the potential for future growth is a key factor influencing investor sentiment.

- Metaverse Development: Although the metaverse's full potential remains unrealized, continued investments and advancements in virtual reality (VR) and augmented reality (AR) technologies demonstrate Meta's commitment to this long-term strategy. This commitment signals to investors a focus on future growth opportunities.

- Artificial Intelligence (AI) Advancements: Meta is heavily investing in AI, a technology crucial for improving ad targeting, enhancing user experience, and driving innovation across its various platforms. These AI advancements are viewed positively by investors as a potential catalyst for future growth.

Addressing Investor Concerns:

Despite the recent stock climb, challenges remain. Concerns about competition from other social media platforms, the ongoing impact of privacy regulations, and the long-term viability of the metaverse continue to influence market sentiment. Investors are carefully monitoring Meta's progress in navigating these complexities.

Looking Ahead: Prospects for Meta Stock:

The recent surge in Meta's stock price suggests a renewed confidence in the company's ability to overcome challenges and capitalize on emerging opportunities. However, investors should maintain a balanced perspective, acknowledging both the positive trends and the persistent headwinds. Careful analysis of Meta's financial performance, strategic initiatives, and competitive landscape remains crucial for making informed investment decisions. The future trajectory of META stock will likely depend on its continued success in adapting to evolving market dynamics and delivering on its long-term vision. Continued monitoring of key performance indicators (KPIs) like advertising revenue, user engagement, and technological advancements will be essential for assessing the long-term potential of this tech giant.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Meta (META) Stock Climbs: Understanding The Market Drivers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Help From Episcopal Church For White South African Refugees

May 14, 2025

No Help From Episcopal Church For White South African Refugees

May 14, 2025 -

Domhnall Gleeson Reveals Details On His The Office Spin Off The Paper

May 14, 2025

Domhnall Gleeson Reveals Details On His The Office Spin Off The Paper

May 14, 2025 -

Socialist Zohran Mamdani Weds In Dubai Exclusive Photos

May 14, 2025

Socialist Zohran Mamdani Weds In Dubai Exclusive Photos

May 14, 2025 -

Russias False Euphoria A Critical Assessment Of The Current Situation

May 14, 2025

Russias False Euphoria A Critical Assessment Of The Current Situation

May 14, 2025 -

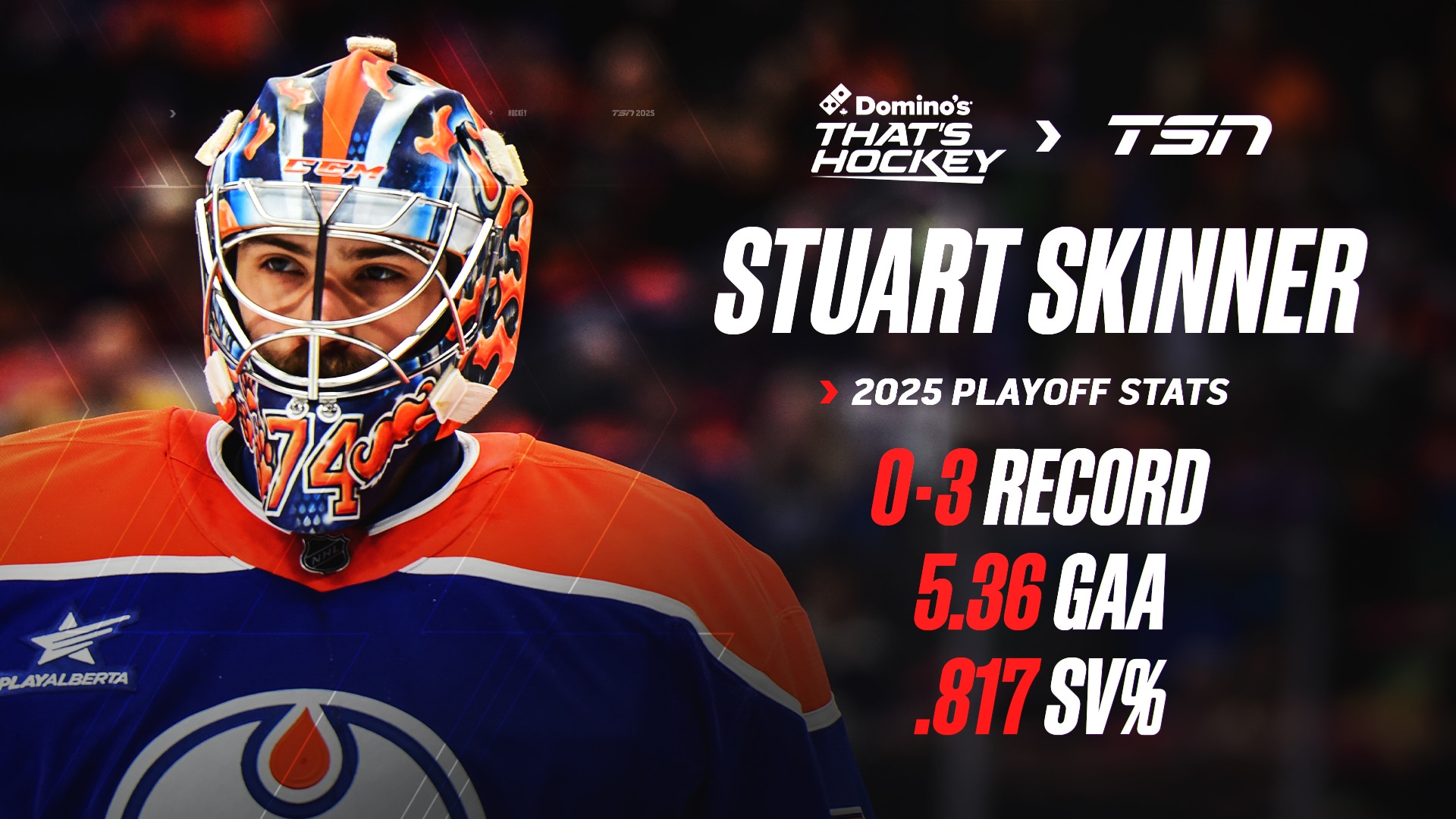

Can Skinner Step Up Analyzing His Chances After Pickards Ouster

May 14, 2025

Can Skinner Step Up Analyzing His Chances After Pickards Ouster

May 14, 2025

Latest Posts

-

Episode 3 Essential Scientific Applications In War Torn Regions

May 14, 2025

Episode 3 Essential Scientific Applications In War Torn Regions

May 14, 2025 -

Choosing Between Mounjaro And Wegovy A Guide To Weight Loss Medications

May 14, 2025

Choosing Between Mounjaro And Wegovy A Guide To Weight Loss Medications

May 14, 2025 -

Major A League Moves Zadkovich Exit And Milligans Newcastle Jets Signing

May 14, 2025

Major A League Moves Zadkovich Exit And Milligans Newcastle Jets Signing

May 14, 2025 -

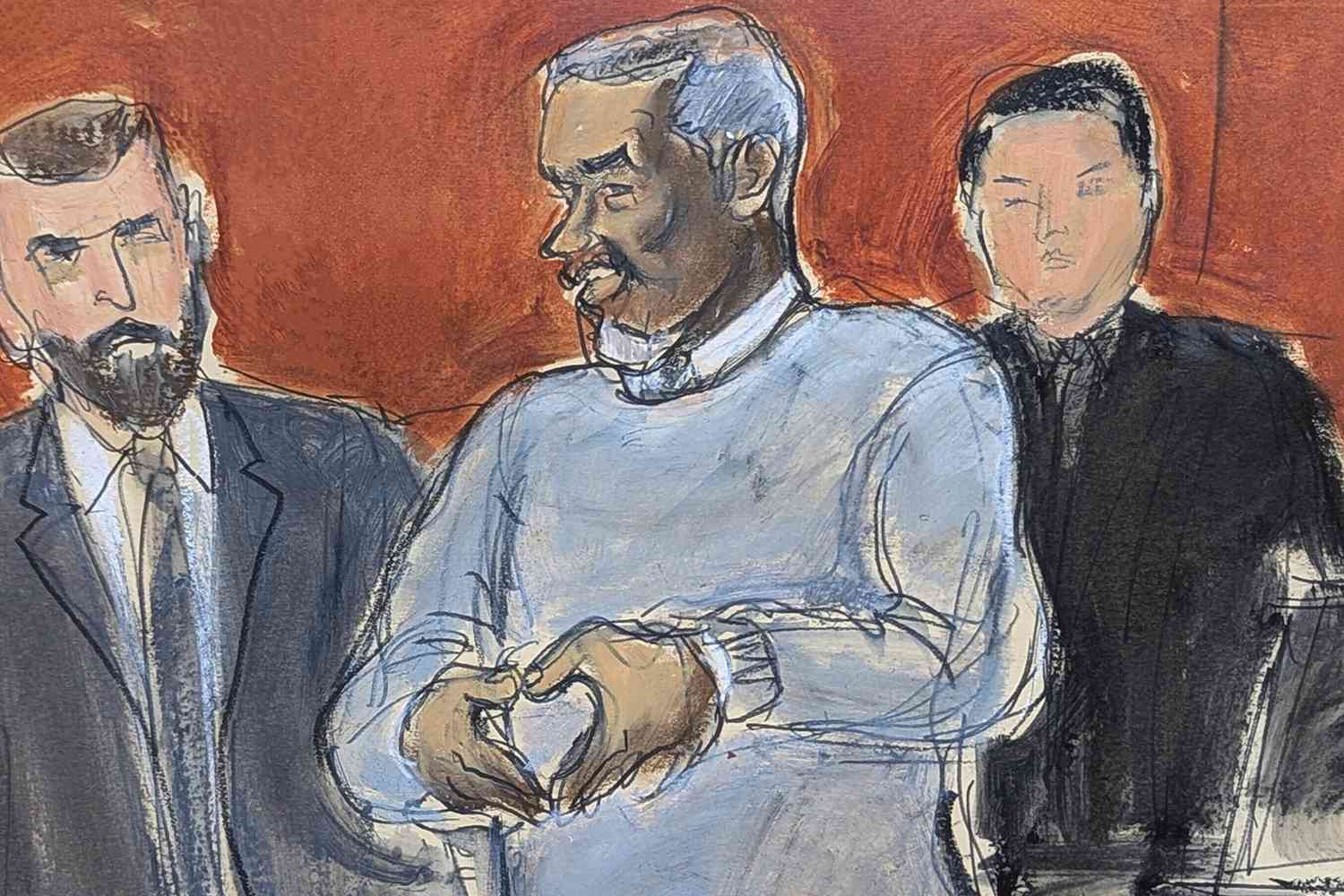

Diddy Cassie And Exotic Dancer A Sex Scandal Unfolds

May 14, 2025

Diddy Cassie And Exotic Dancer A Sex Scandal Unfolds

May 14, 2025 -

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025

Honda Motor Co Ltd Reports Disastrous Earnings 76 Profit Collapse

May 14, 2025