META Stock Price Prediction: How Will The US-China Trade Deal Affect It?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

META Stock Price Prediction: Navigating the Uncertainties of the US-China Trade Deal

The ongoing complexities of the US-China trade relationship continue to cast a long shadow over global markets, and Meta Platforms (META), formerly Facebook, is no exception. While META's stock price is influenced by numerous factors, including advertising revenue, user growth, and regulatory scrutiny, the fluctuating dynamics of the US-China trade deal represent a significant wildcard. This article delves into how this geopolitical chess match could impact META's future stock price and what investors should consider.

Understanding META's Exposure to the US-China Trade Conflict:

META, like many tech giants, has significant operations and revenue streams tied to both the US and Chinese markets. While META doesn't have a direct presence in mainland China (Facebook is banned), the impact of trade tensions is multi-faceted:

-

Global Supply Chains: META relies on global supply chains for hardware manufacturing and other operations. Tariffs and trade restrictions imposed as part of the US-China trade conflict can increase costs and disrupt these supply chains, impacting profitability and potentially affecting investor sentiment.

-

Advertising Revenue: A significant portion of META's revenue comes from advertising. Economic uncertainty stemming from trade disputes can lead to reduced advertising spending by businesses, both in the US and globally, affecting META's bottom line. Chinese businesses, even those operating outside China, may curtail spending if trade tensions escalate.

-

Regulatory Environment: The trade war has fueled broader concerns about global tech regulation and data privacy. Increased regulatory scrutiny in both the US and other countries could further impact META's operations and profitability, influencing its stock price.

Possible Scenarios and Their Impact on META Stock:

Several scenarios could unfold concerning the US-China trade relationship:

-

De-escalation and Cooperation: A resolution leading to decreased trade tensions could positively impact META's stock price. Reduced uncertainty and stabilized global markets often lead to increased investor confidence and higher stock valuations.

-

Continued Tensions and Sporadic Escalation: Prolonged trade disputes or unexpected escalations could negatively impact META's stock price. Increased costs, reduced advertising revenue, and heightened regulatory uncertainty would likely weigh on investor sentiment.

-

Decoupling and Regionalization: A scenario where the US and China further decouple their economies could lead to both opportunities and challenges for META. The company might need to adapt its strategy, potentially investing more heavily in regions outside of China to mitigate risks. This adaptation period could lead to short-term stock price volatility.

META Stock Price Prediction: A Cautious Outlook:

Predicting META's stock price with certainty is impossible. The impact of the US-China trade deal is just one of many factors at play. However, considering the potential for both positive and negative impacts, a cautious approach is warranted.

For investors:

-

Diversification is Key: Don't put all your eggs in one basket. Diversifying your portfolio across different asset classes and sectors can help mitigate risks associated with the US-China trade situation and its impact on META.

-

Stay Informed: Keep abreast of developments in the US-China trade negotiations and their broader economic implications. This will allow you to make more informed investment decisions.

-

Consider Long-Term Growth: META’s long-term growth potential remains significant, despite the short-term uncertainties. Investors with a long-term horizon may view the current volatility as a potential buying opportunity.

The US-China trade relationship remains a significant geopolitical factor influencing global markets and impacting tech companies like META. While the future is uncertain, understanding the potential scenarios and taking a strategic approach to investment can help navigate this complex environment. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on META Stock Price Prediction: How Will The US-China Trade Deal Affect It?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ongoing Traffic Problems Cause Severe Delays In Wiltshire Town

May 13, 2025

Ongoing Traffic Problems Cause Severe Delays In Wiltshire Town

May 13, 2025 -

Nba Playoffs Pacers Upset Bid Against Cavs Fuels Siakam Rumors

May 13, 2025

Nba Playoffs Pacers Upset Bid Against Cavs Fuels Siakam Rumors

May 13, 2025 -

Nyt Connections Hints And Solutions Sunday May 11th Game 700

May 13, 2025

Nyt Connections Hints And Solutions Sunday May 11th Game 700

May 13, 2025 -

The Minds Power Understanding The Impact Of Thoughts And Beliefs

May 13, 2025

The Minds Power Understanding The Impact Of Thoughts And Beliefs

May 13, 2025 -

Crypto Market Update Pepes 90 Rally Shows Signs Of Weakness

May 13, 2025

Crypto Market Update Pepes 90 Rally Shows Signs Of Weakness

May 13, 2025

Latest Posts

-

Game Summary Timberwolves Fall To Warriors May 12 2025

May 13, 2025

Game Summary Timberwolves Fall To Warriors May 12 2025

May 13, 2025 -

The Two Sides Of Evergreen Lessons In Perseverance

May 13, 2025

The Two Sides Of Evergreen Lessons In Perseverance

May 13, 2025 -

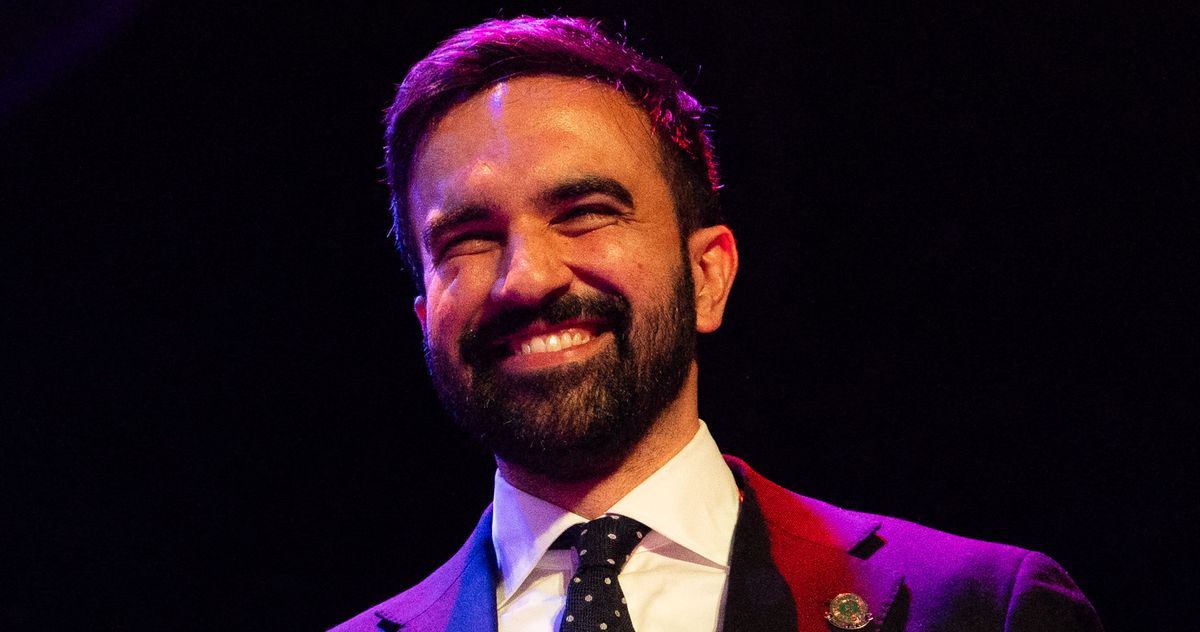

Zohran Mamdani Officially Introduces His Wife To The Public

May 13, 2025

Zohran Mamdani Officially Introduces His Wife To The Public

May 13, 2025 -

Live Traffic Update Severe Delays Cause Chaos In Wiltshire Town

May 13, 2025

Live Traffic Update Severe Delays Cause Chaos In Wiltshire Town

May 13, 2025 -

Spending Crypto Made Easy The Rise Of Stablecoin Debit Cards

May 13, 2025

Spending Crypto Made Easy The Rise Of Stablecoin Debit Cards

May 13, 2025