MSTR Stock Vs BTC: February 2025 Update And Future Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

MSTR Stock vs. BTC: February 2025 Update and Future Outlook

MicroStrategy (MSTR) has become synonymous with Bitcoin (BTC) investment, making it a fascinating case study for investors. But with the volatile nature of both the stock market and the cryptocurrency space, how does MSTR stock compare to holding BTC directly in February 2025? This update analyzes the current landscape and explores the future outlook for both assets.

MSTR Stock Performance: A Rollercoaster Ride

MicroStrategy's stock price has historically mirrored the price of Bitcoin, although not always in a one-to-one relationship. Since its significant Bitcoin acquisitions began, MSTR has experienced periods of dramatic growth and substantial decline, largely dictated by BTC's price fluctuations. February 2025 finds the company navigating a potentially complex market environment. Several factors influence MSTR's performance beyond simply Bitcoin's price:

- Bitcoin's Market Position: The overall health and adoption rate of Bitcoin significantly impact MSTR's valuation. A bullish Bitcoin market generally translates to positive sentiment surrounding MSTR. Conversely, a bearish market can severely pressure MSTR's stock price.

- Company Fundamentals: MicroStrategy's core business performance, separate from its Bitcoin holdings, also contributes to its stock valuation. Strong revenue growth and improved profitability can offer a degree of insulation from Bitcoin's volatility.

- Regulatory Landscape: The evolving regulatory environment surrounding both cryptocurrencies and publicly traded companies plays a crucial role. Changes in regulations can significantly impact both Bitcoin's price and MSTR's operational capacity.

- Debt Levels: MicroStrategy has leveraged significant debt to finance its Bitcoin acquisitions. The company's ability to manage this debt effectively is crucial to maintaining investor confidence.

Bitcoin's February 2025 Trajectory: Predictions and Analysis

Predicting Bitcoin's price with certainty is notoriously difficult. However, several factors influencing its potential trajectory in February 2025 include:

- Technological Advancements: Innovations within the Bitcoin ecosystem, such as the Lightning Network's broader adoption, could positively impact Bitcoin's price.

- Global Adoption: Increasing adoption by institutional investors and governments worldwide can fuel price appreciation.

- Macroeconomic Factors: Global economic conditions, inflation rates, and interest rate policies significantly influence Bitcoin's price. A global recession, for example, could cause investors to seek safe havens, potentially impacting Bitcoin's price positively or negatively depending on market sentiment.

- Regulatory Developments: Regulatory clarity or stricter regulations in major markets can dramatically influence Bitcoin's price.

MSTR Stock vs. BTC: Which is the Better Investment?

The question of whether to invest in MSTR stock or directly in BTC is highly dependent on individual risk tolerance and investment goals.

- MSTR Stock: Offers diversification through MicroStrategy's core business, but exposes investors to the company's debt and overall financial performance. The stock's price is inherently linked to Bitcoin's price, but may not mirror it directly.

- Direct BTC Investment: Offers more direct exposure to Bitcoin's price movements, potentially providing higher returns but also significantly higher risk. Requires a strong understanding of cryptocurrency markets and security best practices.

Conclusion: Navigating the Uncertain Future

The interplay between MSTR stock and BTC in February 2025, and beyond, remains uncertain. Both assets offer unique investment opportunities with varying levels of risk. Thorough research, understanding of market dynamics, and a well-defined risk management strategy are crucial for investors considering either MSTR stock or direct Bitcoin investment. Remember, this analysis is for informational purposes only and does not constitute financial advice. Always consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on MSTR Stock Vs BTC: February 2025 Update And Future Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Examining The Recent Us China Trade Deal Tariff Implications

May 18, 2025

Examining The Recent Us China Trade Deal Tariff Implications

May 18, 2025 -

Precision Vs Power How Luke Donald Outmaneuvered Rory Mc Ilroy At The Masters

May 18, 2025

Precision Vs Power How Luke Donald Outmaneuvered Rory Mc Ilroy At The Masters

May 18, 2025 -

Matt Lucas And David Walliams Pen Cliff Richard Stage Musical

May 18, 2025

Matt Lucas And David Walliams Pen Cliff Richard Stage Musical

May 18, 2025 -

Covid 19 Cases On The Rise In Singapore Authorities Maintain Vigilance

May 18, 2025

Covid 19 Cases On The Rise In Singapore Authorities Maintain Vigilance

May 18, 2025 -

The Deepest Sorrow Prince William Recalls Losing His Mother Princess Diana

May 18, 2025

The Deepest Sorrow Prince William Recalls Losing His Mother Princess Diana

May 18, 2025

Latest Posts

-

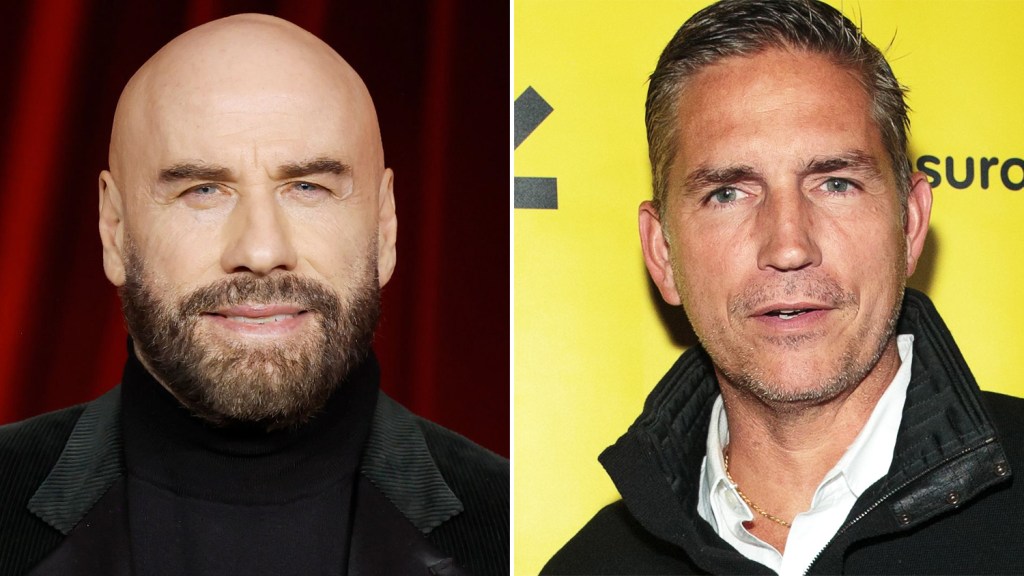

Jim Caviezel And John Travolta Team Up For Faith Based Action Film Syndicate

May 18, 2025

Jim Caviezel And John Travolta Team Up For Faith Based Action Film Syndicate

May 18, 2025 -

Warren Buffetts Investing Principles And Their Application To Cryptocurrency

May 18, 2025

Warren Buffetts Investing Principles And Their Application To Cryptocurrency

May 18, 2025 -

100 Million Inflows Fail To Push Pi Network Pi Above 1 A Market Deep Dive

May 18, 2025

100 Million Inflows Fail To Push Pi Network Pi Above 1 A Market Deep Dive

May 18, 2025 -

Primera Derrota Del Barca En El Camp Nou Analisis Del Partido

May 18, 2025

Primera Derrota Del Barca En El Camp Nou Analisis Del Partido

May 18, 2025 -

Luke Bryan Farm Tour 2024 Erik Nelsons Role Revealed

May 18, 2025

Luke Bryan Farm Tour 2024 Erik Nelsons Role Revealed

May 18, 2025