Nasdaq Sell-Off: Evaluating Palo Alto Networks And Nvidia Stock Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Nasdaq Sell-Off: Palo Alto Networks and Nvidia – A Stock Market Deep Dive

The recent Nasdaq sell-off has sent shockwaves through the tech sector, leaving investors scrambling to assess the impact on individual stocks. Two prominent players, Palo Alto Networks and Nvidia, have experienced significant price fluctuations, prompting crucial questions about their long-term prospects. This analysis delves into the current market conditions, examining the performance of these tech giants and offering insights for investors navigating this turbulent landscape.

The Broader Market Context: Understanding the Nasdaq Decline

The Nasdaq Composite's recent downturn is multifaceted, stemming from a confluence of factors. Rising interest rates, persistent inflation concerns, and anxieties surrounding potential economic slowdowns have all contributed to increased market volatility. Investors are reassessing risk, leading to a flight to safety and a sell-off in growth-oriented tech stocks, impacting companies like Palo Alto Networks and Nvidia.

Palo Alto Networks (PANW): Cybersecurity in a Storm

Palo Alto Networks, a leader in cybersecurity solutions, has seen its stock price fluctuate alongside the broader market. While the company consistently reports strong financial results, fueled by increasing demand for robust cybersecurity infrastructure, the overall market sentiment has dampened investor confidence.

-

Positive Factors: PANW's strong financial performance, continued innovation in cybersecurity, and growing market share in cloud security contribute to its long-term potential. The company’s robust product portfolio and strategic acquisitions further solidify its position in the competitive cybersecurity landscape.

-

Negative Factors: The current economic uncertainty has led some investors to adopt a more cautious approach, impacting even fundamentally strong companies like Palo Alto Networks. The overall market sell-off has disproportionately affected growth stocks, leading to temporary price corrections.

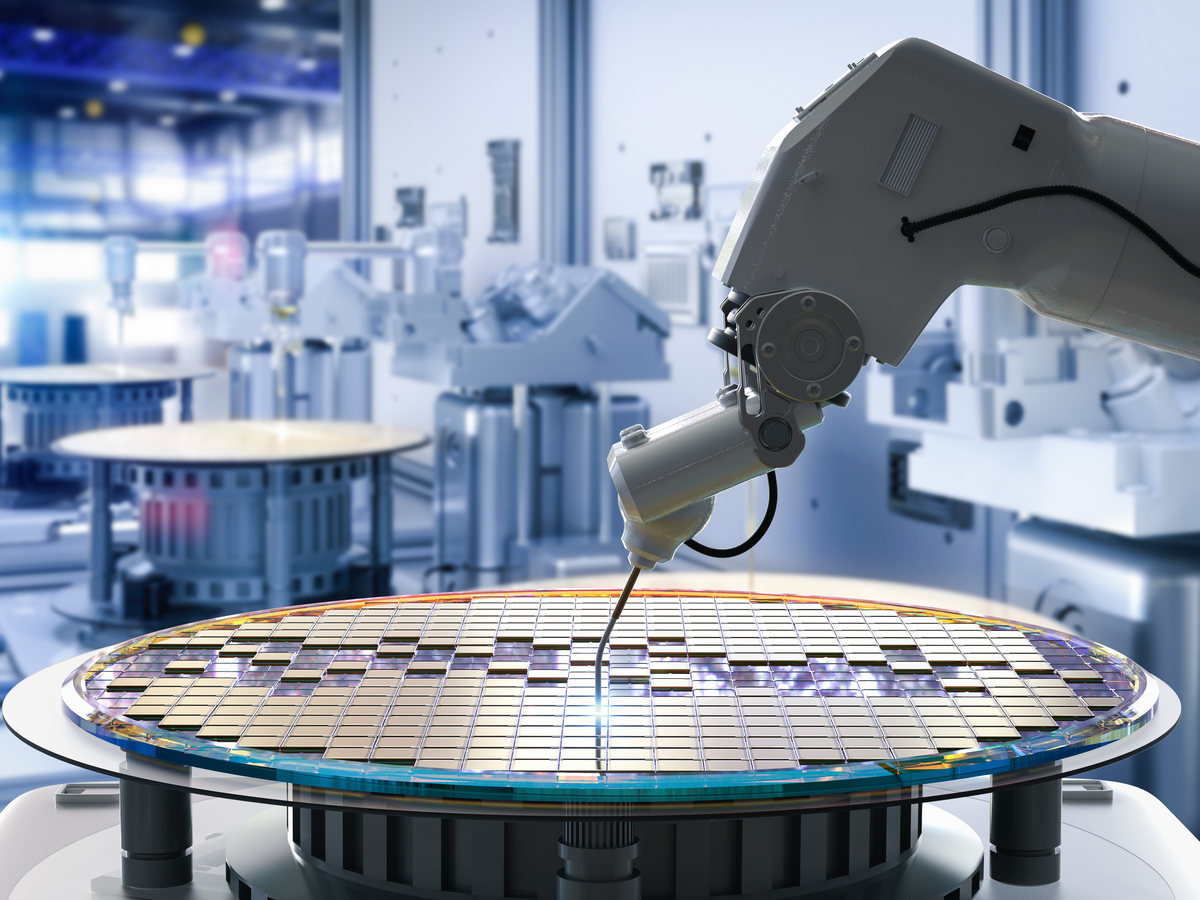

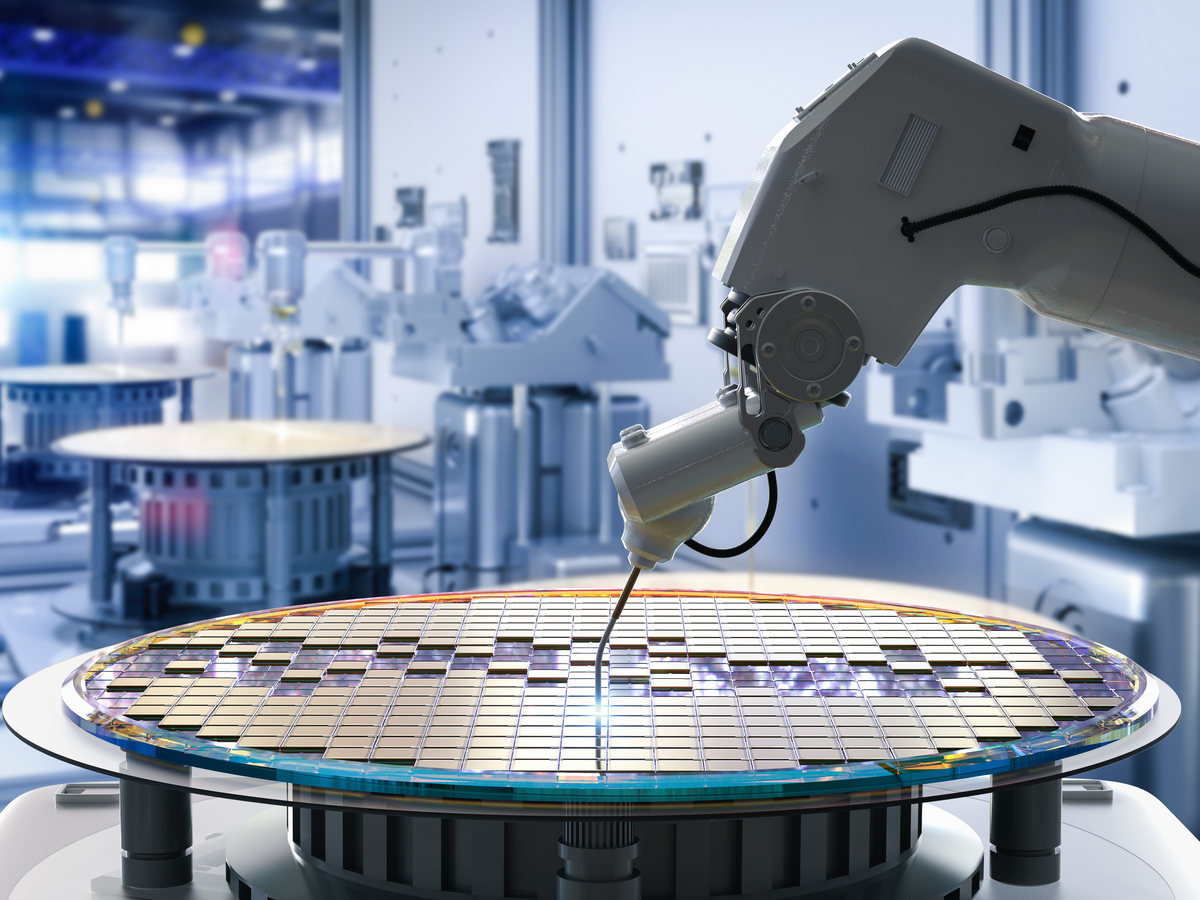

Nvidia (NVDA): Navigating the Chip Shortage and AI Boom

Nvidia, a dominant player in the graphics processing unit (GPU) market, has also experienced price fluctuations amidst the Nasdaq sell-off. While Nvidia benefits from the growing demand for GPUs in AI and data center applications, the ongoing chip shortage and supply chain disruptions continue to present challenges.

-

Positive Factors: Nvidia's strong position in the rapidly expanding AI market, particularly with its data center GPUs, remains a significant growth driver. The company's consistent innovation and expanding applications in various sectors, including autonomous vehicles and gaming, offer long-term growth potential.

-

Negative Factors: The ongoing global chip shortage and supply chain bottlenecks have constrained Nvidia's production capabilities, impacting its revenue growth. Furthermore, the broader market downturn has negatively influenced investor sentiment, leading to price corrections.

Investor Strategies: Navigating the Uncertainty

The current market volatility presents both risks and opportunities for investors. For those with a long-term investment horizon, the sell-off might offer attractive entry points into fundamentally sound companies like Palo Alto Networks and Nvidia. However, it's crucial to conduct thorough due diligence and consider your own risk tolerance before making any investment decisions. Diversification across different asset classes remains a prudent strategy to mitigate risk during periods of market uncertainty.

Conclusion: A Long-Term Perspective is Key

While the recent Nasdaq sell-off has created uncertainty, both Palo Alto Networks and Nvidia remain powerful players in their respective sectors. Their long-term growth prospects remain promising, driven by strong fundamentals and significant market opportunities. Investors should adopt a long-term perspective, focusing on the underlying strengths of these companies rather than reacting solely to short-term market fluctuations. Careful analysis, risk management, and a diversified investment portfolio are essential tools for navigating the current market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Nasdaq Sell-Off: Evaluating Palo Alto Networks And Nvidia Stock Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dan Biggar To Retire End Of An Era For Welsh Rugby

Apr 08, 2025

Dan Biggar To Retire End Of An Era For Welsh Rugby

Apr 08, 2025 -

Angels Offensive Explosion Fuels Dominant Win Over Guardians

Apr 08, 2025

Angels Offensive Explosion Fuels Dominant Win Over Guardians

Apr 08, 2025 -

Ice Storm Damage Two Schools Remain Closed Assessment Underway

Apr 08, 2025

Ice Storm Damage Two Schools Remain Closed Assessment Underway

Apr 08, 2025 -

Jets Land Jaxson Dart 2025 Nfl Mock Draft With Five First Round Trades

Apr 08, 2025

Jets Land Jaxson Dart 2025 Nfl Mock Draft With Five First Round Trades

Apr 08, 2025 -

Understanding The New Fha Residency Requirements For Mortgage Loans

Apr 08, 2025

Understanding The New Fha Residency Requirements For Mortgage Loans

Apr 08, 2025