No Interest Rate Cut In April: Reserve Bank's Decision And Its Effect On Households

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

No Interest Rate Cut in April: Reserve Bank Holds Steady, Leaving Households to Shoulder the Burden

The Reserve Bank (RBA) has announced its decision to hold the official cash rate steady at 3.6% in April, a move that will likely disappoint many hoping for relief from persistent high inflation. This decision marks a pause in the aggressive rate-hiking cycle of the past year, but offers little solace to Australian households grappling with the rising cost of living. The RBA's statement emphasized ongoing concerns about inflation, hinting at further potential increases depending on economic data.

This decision comes amidst a complex economic landscape. While inflation shows some signs of easing, it remains significantly above the RBA's target band, prompting continued caution. The impact of previous rate hikes is still rippling through the economy, with many homeowners facing significantly increased mortgage repayments.

Why the RBA Held Steady: A Look at the Key Factors

The RBA's decision not to cut interest rates in April was driven by several key factors:

-

Persistent Inflation: Inflation, while showing signs of moderation, remains stubbornly high. The RBA is closely monitoring the impact of past rate hikes and global economic conditions before making further adjustments. Core inflation, which excludes volatile items like food and energy, remains a significant concern.

-

Strong Labor Market: Australia's robust employment market, with low unemployment rates, continues to fuel inflationary pressures. Strong wage growth, while positive for workers, also contributes to the overall inflationary environment.

-

Global Economic Uncertainty: The global economic outlook remains uncertain, with geopolitical tensions and ongoing supply chain disruptions adding complexity to the RBA's decision-making process. The RBA is carefully navigating the potential risks to the Australian economy emanating from overseas.

-

Housing Market Slowdown, But Not a Crash: While the housing market is cooling, a significant correction hasn't materialized. The RBA is likely watching this sector closely, as further drops could negatively impact consumer confidence and spending.

The Impact on Australian Households: Feeling the Pinch

The RBA's decision to maintain the current interest rate will continue to place pressure on Australian households already struggling with increased living costs. Many homeowners are facing significantly higher mortgage repayments, impacting disposable income and overall household budgets. This is particularly challenging for those with variable-rate mortgages, as their repayments are directly tied to the cash rate.

What this means for you:

- Higher Mortgage Repayments: Expect to continue paying higher mortgage repayments if you have a variable-rate loan.

- Reduced Spending Power: Increased living costs coupled with higher mortgage payments will likely lead to reduced spending power for many households.

- Increased Financial Strain: Many families may find themselves under increased financial strain, requiring careful budgeting and potentially seeking financial advice.

What's Next? Looking Ahead to Future RBA Decisions

The RBA's statement suggests that future rate decisions will depend heavily on incoming economic data. Inflation figures, wage growth, and the overall state of the global economy will be crucial factors in determining the next move. While an interest rate cut is not entirely off the table, it's unlikely in the immediate future. The RBA's focus remains on bringing inflation back down to its target range, even if it means households must continue to bear the burden in the short term. Further analysis of economic indicators will be crucial in the coming months to determine the RBA's next steps. Stay informed and consult financial professionals for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on No Interest Rate Cut In April: Reserve Bank's Decision And Its Effect On Households. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Expat Tax Deadline Claim Your 1 400 And Ensure Compliance

May 08, 2025

U S Expat Tax Deadline Claim Your 1 400 And Ensure Compliance

May 08, 2025 -

Ligue Des Champions Luis Enrique Un Grand Entraineur Selon Achraf Hakimi

May 08, 2025

Ligue Des Champions Luis Enrique Un Grand Entraineur Selon Achraf Hakimi

May 08, 2025 -

Chuwi Minibook X 10 5 Inch Convertible Laptop Specs Price And Availability

May 08, 2025

Chuwi Minibook X 10 5 Inch Convertible Laptop Specs Price And Availability

May 08, 2025 -

Warriors Vs Timberwolves May 6 2025 Playoff Game Charts And Analysis

May 08, 2025

Warriors Vs Timberwolves May 6 2025 Playoff Game Charts And Analysis

May 08, 2025 -

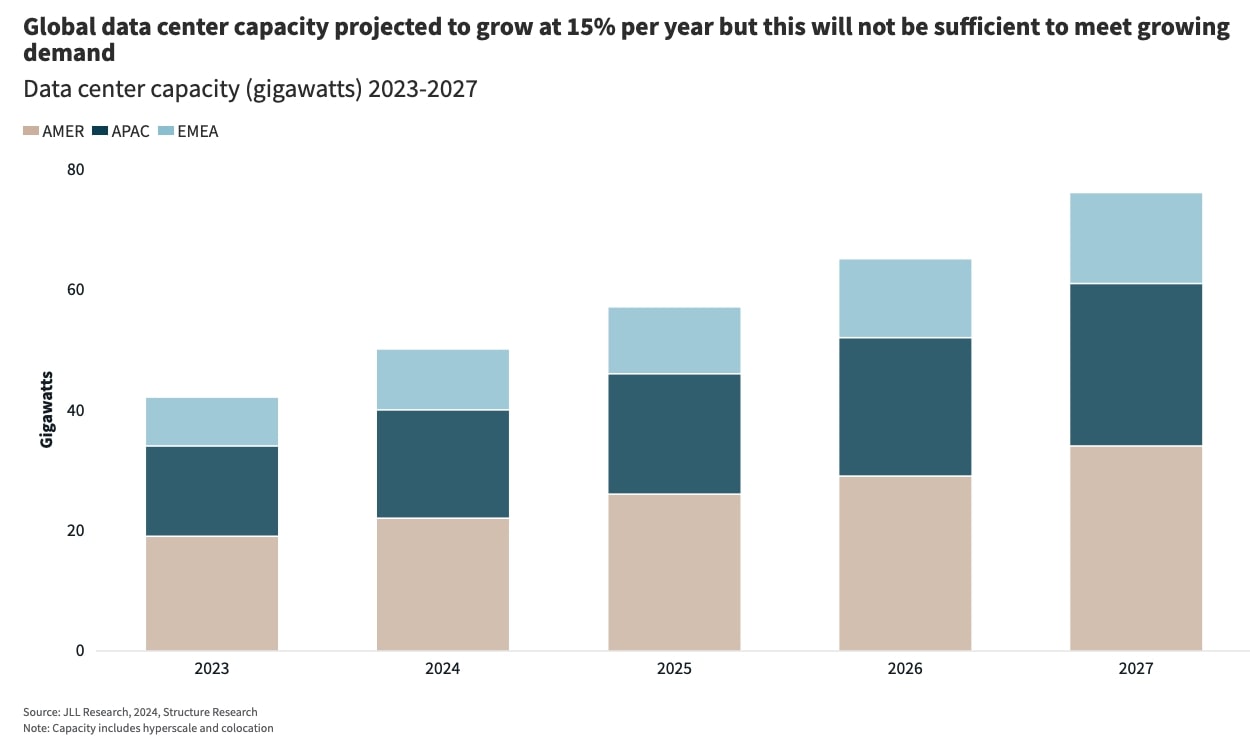

Global Ai Data Center Growth Continues Despite Tech Giant Adjustments

May 08, 2025

Global Ai Data Center Growth Continues Despite Tech Giant Adjustments

May 08, 2025