U.S. Expat Tax Deadline: Claim Your $1,400 & Ensure Compliance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Expat Tax Deadline: Claim Your $1,400 & Ensure Compliance

Don't miss out! The deadline for U.S. expats to file their taxes is fast approaching, and many may be eligible for the remaining stimulus payment of $1,400. This guide will help you understand the complexities of expat taxation and ensure you meet all compliance requirements before the deadline. Missing this could result in significant penalties.

What is the Deadline?

The deadline for filing your 2022 US expat taxes is typically April 15th. However, if you live outside the United States, you may qualify for an automatic two-month extension until June 15th. This extension only applies to the filing deadline, not the payment deadline. Understanding this crucial difference is key to avoiding late payment penalties. Always confirm the exact deadline based on your specific circumstances with the IRS or a qualified tax professional specializing in expat taxation.

Am I Eligible for the Remaining $1,400 Stimulus Payment?

Many expats are eligible for the third Economic Impact Payment (EIP), commonly known as the $1,400 stimulus check. Eligibility depends on your income and filing status. If you haven't received it, you may be able to claim it as a Recovery Rebate Credit on your tax return (Form 1040). This requires careful review of your income and filing status for both the 2020 and 2021 tax years.

Key Considerations for Expat Tax Filers:

- Foreign Bank Account Reporting: If you have foreign bank accounts or financial assets exceeding certain thresholds, you'll need to file Form 8938, Statement of Specified Foreign Financial Assets. Failure to comply can result in substantial penalties.

- Foreign Tax Credits: Many expats are eligible for foreign tax credits, which can significantly reduce their US tax liability. Accurately documenting your foreign taxes paid is crucial.

- Form 2555: This form, Foreign Earned Income Exclusion, allows you to exclude a portion of your foreign income from US taxation. Understanding the eligibility requirements and correctly completing this form is vital.

- Form 1040-X: If you need to amend a previously filed return, you'll need to utilize this form. Amendments are often necessary due to the complex nature of expat tax regulations.

- Professional Advice: Navigating the intricacies of expat taxation can be challenging. Consult with a qualified tax professional specializing in international taxation to ensure compliance and maximize your tax benefits. The potential savings from expert advice significantly outweighs the cost.

Avoiding Penalties:

- File on time: Failing to file by the deadline, even with an extension, results in penalties.

- Pay on time: Even if you have an extension to file, you must still pay your taxes by the original April 15th deadline to avoid interest and penalties.

- Accurate reporting: Inaccurate or incomplete reporting can lead to audits and significant penalties.

Resources:

- IRS Website: The IRS website provides information on expat taxation, but it can be complex.

- Tax Professionals: Seek professional advice from a CPA or tax advisor specializing in international taxation.

Don't delay! The deadline is fast approaching. Take action now to claim your $1,400 and ensure you meet all your US expat tax obligations. Failing to do so could have serious financial consequences. Remember, proactive planning is crucial for successful expat tax compliance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Expat Tax Deadline: Claim Your $1,400 & Ensure Compliance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Increased Demand From Europe And China Lower Us Output Boost Oil Prices By 3

May 08, 2025

Increased Demand From Europe And China Lower Us Output Boost Oil Prices By 3

May 08, 2025 -

Live Tv Interview Backfires Pakistani Minister Grilled Over Terror Allegations

May 08, 2025

Live Tv Interview Backfires Pakistani Minister Grilled Over Terror Allegations

May 08, 2025 -

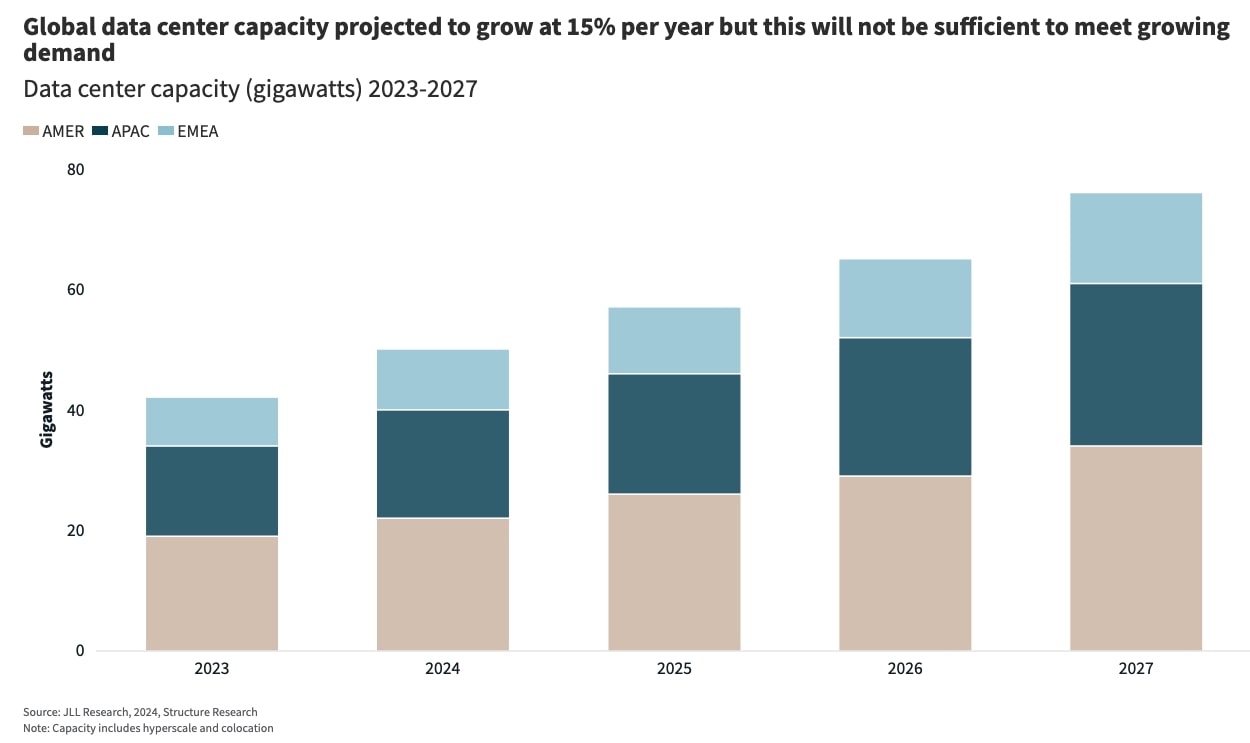

The Future Of Ai How Data Center Growth Is Shaping The Industry

May 08, 2025

The Future Of Ai How Data Center Growth Is Shaping The Industry

May 08, 2025 -

Oil Market Defies Opec Prices Surge After Production Quota Announcement

May 08, 2025

Oil Market Defies Opec Prices Surge After Production Quota Announcement

May 08, 2025 -

How To Make The Most Of Your Saturday

May 08, 2025

How To Make The Most Of Your Saturday

May 08, 2025

Latest Posts

-

Sub 1kg And 512 Gb Ssd Chuwis Minibook X Redefines The Lightweight Laptop

May 08, 2025

Sub 1kg And 512 Gb Ssd Chuwis Minibook X Redefines The Lightweight Laptop

May 08, 2025 -

Inversion De Buffett En Apple Venta De Acciones Y Explicacion De La Reduccion Del 13

May 08, 2025

Inversion De Buffett En Apple Venta De Acciones Y Explicacion De La Reduccion Del 13

May 08, 2025 -

Kamino Kmno Price Surge 100 Rally In 30 Days Following Binance Listing

May 08, 2025

Kamino Kmno Price Surge 100 Rally In 30 Days Following Binance Listing

May 08, 2025 -

Knicks Celtics Matchup Defensive Dominance Vs Offensive Struggles

May 08, 2025

Knicks Celtics Matchup Defensive Dominance Vs Offensive Struggles

May 08, 2025 -

Dbs Shares Surge Over 2 On Strong Earnings Beat

May 08, 2025

Dbs Shares Surge Over 2 On Strong Earnings Beat

May 08, 2025