Oil Market Defies OPEC+ Cuts, Prices Surge Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Market Defies OPEC+ Cuts, Prices Surge Higher

Global oil prices have defied expectations, surging higher despite OPEC+’s decision to significantly cut production. The move, intended to bolster prices and stabilize the market, has instead been met with a surprising increase in demand and a tightening of supply, leading to a volatile and potentially inflationary situation for consumers worldwide.

The Organization of the Petroleum Exporting Countries and its allies (OPEC+), a group that controls a significant portion of global oil production, announced substantial production cuts in October. The aim was to counter the perceived weakening of oil prices and address concerns about global economic uncertainty. However, the market’s reaction has been far from what was predicted.

<h3>Unexpected Demand Surge Fuels Price Hike</h3>

The primary driver behind the price surge appears to be stronger-than-anticipated global demand. Despite economic headwinds in several key regions, robust consumption in Asia, particularly in China, has offset any reduction in demand elsewhere. The reopening of China's economy after strict COVID-19 lockdowns has significantly boosted energy consumption, putting upward pressure on oil prices.

Furthermore, the ongoing geopolitical instability in several oil-producing regions continues to play a crucial role. The ongoing war in Ukraine and its impact on global energy supplies remain a significant factor influencing market sentiment and price volatility. Sanctions and disruptions to supply chains add further complexity to the already delicate situation.

<h3>OPEC+ Strategy Under Scrutiny</h3>

The unexpected price increase raises questions about the effectiveness of OPEC+'s production cut strategy. Analysts are now debating whether the cuts were too significant, leading to a tighter market and higher prices than anticipated. Some experts argue that the group underestimated the resilience of global demand and the potential for geopolitical factors to further escalate prices.

- Concerns about future supply: The current situation highlights concerns about the long-term availability of oil and the potential for future price volatility.

- Inflationary pressures: The rise in oil prices is likely to contribute to inflationary pressures globally, impacting consumers and businesses alike.

- Geopolitical implications: The situation underscores the interconnectedness of global energy markets and the significant geopolitical implications of oil price fluctuations.

<h3>What Lies Ahead for Oil Prices?</h3>

Predicting future oil prices remains a challenging task, given the numerous factors at play. However, several key indicators suggest that prices could remain elevated in the near term. These include:

- Continued strong demand from Asia: The sustained recovery of the Chinese economy is expected to keep demand high.

- Geopolitical risks: Ongoing conflicts and geopolitical uncertainties are likely to persist, creating further price volatility.

- Limited spare production capacity: The current situation shows limited capacity among OPEC+ members to increase production quickly if demand continues to rise.

The oil market is currently navigating a complex and unpredictable landscape. While OPEC+'s production cuts aimed to stabilize prices, the market's response has been a surprising surge, raising questions about the efficacy of the strategy and highlighting the intricate interplay of global demand, geopolitical factors, and economic uncertainty. The coming months will be crucial in determining the trajectory of oil prices and their impact on the global economy. Investors and consumers alike will be closely watching for any further developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Market Defies OPEC+ Cuts, Prices Surge Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lu Dorts Shooting Woes A Potential Roadblock For Okc Thunder In Round Two

May 07, 2025

Lu Dorts Shooting Woes A Potential Roadblock For Okc Thunder In Round Two

May 07, 2025 -

Ong Ye Kung Chee Hong Tat Deny Links To Fujian Gang Member Su Haijin

May 07, 2025

Ong Ye Kung Chee Hong Tat Deny Links To Fujian Gang Member Su Haijin

May 07, 2025 -

Ukrainian Drone Attack Su 30 Fighter Jet Shot Down By Naval Forces

May 07, 2025

Ukrainian Drone Attack Su 30 Fighter Jet Shot Down By Naval Forces

May 07, 2025 -

Minnesota Timberwolves Naz Reid Expected Back Tuesday

May 07, 2025

Minnesota Timberwolves Naz Reid Expected Back Tuesday

May 07, 2025 -

Eta Aquarids Meteor Shower 2024 Best Viewing Locations And Times

May 07, 2025

Eta Aquarids Meteor Shower 2024 Best Viewing Locations And Times

May 07, 2025

Latest Posts

-

Falling Retail Sales Pressure Rba Into Interest Rate Decision

May 08, 2025

Falling Retail Sales Pressure Rba Into Interest Rate Decision

May 08, 2025 -

Celtics Vs Knicks Jayson Tatums Offseason Strategy In The Spotlight

May 08, 2025

Celtics Vs Knicks Jayson Tatums Offseason Strategy In The Spotlight

May 08, 2025 -

Thunder Face Adversity How Okc Will Respond To Playoff Setback

May 08, 2025

Thunder Face Adversity How Okc Will Respond To Playoff Setback

May 08, 2025 -

End Of An Era Sonos And Ikeas Symfonisk Speaker Partnership Concludes

May 08, 2025

End Of An Era Sonos And Ikeas Symfonisk Speaker Partnership Concludes

May 08, 2025 -

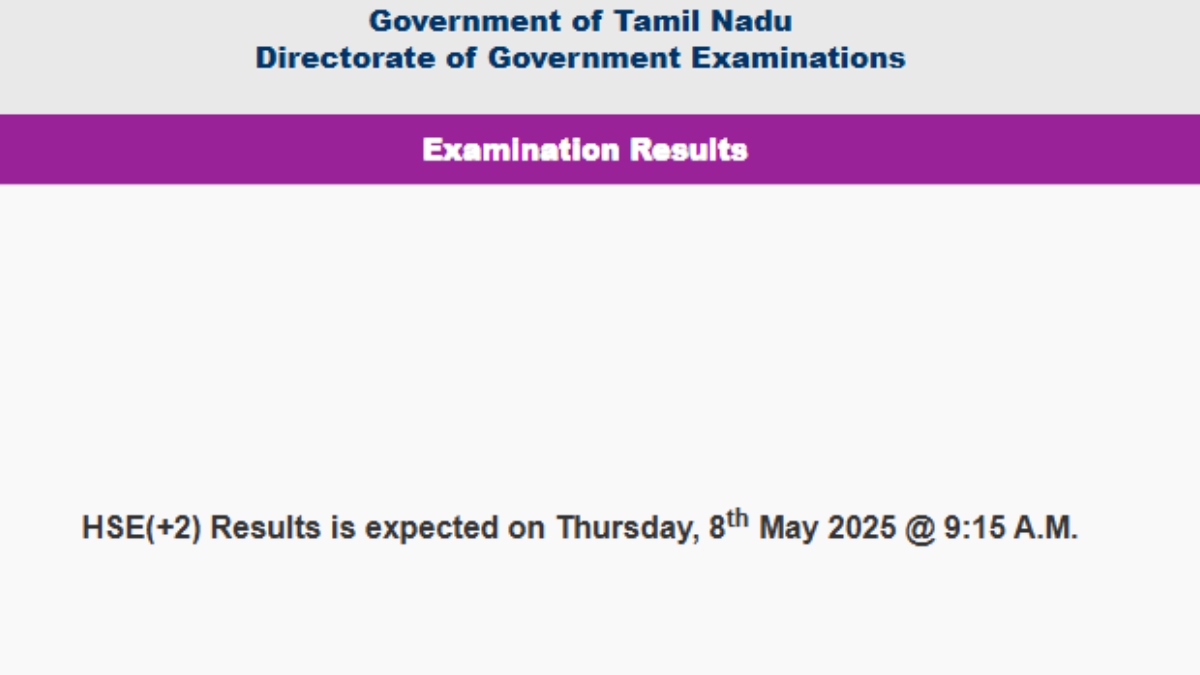

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025

Tngde Tamil Nadu 2 Results 2025 Direct Link To Check Your Hsc Scores On Tnresults Nic In

May 08, 2025