Oil Market Instability: OPEC+ Production Hike Creates Global Supply Surplus

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Oil Market Instability: OPEC+ Production Hike Creates Global Supply Surplus

The global oil market is facing a period of significant instability, largely driven by a recent OPEC+ decision to increase production. This unexpected hike, announced amidst already softening demand, has led to a global supply surplus, sending shockwaves through the energy sector and sparking concerns about price volatility and future market trends. Experts are now debating the long-term consequences of this move and its impact on both producers and consumers.

OPEC+'s Risky Gamble: A Surplus in the Making

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) surprised analysts by agreeing to increase oil production. This decision, seemingly counterintuitive given the current economic slowdown and weakening global demand, has resulted in a noticeable surplus of crude oil in the market. While OPEC+ cited a need to meet anticipated future demand, critics argue that the timing is flawed, exacerbating existing price pressures and potentially triggering a price war.

Weakening Demand: A Perfect Storm for Price Drops?

The global economy is facing headwinds, with several major economies experiencing slower-than-expected growth. This translates to reduced energy consumption, dampening the demand for oil. Coupled with the increased supply from OPEC+, this weakening demand creates a perfect storm for lower oil prices. The current surplus is likely to persist for several months, putting downward pressure on prices and impacting the profitability of oil-producing nations.

Impact on Oil Prices and Global Markets:

The immediate consequence of the OPEC+ production hike has been a decline in oil prices. Benchmark Brent crude and West Texas Intermediate (WTI) have both seen significant drops, impacting energy companies' stock prices and potentially triggering job losses in the sector. This price volatility can also ripple through the global economy, affecting inflation rates and impacting consumer spending.

Long-Term Implications and Uncertain Future:

The long-term implications of this supply surplus remain uncertain. While some analysts predict a gradual rebalancing of the market as demand recovers, others warn of a prolonged period of low prices and potential market instability. Geopolitical factors, unforeseen economic shocks, and changes in consumer behavior will all play a significant role in shaping the future of the oil market.

Key Questions Facing the Industry:

- Will demand recover sufficiently to absorb the surplus? The global economic outlook will be crucial in answering this question.

- How will OPEC+ respond to sustained low prices? Further production cuts or adjustments to their strategy are possible.

- What will be the impact on investment in the oil and gas sector? Lower prices may discourage future investment in exploration and production.

- How will consumers benefit (or suffer) from fluctuating oil prices? The impact on gasoline prices and other energy costs will be felt globally.

The oil market is navigating a complex and volatile landscape. The recent OPEC+ decision, coupled with weakening global demand, has created a substantial supply surplus, leading to lower oil prices and raising concerns about future market stability. The coming months will be crucial in determining the long-term consequences of this unprecedented situation. Staying informed about market trends and geopolitical developments will be vital for both producers and consumers alike.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Oil Market Instability: OPEC+ Production Hike Creates Global Supply Surplus. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

10 Lego F1 Cars Conquer Miami Grand Prix Circuit

May 06, 2025

10 Lego F1 Cars Conquer Miami Grand Prix Circuit

May 06, 2025 -

Oil Prices Crash U S Crude At Lowest Point Since 2021 After Opec Announcement

May 06, 2025

Oil Prices Crash U S Crude At Lowest Point Since 2021 After Opec Announcement

May 06, 2025 -

Met Gala 2024 Analyzing The Red Carpet Looks Of Zendaya Sabrina Carpenter Lorde Erivo And Ross

May 06, 2025

Met Gala 2024 Analyzing The Red Carpet Looks Of Zendaya Sabrina Carpenter Lorde Erivo And Ross

May 06, 2025 -

Ai Fuels Palantirs Revenue Growth But Investors Remain Skeptical

May 06, 2025

Ai Fuels Palantirs Revenue Growth But Investors Remain Skeptical

May 06, 2025 -

Met Gala 2025 Celebrity Style And Rihannas Unexpected Debut

May 06, 2025

Met Gala 2025 Celebrity Style And Rihannas Unexpected Debut

May 06, 2025

Latest Posts

-

Mlb Betting Cubs Vs Giants Game Preview Odds Analysis And Picks For May 5

May 06, 2025

Mlb Betting Cubs Vs Giants Game Preview Odds Analysis And Picks For May 5

May 06, 2025 -

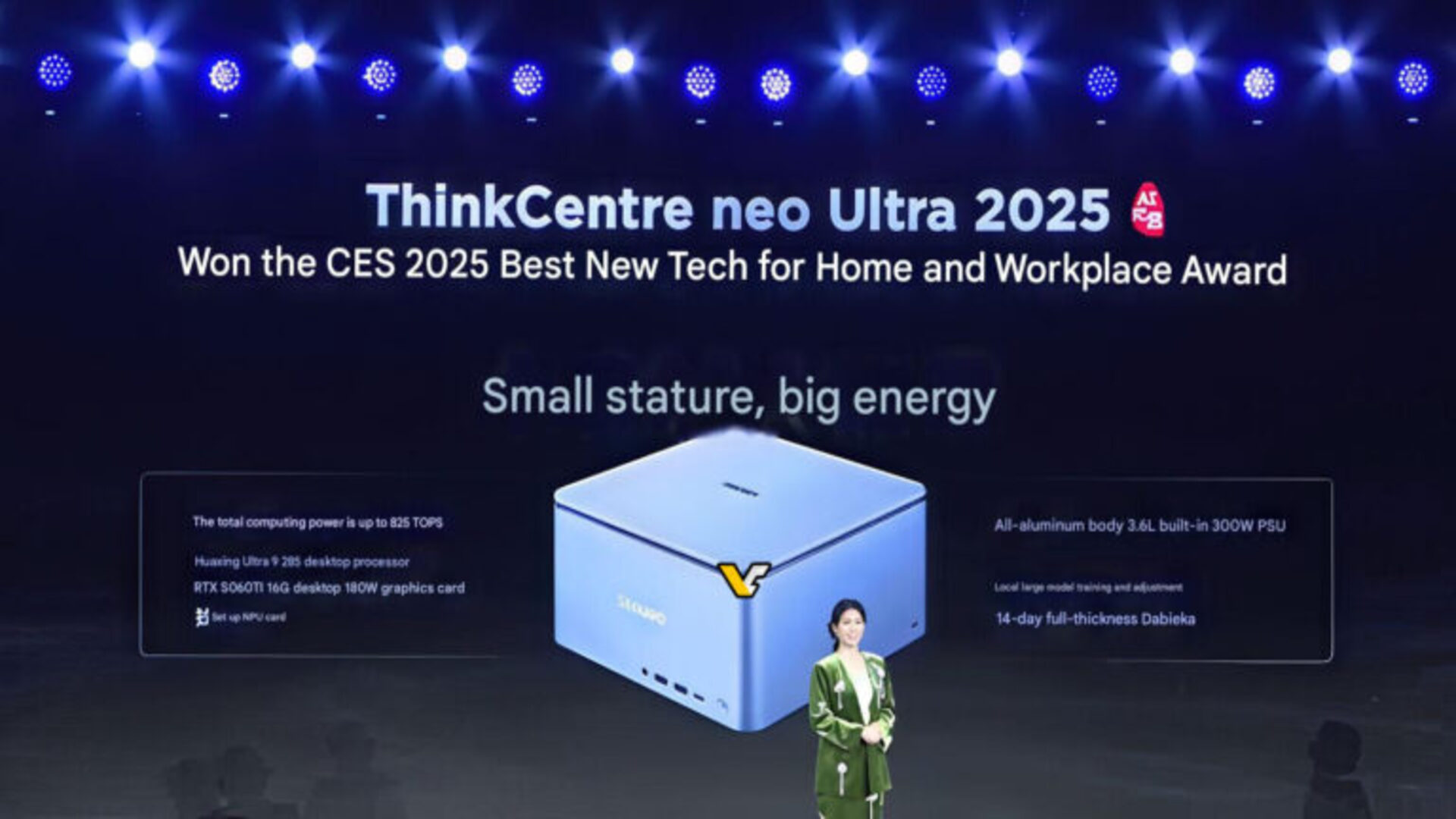

Lenovo Unveils Mac Studio Challenger High Performance Workstation Specs Revealed

May 06, 2025

Lenovo Unveils Mac Studio Challenger High Performance Workstation Specs Revealed

May 06, 2025 -

Russell Westbrooks Game 7 Outburst The Heat The Anger The Sweet Revenge

May 06, 2025

Russell Westbrooks Game 7 Outburst The Heat The Anger The Sweet Revenge

May 06, 2025 -

Western Conference Playoffs Nuggets Experience A Major Hurdle For Thunders Sga

May 06, 2025

Western Conference Playoffs Nuggets Experience A Major Hurdle For Thunders Sga

May 06, 2025 -

Copom Decide Impacto Do Ipca E Dados Da China Na Industria Brasileira

May 06, 2025

Copom Decide Impacto Do Ipca E Dados Da China Na Industria Brasileira

May 06, 2025