Outdated Crypto Tax Laws: How 2014 Regulations Hamper 2024 Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Outdated Crypto Tax Laws: How 2014 Regulations Hamper 2024 Growth

The cryptocurrency market is booming, but a relic of the past – 2014 tax regulations – is threatening to stifle its 2024 growth. These outdated laws, designed for a nascent industry vastly different from today's sophisticated ecosystem, are creating significant hurdles for both individual investors and burgeoning crypto businesses. The mismatch between antiquated legislation and the rapid evolution of blockchain technology is hindering innovation and investment, demanding urgent reform.

The Problem with 2014's Regulatory Framework:

In 2014, the IRS issued guidance classifying cryptocurrency as property, not currency. While this seemingly straightforward classification was a starting point, it fails to adequately address the complexities of the modern crypto landscape. This outdated framework presents several key challenges:

-

Staking and Lending Complications: The rise of staking and lending protocols – crucial aspects of many blockchain ecosystems – creates tax complexities not envisioned in 2014. Determining taxable events and calculating gains or losses in these scenarios is often unclear, leading to uncertainty and potential non-compliance.

-

Decentralized Finance (DeFi) Challenges: The explosive growth of DeFi, with its myriad of automated protocols and yield farming opportunities, is largely unaccounted for in the existing regulatory framework. The sheer number of transactions and the complexity of DeFi protocols make accurate tax reporting extremely difficult.

-

NFT Taxation Ambiguity: Non-Fungible Tokens (NFTs) present another significant challenge. Are they collectibles? Are they securities? The lack of clear guidance leaves taxpayers in a precarious position, unsure how to correctly report NFT sales, transfers, or even the use of NFTs in decentralized games.

-

International Tax Inconsistencies: The lack of harmonization in international crypto tax laws adds another layer of complexity for investors and businesses operating across borders. Navigating different jurisdictions and their varying interpretations of crypto taxation is a significant burden.

Impact on Crypto Growth:

These outdated laws are creating a chilling effect on the crypto market. The uncertainty and complexity surrounding tax compliance deter both institutional and individual investment. This hesitancy translates to:

-

Stifled Innovation: Businesses are less likely to invest in and develop new crypto technologies if the tax implications are unclear and overly burdensome.

-

Reduced Market Participation: Individual investors may be deterred from participating in the market due to the complexities of crypto tax reporting.

-

Increased Regulatory Arbitrage: The lack of clear, consistent rules encourages regulatory arbitrage, where individuals and businesses seek out jurisdictions with more favorable tax regimes, undermining the efforts of regulators to create a fair and transparent market.

The Need for Modernized Crypto Tax Laws:

The current situation demands immediate action. Legislators need to work collaboratively with industry experts to create a modern, comprehensive regulatory framework that:

- Clarifies the tax treatment of staking, lending, and DeFi activities.

- Provides clear guidance on NFT taxation.

- Addresses international inconsistencies in crypto tax laws.

- Simplifies tax reporting processes for both individuals and businesses.

Ignoring this pressing issue will only further hinder the growth of the crypto industry, an area with the potential to revolutionize finance and technology. A proactive and well-defined regulatory environment is crucial to unlocking the full potential of this transformative sector and ensuring responsible innovation. The time for updated crypto tax laws is now, not tomorrow.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Outdated Crypto Tax Laws: How 2014 Regulations Hamper 2024 Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Westbrooks Revenge Nuggets Defeat Clippers After Wrong Person Pick

May 06, 2025

Westbrooks Revenge Nuggets Defeat Clippers After Wrong Person Pick

May 06, 2025 -

Labors Easier Senate Path Pocock Lambie Influence Waning

May 06, 2025

Labors Easier Senate Path Pocock Lambie Influence Waning

May 06, 2025 -

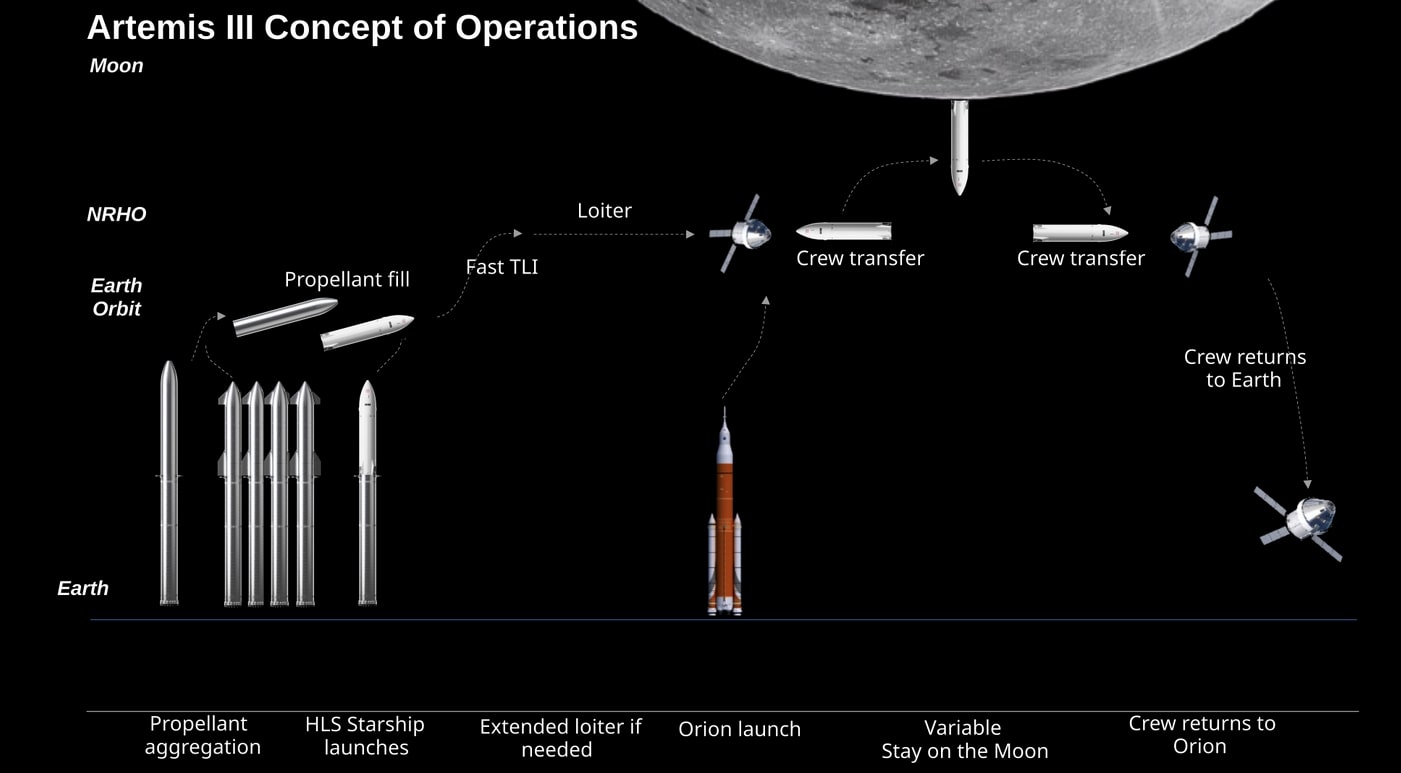

Nasa And The Federal Government Uncovering The Truth Behind Budget Overruns

May 06, 2025

Nasa And The Federal Government Uncovering The Truth Behind Budget Overruns

May 06, 2025 -

Mixed Reactions Among Wp Supporters Following Ge 2025 Election Outcomes

May 06, 2025

Mixed Reactions Among Wp Supporters Following Ge 2025 Election Outcomes

May 06, 2025 -

Red Hot Padres Pitching Poses Major Threat To Yankees

May 06, 2025

Red Hot Padres Pitching Poses Major Threat To Yankees

May 06, 2025

Latest Posts

-

Game 1 Eastern Semifinals Knicks Unbelievable 20 Point Comeback

May 06, 2025

Game 1 Eastern Semifinals Knicks Unbelievable 20 Point Comeback

May 06, 2025 -

Janelle Brown Speaks Out The Final Hours Of Son Garrisons Life Before Suicide

May 06, 2025

Janelle Brown Speaks Out The Final Hours Of Son Garrisons Life Before Suicide

May 06, 2025 -

May 6 2025 Nba Game Nuggets Vs Thunder Final Score And Highlights Espn Au

May 06, 2025

May 6 2025 Nba Game Nuggets Vs Thunder Final Score And Highlights Espn Au

May 06, 2025 -

Ukrainian Navy Drone Downs Russian Su 30 A Major Turning Point

May 06, 2025

Ukrainian Navy Drone Downs Russian Su 30 A Major Turning Point

May 06, 2025 -

U S Crude Oil Prices Plummet Opec Decision Impacts Global Markets

May 06, 2025

U S Crude Oil Prices Plummet Opec Decision Impacts Global Markets

May 06, 2025