Outdated Tax Laws Stifle Cryptocurrency Innovation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Outdated Tax Laws Stifle Cryptocurrency Innovation: A Call for Reform

The rapid rise of cryptocurrency has thrown a wrench into existing tax frameworks, leaving many jurisdictions struggling to keep pace. Outdated tax laws, designed for traditional financial instruments, are now actively stifling innovation and hindering the growth of this burgeoning industry. This isn't just a problem for crypto enthusiasts; it's a significant obstacle to global economic development.

The Problem with Antiquated Legislation:

Many countries are grappling with how to classify cryptocurrency for tax purposes. Is it a currency, a commodity, or a security? This lack of clarity creates significant uncertainty for businesses operating in the crypto space and individuals investing in digital assets. The consequences are far-reaching:

- Increased Compliance Costs: Navigating ambiguous regulations forces businesses to dedicate significant resources to legal and accounting advice, increasing operational costs and potentially hindering their ability to compete.

- Reduced Investment: The uncertainty surrounding tax implications discourages both individual and institutional investment in the crypto market, limiting its potential for growth and innovation.

- Brain Drain: Talented developers and entrepreneurs may choose to relocate to jurisdictions with clearer and more favorable crypto tax laws, leading to a loss of expertise and economic opportunity.

- Limited Adoption: The complexity and uncertainty surrounding cryptocurrency taxation discourage wider adoption by mainstream businesses and consumers.

Specific Examples of Stifling Regulations:

Several countries are facing specific challenges in adapting their tax systems to the cryptocurrency landscape. For example, the US's complex reporting requirements for crypto transactions place a heavy burden on taxpayers, while certain European countries struggle to define the VAT implications of crypto transactions. These inconsistencies create a fragmented and unpredictable regulatory environment.

The Need for Modern, Comprehensive Frameworks:

To unlock the full potential of the cryptocurrency industry, governments need to implement modern and comprehensive tax frameworks that:

- Clearly Define Crypto Assets: Establish a clear legal definition of cryptocurrency, addressing its classification and tax treatment.

- Simplify Reporting Requirements: Introduce streamlined and user-friendly reporting systems to reduce the compliance burden on individuals and businesses.

- Harmonize International Standards: Collaborate internationally to develop consistent tax regulations for cryptocurrencies, creating a more predictable global environment.

- Encourage Innovation: Develop regulatory sandboxes and other initiatives that support innovation while mitigating risks.

Looking Ahead: A Call for Action

Outdated tax laws are not merely a technicality; they represent a significant barrier to the growth and development of the cryptocurrency ecosystem. By embracing a forward-thinking approach and implementing clear, comprehensive, and internationally harmonized tax regulations, governments can unlock the immense potential of this transformative technology while fostering a thriving and secure environment for businesses and individuals alike. The time for decisive action is now; failure to adapt will only serve to hinder global economic progress and competitiveness. The future of finance depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Outdated Tax Laws Stifle Cryptocurrency Innovation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Deepens Accused In Sycamore Gap Tree Felling Case Points Fingers

May 06, 2025

Investigation Deepens Accused In Sycamore Gap Tree Felling Case Points Fingers

May 06, 2025 -

Nuggets Vs Thunder Full Game Highlights And Analysis May 5 2025

May 06, 2025

Nuggets Vs Thunder Full Game Highlights And Analysis May 5 2025

May 06, 2025 -

O Mineirao Palco De Uniao E Rivalidade Entre Cruzeirenses E Flamenguistas

May 06, 2025

O Mineirao Palco De Uniao E Rivalidade Entre Cruzeirenses E Flamenguistas

May 06, 2025 -

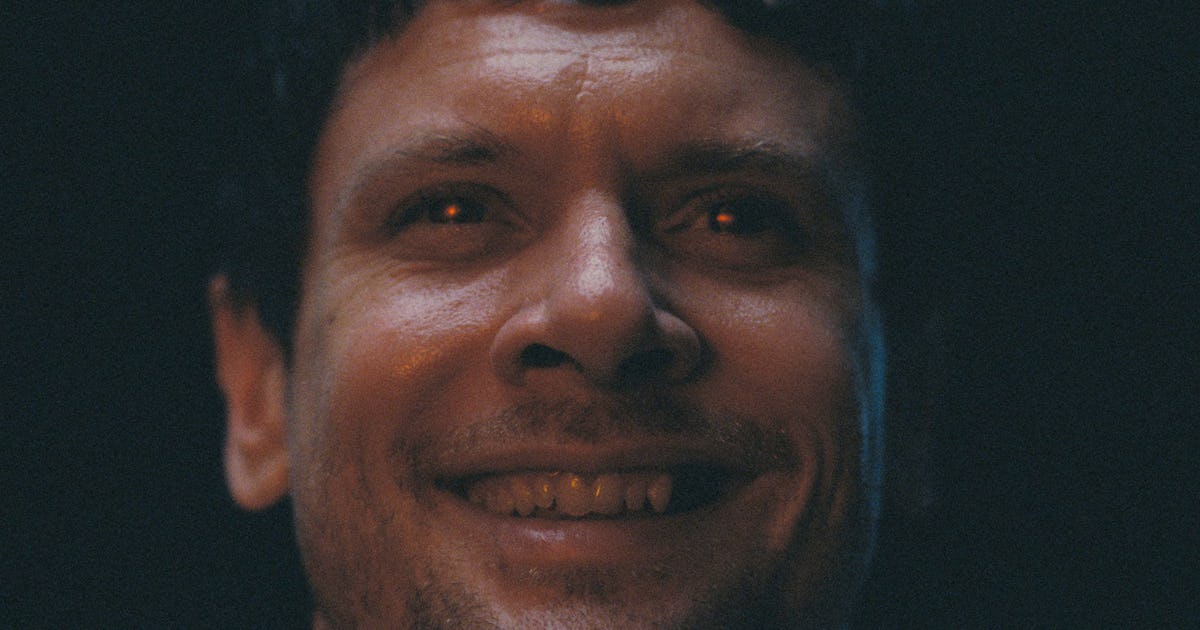

Sinners Jack O Connell On His Unexpected Vampire Role In Ryan Cooglers Film

May 06, 2025

Sinners Jack O Connell On His Unexpected Vampire Role In Ryan Cooglers Film

May 06, 2025 -

Ukraines Naval Drone Program Scores Major Success Su 30 Fighter Jet Downed

May 06, 2025

Ukraines Naval Drone Program Scores Major Success Su 30 Fighter Jet Downed

May 06, 2025

Latest Posts

-

Kurek To Step Aside For Poilievre Legal Hurdles Delay Alberta Mlas Resignation

May 06, 2025

Kurek To Step Aside For Poilievre Legal Hurdles Delay Alberta Mlas Resignation

May 06, 2025 -

Oil Market Instability Opec Production Hike Creates Global Supply Surplus

May 06, 2025

Oil Market Instability Opec Production Hike Creates Global Supply Surplus

May 06, 2025 -

Krakens Interview Trap A North Korean State Sponsored Hackers Downfall

May 06, 2025

Krakens Interview Trap A North Korean State Sponsored Hackers Downfall

May 06, 2025 -

250 Degrees Of Heat Westbrooks Game 7 Fuels Series Clincher

May 06, 2025

250 Degrees Of Heat Westbrooks Game 7 Fuels Series Clincher

May 06, 2025 -

Analysis The Catholic Churchs Response To The Ai Generated Image Of Donald Trump As Pope

May 06, 2025

Analysis The Catholic Churchs Response To The Ai Generated Image Of Donald Trump As Pope

May 06, 2025