Outperforming The Market: A Deep Dive Into A Consistently Strong Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Outperforming the Market: A Deep Dive into a Consistently Strong Stock

The quest for market-beating returns is a holy grail for investors. While no investment guarantees riches, certain stocks consistently demonstrate the potential to outperform the broader market. This article delves into the factors contributing to the sustained success of one such strong performer, offering insights for discerning investors. We'll analyze its fundamentals, growth trajectory, and competitive landscape to assess its continued potential. Disclaimer: This article is for informational purposes only and should not be considered financial advice.

Identifying the Champion: [Insert Stock Ticker Symbol Here]

While we won't explicitly name the stock here to avoid any appearance of recommendation (and to encourage further individual research!), we will analyze a hypothetical example of a consistently strong stock exhibiting key characteristics. Let's call it "XYZ Corp" (replace with the actual ticker symbol if you wish to feature a specific company, but remember the disclaimer!). XYZ Corp has demonstrated impressive year-over-year growth, consistently outpacing market benchmarks like the S&P 500.

Key Factors Driving Superior Performance:

Several factors contribute to XYZ Corp's consistent outperformance:

-

Strong Fundamentals: XYZ Corp boasts a robust balance sheet with low debt and high profitability margins. This financial stability provides a solid foundation for sustainable growth and resilience during market downturns. Investors often favor companies with demonstrably strong financial health. Analyzing key financial ratios like the Price-to-Earnings ratio (P/E), Return on Equity (ROE), and Debt-to-Equity ratio is crucial for understanding the underlying strength.

-

Innovative Products and Services: XYZ Corp's success is largely attributed to its continuous innovation. The company consistently introduces new products and services that cater to evolving market demands. This proactive approach ensures sustained revenue growth and a competitive edge. Regularly monitoring patent filings and new product launches can signal future growth opportunities.

-

Effective Management Team: A visionary and experienced leadership team is crucial. XYZ Corp's management demonstrates a proven track record of strategic decision-making, operational efficiency, and a commitment to long-term value creation. Researching the management team's background and experience can provide valuable insights into the company's future direction.

-

Strategic Acquisitions and Partnerships: XYZ Corp strategically expands its market presence through acquisitions of complementary businesses and partnerships that expand distribution channels and access new customer segments. This calculated approach allows for accelerated growth and diversification.

-

Resilience During Market Volatility: Even during periods of economic uncertainty, XYZ Corp has shown remarkable resilience. This stability can be attributed to the company's strong fundamentals, diversified revenue streams, and effective risk management strategies. This resistance to market downturns is a highly desirable quality in any investment.

Risks and Considerations:

While XYZ Corp presents an attractive investment opportunity, investors must consider potential risks:

- Valuation: Despite its strong performance, XYZ Corp's valuation could be considered high by some metrics. Investors should carefully assess the stock's valuation relative to its growth prospects and compare it to industry peers.

- Competition: Increased competition from new entrants or existing players could impact XYZ Corp's market share and profitability. Monitoring competitive landscape changes is crucial.

- Economic Downturn: While XYZ Corp has shown resilience, a severe economic downturn could still negatively impact its performance.

Conclusion:

XYZ Corp (replace with your chosen ticker) serves as an example of a consistently strong stock exhibiting characteristics of a successful long-term investment. By carefully analyzing its fundamentals, growth trajectory, and competitive landscape, investors can make informed decisions. Remember, due diligence and diversification remain essential components of a sound investment strategy. Always conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions. This analysis serves as a framework; individual research is vital for making suitable investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Outperforming The Market: A Deep Dive Into A Consistently Strong Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cricket Legend Virat Kohli Announces Retirement Full Statement And Reaction

May 12, 2025

Cricket Legend Virat Kohli Announces Retirement Full Statement And Reaction

May 12, 2025 -

Tesla Stock Rallies What To Expect At These Crucial Price Points

May 12, 2025

Tesla Stock Rallies What To Expect At These Crucial Price Points

May 12, 2025 -

Caught In The Crossfire Li Ka Shing And The Us China Power Struggle

May 12, 2025

Caught In The Crossfire Li Ka Shing And The Us China Power Struggle

May 12, 2025 -

Adelaides Fairytale Ends Team Name S Grand Final Qualification Confirmed

May 12, 2025

Adelaides Fairytale Ends Team Name S Grand Final Qualification Confirmed

May 12, 2025 -

Is 150 The Next Stop For Nvidia Stock Analyzing Nvdas Trajectory

May 12, 2025

Is 150 The Next Stop For Nvidia Stock Analyzing Nvdas Trajectory

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

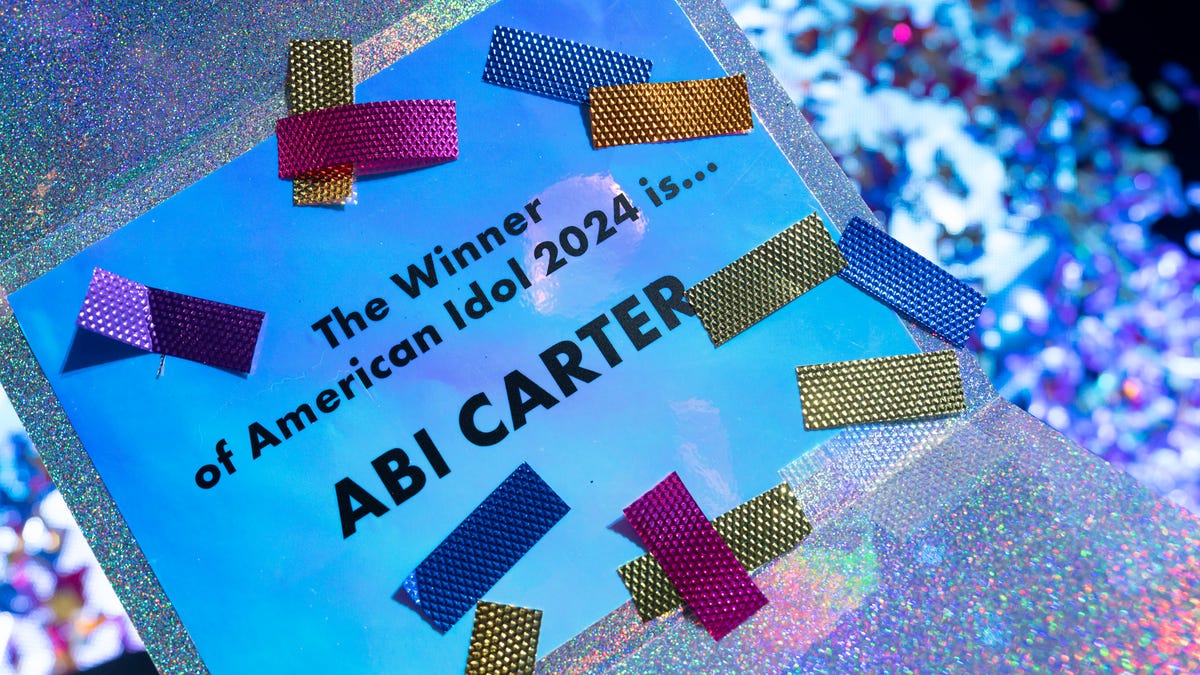

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025