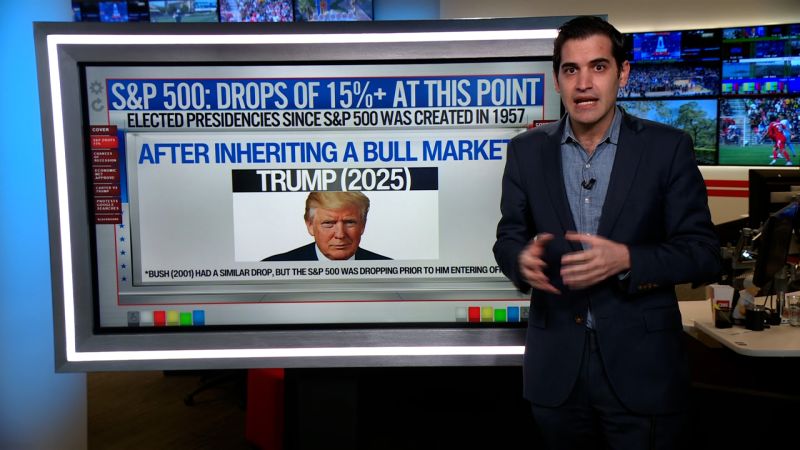

Rs 20 Lakh Crore Vanishes: Analysis Of The Sudden Indian Market Crash Caused By Trump Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Rs 20 Lakh Crore Vanishes: Decoding the Indian Market Crash Triggered by Trump Tariffs

The Indian stock market witnessed a dramatic plunge, wiping out a staggering Rs 20 lakh crore in investor wealth. This seismic shift, leaving many wondering what caused this sudden crash, can be largely attributed to the ripple effects of former US President Donald Trump's tariffs. While multiple factors contributed to the downturn, the impact of these tariffs remains a significant, albeit complex, element in understanding the situation.

The Trump Tariff Tsunami: A Perfect Storm for India

Trump's protectionist trade policies, implemented through hefty tariffs on various goods, created a global economic instability that disproportionately affected India. These tariffs disrupted global supply chains, impacting Indian exports significantly. Sectors heavily reliant on exports, such as textiles, pharmaceuticals, and engineering goods, faced immediate challenges. Reduced demand from the US, a major trading partner, led to decreased production and profitability, triggering a domino effect across the Indian economy.

Beyond the Tariffs: A Multifaceted Crisis

While the Trump tariffs were a major catalyst, it's crucial to acknowledge that the market crash wasn't solely attributable to this single factor. Other contributing factors include:

- Global Economic Slowdown: The global economy was already experiencing a slowdown before the tariffs were fully implemented. This pre-existing weakness amplified the negative impact of the trade war.

- Domestic Economic Challenges: India faced its own internal economic headwinds, including issues related to Non-Performing Assets (NPAs) in the banking sector and concerns about fiscal deficits.

- Investor Sentiment: The uncertainty created by the trade war significantly impacted investor sentiment, leading to a sell-off in the Indian stock market. Fear and uncertainty often drive market volatility more than rational economic indicators.

- Rupee Depreciation: The weakening of the Indian Rupee against the US Dollar further exacerbated the situation, making imports more expensive and reducing the purchasing power of Indian consumers.

Analyzing the Rs 20 Lakh Crore Loss: A Deeper Dive

The Rs 20 lakh crore loss represents a significant blow to investor confidence. This massive figure highlights the vulnerability of emerging markets to global economic shocks and the interconnectedness of the global financial system. The impact was felt across various market segments, with significant losses observed in both large-cap and mid-cap stocks.

The Aftermath and Lessons Learned:

The Indian market crash served as a stark reminder of the importance of diversification and robust risk management strategies for investors. The event highlighted the vulnerabilities of an economy heavily reliant on exports to a single major market. Furthermore, it underscored the need for proactive measures to address domestic economic challenges and enhance resilience against external shocks.

Looking Ahead: Mitigation Strategies and Future Outlook

India has since implemented several policy measures aimed at boosting domestic demand and improving the ease of doing business. However, the long-term impact of the Trump-era tariffs continues to be felt, and future economic stability depends on ongoing diversification strategies and effective management of domestic economic challenges. India’s ability to navigate future global uncertainties will depend on its capacity to build a more resilient and diversified economy.

Keywords: Indian Stock Market Crash, Trump Tariffs, Rs 20 Lakh Crore, Global Economic Slowdown, Investor Sentiment, Rupee Depreciation, Indian Economy, Export Impact, Trade War, Market Volatility, Economic Resilience, Investment Strategies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Rs 20 Lakh Crore Vanishes: Analysis Of The Sudden Indian Market Crash Caused By Trump Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Myanmar Earthquake Death Toll Rises To 3 471 Amidst Devastating Rains

Apr 07, 2025

Myanmar Earthquake Death Toll Rises To 3 471 Amidst Devastating Rains

Apr 07, 2025 -

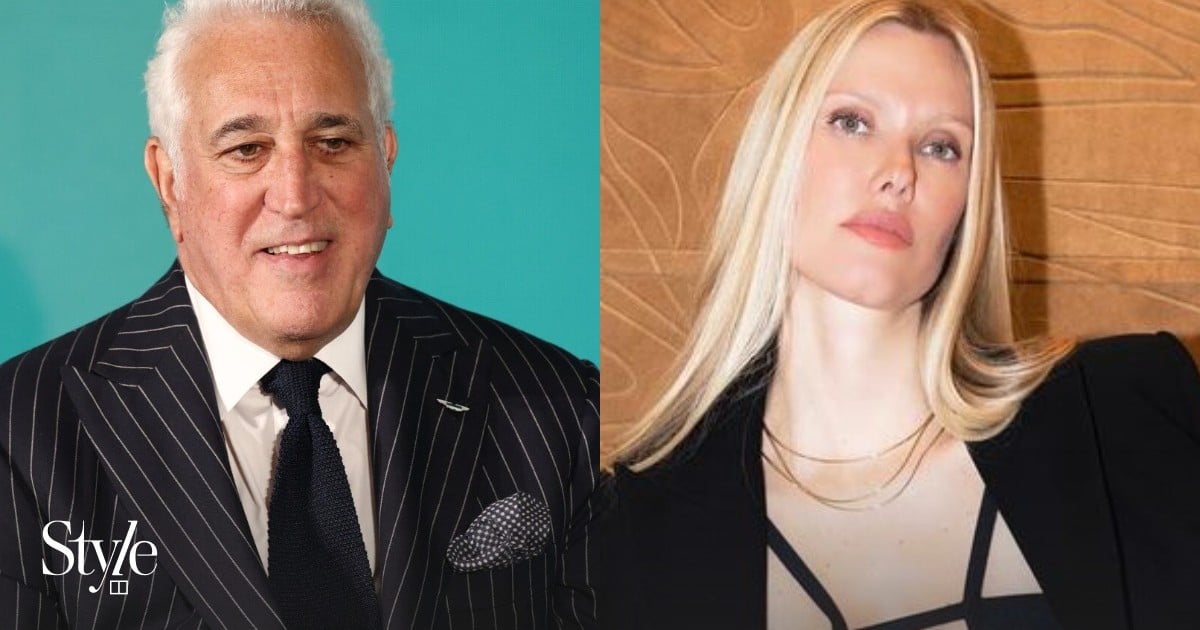

Raquel Stroll Style Icon And Wife Of Aston Martin Ceo Lawrence Stroll

Apr 07, 2025

Raquel Stroll Style Icon And Wife Of Aston Martin Ceo Lawrence Stroll

Apr 07, 2025 -

Kenan Thompsons Snl Future A Permanent Fixture

Apr 07, 2025

Kenan Thompsons Snl Future A Permanent Fixture

Apr 07, 2025 -

Market Sell Off Intensifies Dow Futures Suffer Heavy Losses

Apr 07, 2025

Market Sell Off Intensifies Dow Futures Suffer Heavy Losses

Apr 07, 2025 -

Designer Raquel Stroll Beyond The Spotlight A Fashionable Life

Apr 07, 2025

Designer Raquel Stroll Beyond The Spotlight A Fashionable Life

Apr 07, 2025