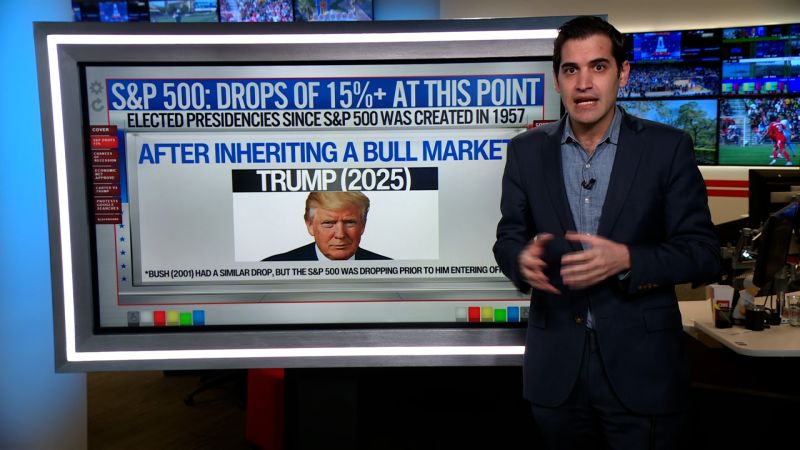

Market Sell-Off Intensifies: Dow Futures Suffer Heavy Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Sell-Off Intensifies: Dow Futures Suffer Heavy Losses

Investors brace for a turbulent week as a deepening market sell-off sends Dow futures plummeting.

The global market experienced a significant downturn today, with Dow futures suffering heavy losses, signaling a potential intensification of the ongoing sell-off. This sharp decline follows weeks of uncertainty fueled by rising interest rates, inflation concerns, and geopolitical instability. The dramatic drop has sent shockwaves through the financial world, leaving investors on edge and prompting concerns about a potential broader market correction.

What Triggered the Plunge?

Several factors contributed to today's market turmoil. Firstly, persistent inflation continues to pressure central banks to maintain aggressive interest rate hikes. This monetary tightening, while aimed at curbing inflation, also risks slowing economic growth and potentially triggering a recession. The recent release of stronger-than-expected inflation data further fueled these anxieties, reinforcing expectations of continued rate increases.

Secondly, geopolitical tensions remain a significant source of uncertainty. The ongoing conflict in Ukraine, coupled with escalating tensions in other regions, contributes to a climate of global instability that impacts investor confidence. Uncertainty regarding energy supplies and global trade further exacerbates market volatility.

Dow Futures: A Leading Indicator of Market Sentiment

The sharp decline in Dow futures serves as a crucial indicator of market sentiment and anticipates potential losses in the broader market. These futures contracts, representing obligations to buy or sell the Dow Jones Industrial Average at a future date, often reflect investor expectations and anxieties. The significant drop in Dow futures today points towards a pessimistic outlook for the coming trading sessions.

What Does This Mean for Investors?

The current market sell-off presents both challenges and opportunities for investors. For those with a long-term investment horizon, this downturn could represent a buying opportunity, provided they have a thorough understanding of their risk tolerance and investment strategy. However, for those with shorter-term investment goals, the volatility may cause significant concern.

Expert Opinions and Market Analysis:

Financial analysts are divided on the extent and duration of this market correction. Some predict a short-term correction, while others express concerns about a more prolonged downturn. Many emphasize the importance of a diversified investment portfolio and a well-defined risk management strategy to navigate this period of uncertainty. Several experts advise against making impulsive decisions based on short-term market fluctuations.

Key Takeaways:

- Increased Volatility: The market is experiencing a period of heightened volatility, requiring careful monitoring and strategic adjustments.

- Inflation Concerns: Persistent inflation and the resulting monetary tightening policies are major drivers of the sell-off.

- Geopolitical Risks: Global instability and geopolitical tensions contribute significantly to market uncertainty.

- Dow Futures as an Indicator: The sharp decline in Dow futures reflects negative market sentiment and anticipates potential losses.

- Long-Term Perspective: Investors are advised to maintain a long-term perspective and avoid impulsive reactions.

The coming days will be crucial in determining the trajectory of the market. Investors should carefully monitor economic indicators and geopolitical developments for further insights. Stay tuned for further updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Sell-Off Intensifies: Dow Futures Suffer Heavy Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indian Market Crash Today Sensex And Nifty Plunge Reasons Explained

Apr 07, 2025

Indian Market Crash Today Sensex And Nifty Plunge Reasons Explained

Apr 07, 2025 -

Tense Qualifying Session Verstappen Beats Norris To Top Spot In Japan

Apr 07, 2025

Tense Qualifying Session Verstappen Beats Norris To Top Spot In Japan

Apr 07, 2025 -

3 Tech Stocks To Buy Before The Next Bull Market

Apr 07, 2025

3 Tech Stocks To Buy Before The Next Bull Market

Apr 07, 2025 -

Complete Japanese Grand Prix Starting Lineup Analysis And Predictions

Apr 07, 2025

Complete Japanese Grand Prix Starting Lineup Analysis And Predictions

Apr 07, 2025 -

Japanese Grand Prix Tense Start Sees Verstappen Ahead Alonso Gasly Duel

Apr 07, 2025

Japanese Grand Prix Tense Start Sees Verstappen Ahead Alonso Gasly Duel

Apr 07, 2025