Secure $3,100 Yearly Dividends: A $18,000 Portfolio Focused On 3 High-Yield Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Secure $3,100 Yearly Dividends: A $18,000 Portfolio Focused on 3 High-Yield Stocks

Dreaming of a passive income stream that bolsters your finances? Imagine generating $3,100 in yearly dividends from a relatively modest $18,000 investment portfolio. It sounds too good to be true, but with careful selection of high-yield dividend stocks, it's entirely achievable. This strategy focuses on diversification within a select group of reliable dividend payers, mitigating risk while maximizing returns. Let's dive into the details of this potentially lucrative investment approach.

Understanding the Power of Dividend Investing

Dividend investing offers a powerful way to generate passive income. Unlike relying solely on capital appreciation (the increase in stock price), dividend stocks pay out a portion of their profits directly to shareholders. This consistent stream of income can be reinvested for further growth or used to supplement your current income. However, it's crucial to remember that dividends are not guaranteed and can be reduced or eliminated depending on a company's financial performance.

The $18,000 Portfolio: A 3-Stock Strategy

This strategy centers around carefully selecting three high-yield dividend stocks known for their stability and consistent payouts. While past performance isn't indicative of future results, analyzing historical dividend payouts and the company's financial health can help mitigate risk. Remember to conduct your own thorough research before making any investment decisions.

This example portfolio assumes a 17.2% dividend yield across the three stocks. This high yield requires careful selection and carries inherent risk. It's vital to understand the potential downsides before investing.

Stock Selection Criteria:

- High and Consistent Dividend Yield: Look for companies with a history of paying substantial dividends consistently over several years.

- Strong Financial Performance: Analyze the company's financial statements to ensure stable earnings and a healthy balance sheet.

- Industry Stability: Choose companies in relatively stable industries less susceptible to significant economic downturns.

- Dividend Growth Potential: Look for companies that have a track record of increasing their dividend payouts over time.

Hypothetical Portfolio Breakdown (for illustrative purposes only):

(Note: These are hypothetical examples and should not be considered financial advice. Always conduct thorough research and consult a financial advisor before investing.)

The following allocation is purely for illustrative purposes and does not constitute a recommendation. Your individual portfolio should be tailored to your risk tolerance and financial goals.

Let's assume the following allocation for a $18,000 portfolio aiming for a $3,100 annual dividend income (approximately 17.2% yield):

- Stock A: $6,000 (Targeting a 6% dividend yield)

- Stock B: $6,000 (Targeting a 6% dividend yield)

- Stock C: $6,000 (Targeting 5.2% dividend yield)

Disclaimer: The above yield percentages are purely illustrative and can fluctuate significantly.

Managing Risk in High-Yield Dividend Investing

While the potential for high returns is attractive, high-yield dividend investing comes with increased risk. Companies offering exceptionally high yields might be facing financial difficulties. Diversification, thorough due diligence, and a long-term investment horizon are crucial to mitigate these risks.

Conclusion: A Path to Passive Income Requires Careful Planning

Generating $3,100 in yearly dividends from an $18,000 portfolio is achievable through strategic high-yield dividend investing. However, success depends on careful research, diversification, and a realistic understanding of the inherent risks. This article provides a framework; individual circumstances necessitate personalized investment strategies. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Secure $3,100 Yearly Dividends: A $18,000 Portfolio Focused On 3 High-Yield Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Simu Lius Engagement Details On His Proposal To Allison Hsu

May 12, 2025

Simu Lius Engagement Details On His Proposal To Allison Hsu

May 12, 2025 -

Virat Kohli Retires 269 Tests A Legacy Forged

May 12, 2025

Virat Kohli Retires 269 Tests A Legacy Forged

May 12, 2025 -

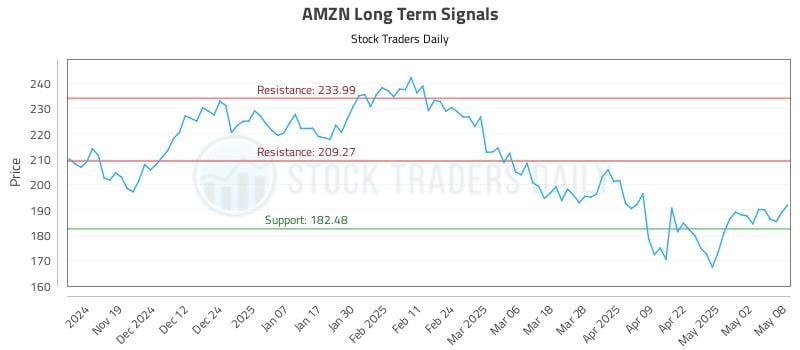

Amzn Investment Report 2024 Trends Risks And Opportunities

May 12, 2025

Amzn Investment Report 2024 Trends Risks And Opportunities

May 12, 2025 -

India Pakistan Ceasefire Both Sides Claim Victory

May 12, 2025

India Pakistan Ceasefire Both Sides Claim Victory

May 12, 2025 -

Greves Prolongadas Consequencias Devastadoras Para Empresas E Setores

May 12, 2025

Greves Prolongadas Consequencias Devastadoras Para Empresas E Setores

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

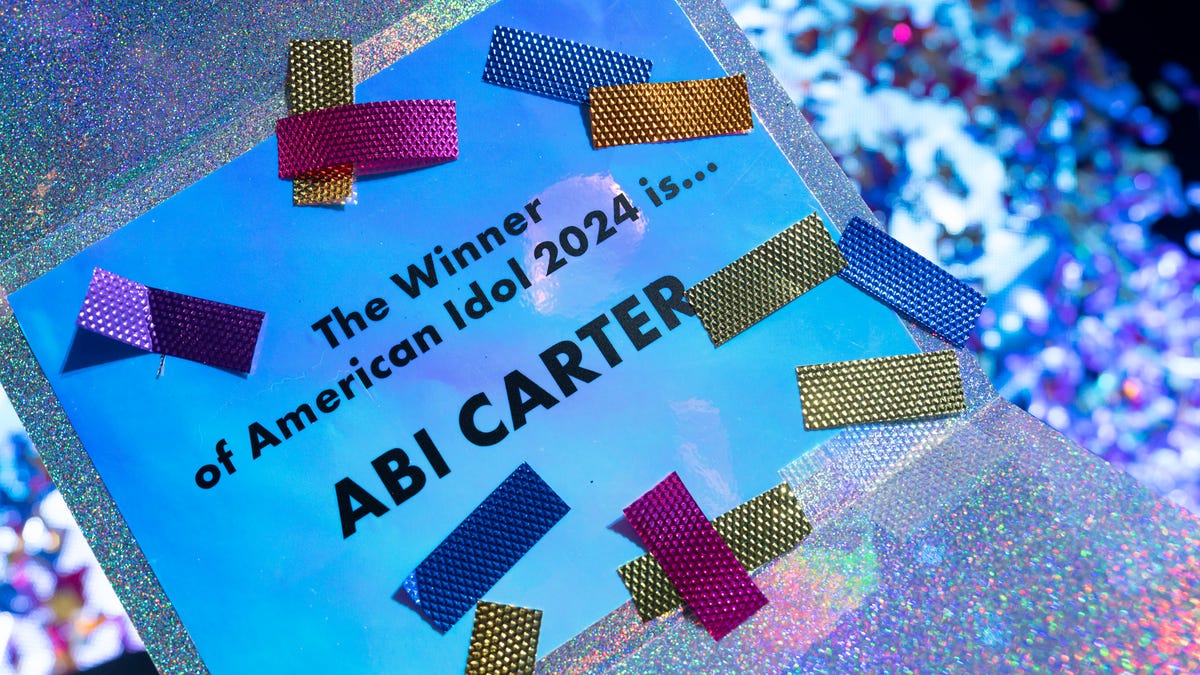

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025