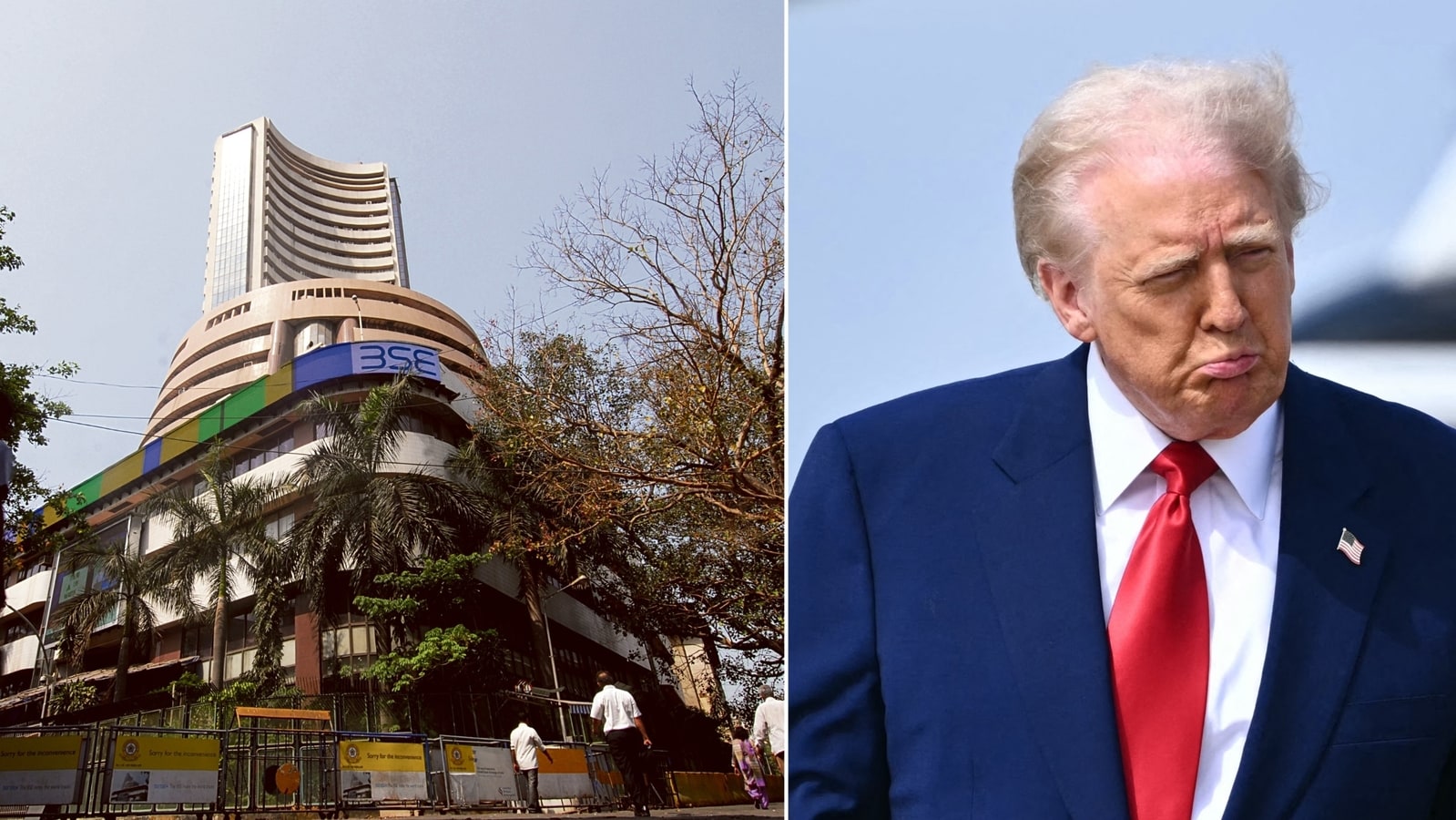

Sensex And Nifty Plunge: Reasons Behind Today's Indian Market Crash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sensex and Nifty Plunge: Reasons Behind Today's Indian Market Crash

Indian stock markets experienced a significant downturn today, with both the Sensex and Nifty plunging sharply. This unexpected crash has sent ripples through the financial world, leaving investors scrambling to understand the underlying causes. While pinpointing a single reason is difficult, several factors contributed to this dramatic market decline. This article delves into the key reasons behind today's market turmoil, providing crucial insights for investors navigating these turbulent waters.

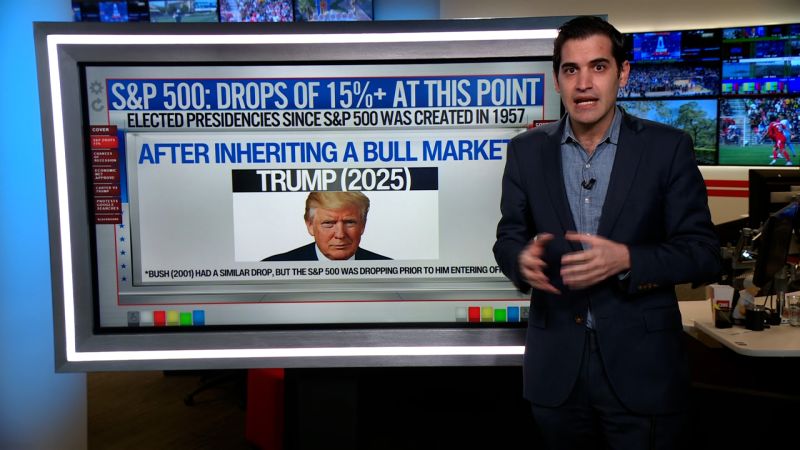

H2: Global Factors Fueling the Fall

The global economic landscape played a significant role in today's crash. Concerns surrounding [mention specific global event, e.g., rising inflation in major economies, geopolitical tensions, a specific negative economic report from a key trading partner] contributed to a risk-off sentiment globally. This negative sentiment spilled over into the Indian markets, impacting investor confidence and triggering widespread selling.

- Increased Interest Rates: The ongoing global trend of rising interest rates continues to weigh heavily on market sentiment. Higher borrowing costs impact corporate profitability and reduce investment appetite, leading to decreased demand for stocks.

- Geopolitical Uncertainty: [Mention specific geopolitical event impacting the market, e.g., escalating tensions in a particular region, potential trade wars]. This uncertainty creates instability and prompts investors to move towards safer assets, leading to capital flight from riskier markets like India.

- Strengthening US Dollar: A stronger US dollar often leads to capital outflow from emerging markets like India as investors seek higher returns in dollar-denominated assets.

H2: Domestic Concerns Adding to the Pressure

Beyond global factors, several domestic issues also contributed to the market's decline.

- Inflationary Pressures: Persistent inflationary pressures in India are eroding consumer purchasing power and impacting corporate earnings. High inflation often prompts central banks to increase interest rates, further dampening economic growth and market sentiment.

- Rupee Depreciation: The recent depreciation of the Indian Rupee against the US dollar further exacerbates the situation, increasing the cost of imports and impacting profitability of businesses.

- Foreign Institutional Investor (FII) Outflows: [Mention if there's a specific data point on FII outflows]. Significant FII selling adds pressure on the market, leading to further price declines. Understanding the reasons behind these outflows is crucial for assessing the market's future trajectory.

H2: Sector-Specific Impacts

The market crash impacted various sectors differently. [Mention specific sectors that were hit hardest and explain why, e.g., "The IT sector experienced a particularly sharp decline due to concerns about slowing global tech growth."] Analyzing sector-specific performance is crucial for investors to understand the nuanced impact of the crash.

H2: What This Means for Investors

Today's market crash underscores the inherent volatility of the stock market. Investors should adopt a cautious approach and carefully consider their risk tolerance before making any investment decisions. Diversification remains crucial for mitigating risk. It's advisable to consult with a financial advisor before making significant changes to your investment portfolio. The current situation highlights the importance of long-term investment strategies and the need to ride out short-term market fluctuations.

H2: Looking Ahead:

While today's plunge is alarming, it's important to avoid panic selling. The Indian economy possesses strong fundamentals, and historical data shows that markets recover from such dips. However, closely monitoring global and domestic developments remains crucial for informed decision-making. Investors should stay updated on macroeconomic indicators, government policies, and corporate earnings to gauge the market's future trajectory. The coming days and weeks will be critical in determining the extent and duration of this market correction. This situation underscores the importance of careful risk management and a well-defined investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sensex And Nifty Plunge: Reasons Behind Today's Indian Market Crash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Amazon Amzn A Top Investment Think Investments Weighs In

Apr 07, 2025

Is Amazon Amzn A Top Investment Think Investments Weighs In

Apr 07, 2025 -

Minecraft Movie Review A Gamers Perspective On The Blockbuster

Apr 07, 2025

Minecraft Movie Review A Gamers Perspective On The Blockbuster

Apr 07, 2025 -

Dow Futures Extend Losses Amidst Broad Market Sell Off

Apr 07, 2025

Dow Futures Extend Losses Amidst Broad Market Sell Off

Apr 07, 2025 -

Top Analysts Highlight Undervalued Tech Stocks For Second Quarter Investment

Apr 07, 2025

Top Analysts Highlight Undervalued Tech Stocks For Second Quarter Investment

Apr 07, 2025 -

Verstappen Vs Alonso Vs Gasly A Close Look At The Japanese Gp Start

Apr 07, 2025

Verstappen Vs Alonso Vs Gasly A Close Look At The Japanese Gp Start

Apr 07, 2025