Sharpest US Stock Market Decline Since COVID-19: China's Retaliatory Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sharpest US Stock Market Decline Since COVID-19: China's Retaliatory Tariffs Trigger Market Tremors

The US stock market experienced its most significant single-day drop since the initial COVID-19 pandemic crash, plummeting sharply in response to China's announcement of retaliatory tariffs on American goods. This unexpected escalation of trade tensions sent shockwaves through Wall Street, leaving investors reeling and raising serious concerns about the global economic outlook.

The Dow Jones Industrial Average plunged over 700 points, while the S&P 500 and Nasdaq Composite also suffered substantial losses, exceeding expectations and wiping out billions in market capitalization. This dramatic decline marks a significant setback for the ongoing economic recovery and fuels anxieties about a potential global recession.

China's Response: A Calculated Blow to the US Economy

China's announcement of new tariffs, targeting key US agricultural products and technology exports, was a direct response to the recent increase in US tariffs on Chinese goods. Beijing characterized these measures as necessary to protect its national interests and counter what it perceives as unfair trade practices. The magnitude of the tariffs and the breadth of affected products caught many market analysts off guard, highlighting the unpredictable nature of the ongoing trade war.

The targeted sectors are likely to feel the most immediate impact, with agricultural producers and technology companies facing significant challenges in the coming months. The ripple effect will undoubtedly extend throughout the US economy, impacting jobs, consumer prices, and investor confidence.

Market Analysts Weigh In: Uncertainty and Volatility Ahead

Market analysts are expressing a range of opinions, with many emphasizing the increased volatility and uncertainty in the global markets. Several factors are contributing to this widespread anxiety:

- Escalating Trade Tensions: The tit-for-tat tariff increases are a clear indication of worsening trade relations between the world's two largest economies. This uncertainty makes it difficult for businesses to plan for the future and invest confidently.

- Global Economic Slowdown: Concerns about a potential global economic slowdown are intensifying, particularly given the ongoing geopolitical instability and the recent weakening of several major economies.

- Investor Sentiment: The sharp market decline reflects a significant shift in investor sentiment. Fear and uncertainty are driving investors to seek safer havens, resulting in a sell-off of riskier assets.

What to Expect Next: Navigating the Uncertain Future

The immediate future remains uncertain. The impact of China's retaliatory tariffs will unfold over the coming weeks and months, with potential consequences ranging from supply chain disruptions to higher consumer prices. The response of the US government and further developments in trade negotiations will be crucial in determining the trajectory of the market.

Keywords: US Stock Market, Stock Market Decline, China Tariffs, Retaliatory Tariffs, Trade War, Dow Jones, S&P 500, Nasdaq, Global Economy, Economic Recession, Investor Sentiment, Market Volatility, Supply Chain Disruptions, US-China Trade Relations.

Conclusion:

The sharpest US stock market decline since the COVID-19 pandemic underscores the significant risks associated with escalating trade tensions between the US and China. The unfolding situation demands close monitoring, as the ripple effects of these retaliatory tariffs are likely to have far-reaching consequences for the global economy and financial markets. The uncertainty surrounding future trade negotiations adds another layer of complexity, making it crucial for investors and businesses to adopt a cautious approach and carefully consider the evolving geopolitical landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sharpest US Stock Market Decline Since COVID-19: China's Retaliatory Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Facebook Ad Wars Trump Vs Bidens Strategies To Reach Older Female Voters

Apr 08, 2025

Facebook Ad Wars Trump Vs Bidens Strategies To Reach Older Female Voters

Apr 08, 2025 -

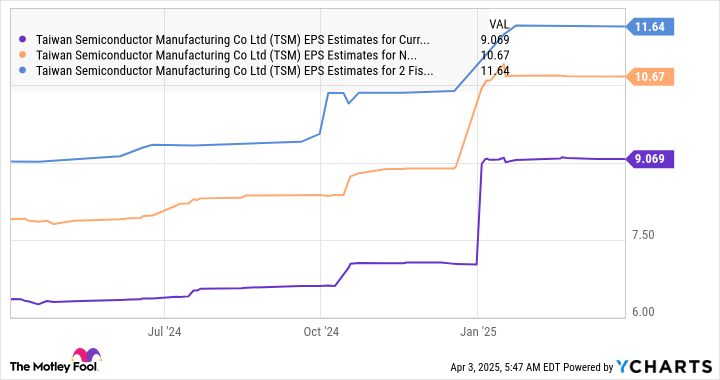

Is This Top Ai Stock A Bargain After A 25 Drop

Apr 08, 2025

Is This Top Ai Stock A Bargain After A 25 Drop

Apr 08, 2025 -

Fha Alters Residency Rules Impact On Loan Eligibility And Approval

Apr 08, 2025

Fha Alters Residency Rules Impact On Loan Eligibility And Approval

Apr 08, 2025 -

Fha Residency Requirements Updated Rules And Implications For Homebuyers

Apr 08, 2025

Fha Residency Requirements Updated Rules And Implications For Homebuyers

Apr 08, 2025 -

Are Falling Prices Misrepresenting Web3 Game Fis True Potential

Apr 08, 2025

Are Falling Prices Misrepresenting Web3 Game Fis True Potential

Apr 08, 2025