Should You Buy Amazon (AMZN) Stock? Think Investments Weighs In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Amazon (AMZN) Stock? Think Investments Weighs In

Amazon (AMZN). The name conjures images of ubiquitous online shopping, cloud computing dominance, and innovative technological advancements. But for investors, the question remains: is now the right time to buy Amazon stock? Think Investments examines the complexities of this tech giant and offers a nuanced perspective.

The allure of Amazon is undeniable. Its market dominance across e-commerce, cloud computing (AWS), and advertising presents a compelling investment case. However, recent market volatility and concerns about economic headwinds require careful consideration. Let's delve into the factors Think Investments weighs when assessing AMZN's investment potential.

Amazon's Strengths: A Goliath in Multiple Markets

-

E-commerce Giant: Amazon remains the undisputed king of online retail. Its vast selection, Prime membership program, and efficient logistics network continue to attract millions of customers globally. This established market share provides a robust foundation for future growth.

-

AWS Dominance: Amazon Web Services (AWS) is the leading cloud computing platform, powering countless businesses and applications. Its consistent growth and high margins make AWS a significant driver of Amazon's overall profitability.

-

Advertising Powerhouse: Amazon's advertising business is rapidly expanding, capitalizing on its massive customer base and data-driven targeting capabilities. This diversifies Amazon's revenue streams and enhances its long-term prospects.

-

Innovation and Expansion: Amazon consistently invests in research and development, exploring new technologies and markets. From autonomous delivery drones to advancements in artificial intelligence, its commitment to innovation fuels future growth potential.

Amazon's Challenges: Navigating Headwinds

-

Economic Uncertainty: Global economic slowdowns and rising inflation can impact consumer spending, potentially affecting Amazon's e-commerce sales and overall profitability.

-

Increased Competition: Amazon faces increasing competition in all its key markets. Competitors are vying for market share in e-commerce, cloud computing, and advertising, creating a more challenging landscape.

-

Labor Costs and Supply Chain Issues: Rising labor costs and potential supply chain disruptions can put pressure on Amazon's margins and operational efficiency.

-

Regulatory Scrutiny: Amazon faces ongoing regulatory scrutiny related to antitrust concerns and labor practices. Navigating these regulatory hurdles adds complexity to its operations.

Think Investments' Assessment: A Balanced Perspective

Think Investments acknowledges both the significant strengths and challenges facing Amazon. While the long-term prospects remain positive due to its diverse business model and innovative capacity, the current economic climate presents some uncertainty.

Our recommendation is not a simple "buy" or "sell." Instead, we advocate for a cautious approach. Investors should carefully consider their risk tolerance, investment horizon, and diversification strategy before making any investment decisions regarding Amazon stock.

Key Considerations for Investors:

-

Long-term perspective: Amazon is a long-term growth story. Short-term market fluctuations should not overshadow its long-term potential.

-

Diversification: Investors should diversify their portfolios to mitigate risk. Don't put all your eggs in one basket, even one as seemingly robust as Amazon.

-

Fundamental analysis: Conduct thorough due diligence, including fundamental analysis of Amazon's financials and competitive landscape.

-

Professional advice: Consult with a qualified financial advisor before making any significant investment decisions.

Conclusion:

Amazon remains a powerful force in the global economy. However, the decision to buy Amazon stock requires careful consideration of both its strengths and weaknesses, alongside current market conditions. Think Investments encourages investors to conduct thorough research and seek professional advice before investing in AMZN or any other stock. Remember, past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Amazon (AMZN) Stock? Think Investments Weighs In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Martyns Law For Australia The Urgent Need For Enhanced Venue Security After The Mcg Incident

Apr 08, 2025

Martyns Law For Australia The Urgent Need For Enhanced Venue Security After The Mcg Incident

Apr 08, 2025 -

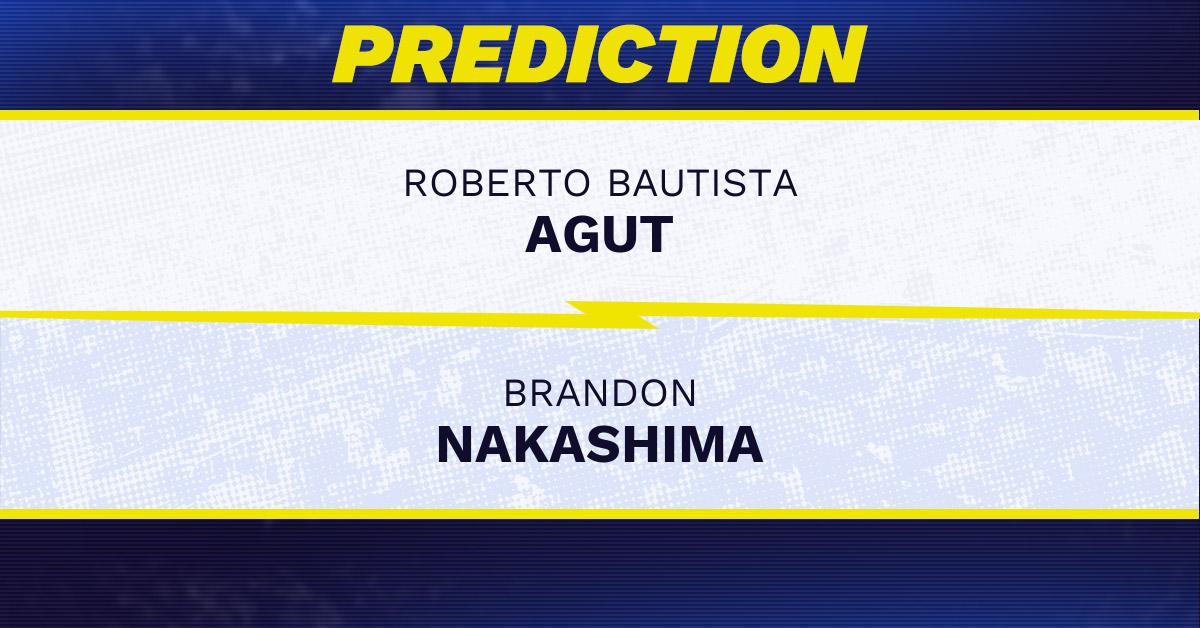

Monte Carlo Masters 2025 Roberto Bautista Agut Vs Brandon Nakashima Betting Odds And Picks

Apr 08, 2025

Monte Carlo Masters 2025 Roberto Bautista Agut Vs Brandon Nakashima Betting Odds And Picks

Apr 08, 2025 -

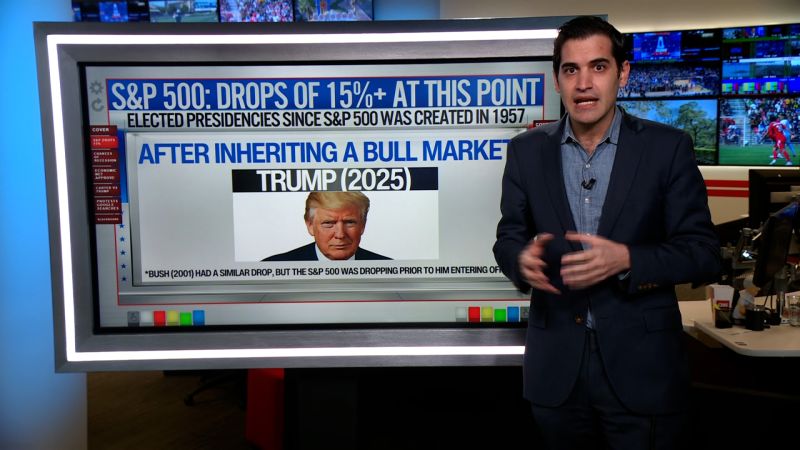

Dow Futures Tank Whats Driving The Continued Market Decline

Apr 08, 2025

Dow Futures Tank Whats Driving The Continued Market Decline

Apr 08, 2025 -

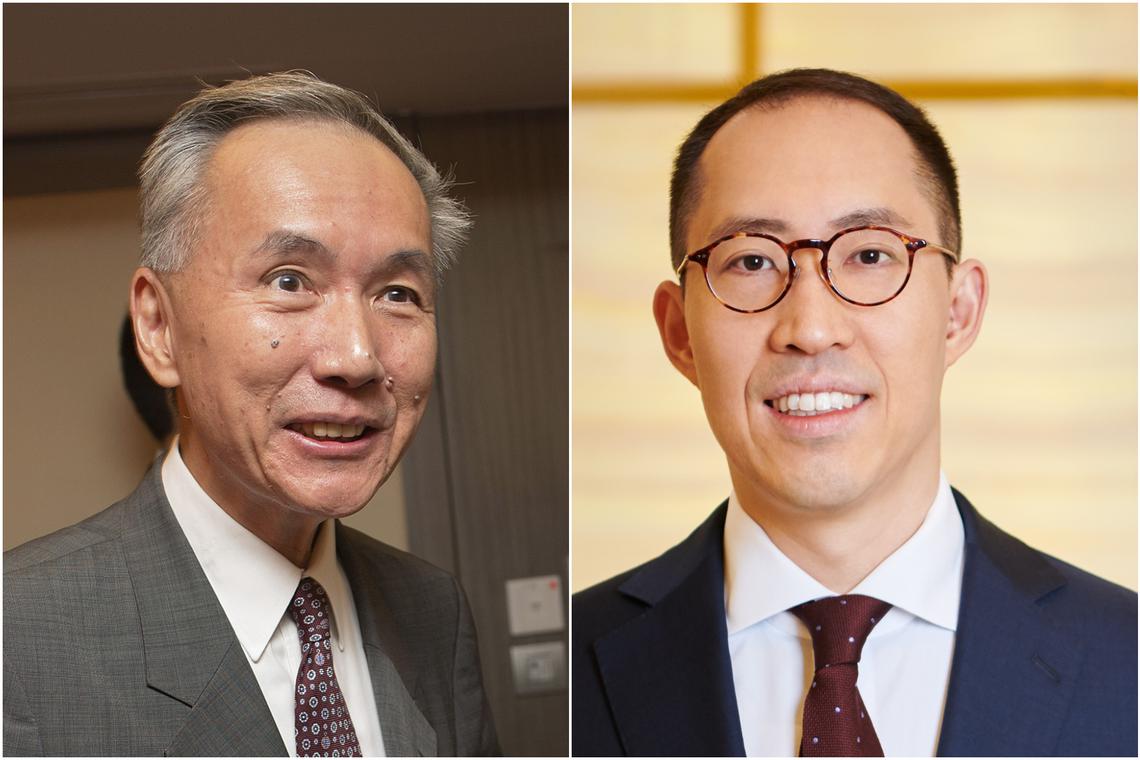

Fica Designates Robert Ng And Three Children As Politically Exposed Persons

Apr 08, 2025

Fica Designates Robert Ng And Three Children As Politically Exposed Persons

Apr 08, 2025 -

Metas Llama 4 And Open Ais Powerful New Model A Showdown In Open Source Ai

Apr 08, 2025

Metas Llama 4 And Open Ais Powerful New Model A Showdown In Open Source Ai

Apr 08, 2025