Should You Buy Amazon (AMZN)? Think Investments' Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Amazon (AMZN)? Think Investments' Perspective

Amazon (AMZN). The name conjures images of instant gratification, a vast online marketplace, and a technological behemoth. But for investors, the question isn't about convenience; it's about returns. Should you buy Amazon stock? The answer, as with any investment, is complex and depends on your individual financial goals and risk tolerance. Let's delve into Think Investments' perspective, examining the arguments for and against adding AMZN to your portfolio.

Amazon's Strengths: A Colossus in Multiple Markets

Amazon's dominance is undeniable. Its sprawling empire encompasses:

- E-commerce: Amazon remains the undisputed king of online retail, boasting unparalleled logistics and a massive customer base. This core business continues to generate significant revenue, even in the face of increased competition.

- Cloud Computing (AWS): Amazon Web Services (AWS) is the global leader in cloud computing, providing crucial infrastructure for businesses of all sizes. AWS boasts high margins and consistent growth, a key driver of Amazon's overall profitability.

- Advertising: Amazon's advertising platform is rapidly expanding, capitalizing on its vast user base and data-driven targeting capabilities. This segment presents a significant growth opportunity.

- Subscription Services (Prime): Amazon Prime offers a compelling value proposition, locking in millions of loyal customers and generating recurring revenue. This sticky revenue stream provides stability and predictability.

These diverse revenue streams offer significant resilience against economic downturns. While one sector might face headwinds, others often offset those challenges, making Amazon a relatively diversified investment compared to many other tech giants.

Amazon's Challenges: Navigating a Competitive Landscape

Despite its considerable strengths, Amazon faces several challenges:

- Increased Competition: Competitors like Walmart and Shopify are aggressively challenging Amazon's dominance in e-commerce. Maintaining its market share requires continuous innovation and investment.

- Economic Slowdown: Consumer spending is sensitive to economic conditions. A significant economic downturn could impact Amazon's sales, particularly in its discretionary spending categories.

- Regulatory Scrutiny: Amazon faces ongoing regulatory scrutiny regarding antitrust concerns and labor practices. Negative regulatory outcomes could significantly impact its operations and profitability.

- Inflation and Rising Costs: Increased inflation and supply chain disruptions are impacting Amazon's margins, requiring strategic adjustments to maintain profitability.

These challenges highlight the inherent risks associated with investing in Amazon. While the company's size and diversification offer some protection, it's not immune to market forces or regulatory pressures.

Think Investments' Verdict: A Long-Term Perspective

Think Investments views Amazon as a long-term investment opportunity, but not without caveats. The company's innovative culture and diverse business model offer significant growth potential. However, the current economic climate and increased competition demand careful consideration.

For Investors:

- Long-term horizon: Amazon is a marathon, not a sprint. Investors should have a long-term perspective and be prepared for market volatility.

- Diversification: Amazon shouldn't be the sole focus of your portfolio. Diversification across different asset classes is crucial to mitigate risk.

- Risk Tolerance: Only invest what you can afford to lose. The stock market is inherently risky, and even established companies like Amazon can experience significant price fluctuations.

In conclusion, while Amazon presents compelling investment opportunities, it's essential to conduct thorough due diligence and assess your own risk tolerance before making any investment decisions. The information provided here is for educational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Amazon (AMZN)? Think Investments' Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

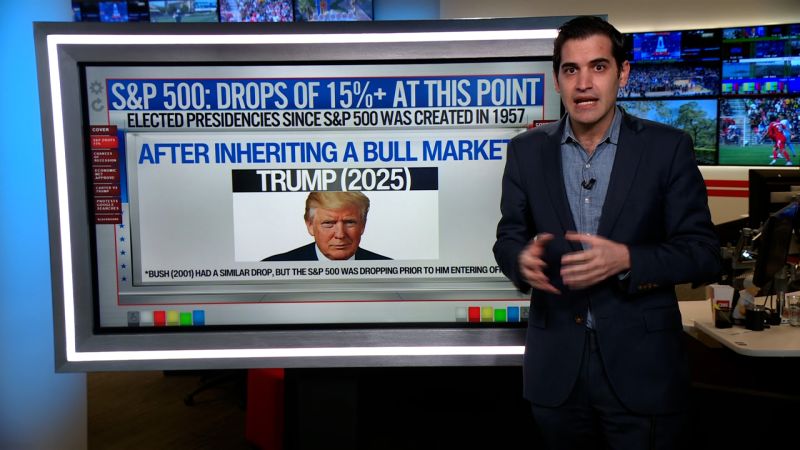

Market Sell Off Intensifies Dow Futures Suffer Heavy Losses

Apr 07, 2025

Market Sell Off Intensifies Dow Futures Suffer Heavy Losses

Apr 07, 2025 -

1 Billion Eu Fine For X Musks Platform And Tech Giants Under Dma Scrutiny

Apr 07, 2025

1 Billion Eu Fine For X Musks Platform And Tech Giants Under Dma Scrutiny

Apr 07, 2025 -

Suzuka Circuit Live F1 Japanese Gp Commentary And Race Updates

Apr 07, 2025

Suzuka Circuit Live F1 Japanese Gp Commentary And Race Updates

Apr 07, 2025 -

Solve The Nyt Connections Puzzle For April 7 2025 Hints And Solutions

Apr 07, 2025

Solve The Nyt Connections Puzzle For April 7 2025 Hints And Solutions

Apr 07, 2025 -

Malmoependeln Samarbetsavbrott Mellan Malmoe Stad Och Region Skane

Apr 07, 2025

Malmoependeln Samarbetsavbrott Mellan Malmoe Stad Och Region Skane

Apr 07, 2025