Should You Buy Nvidia Stock? 3 Key Reasons To Consider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Nvidia Stock? 3 Key Reasons to Consider

Nvidia (NVDA) has become a household name, synonymous with cutting-edge graphics processing units (GPUs). But beyond the gaming world, Nvidia's technology is powering revolutions in artificial intelligence (AI), data centers, and autonomous vehicles. This begs the question: should you buy Nvidia stock? While no investment is without risk, three key reasons strongly suggest Nvidia warrants serious consideration for your portfolio.

H2: The AI Boom: Nvidia's Undisputed Leader

The current AI boom is arguably the most significant technological shift of our time. And Nvidia is at the forefront, providing the powerful GPUs crucial for training and deploying large language models (LLMs) like those powering ChatGPT and similar applications. This isn't just about hype; Nvidia's data center revenue is exploding, demonstrating a clear and substantial market demand for their hardware.

- Massive Market Growth: The AI market is projected to grow exponentially in the coming years, creating a massive tailwind for Nvidia's already impressive growth trajectory. Analysts predict continued high demand for Nvidia's GPUs, leading to sustained revenue growth.

- Technological Superiority: Nvidia holds a significant technological advantage over its competitors, possessing a strong patent portfolio and a consistently innovative approach to GPU architecture. This competitive edge allows them to command premium pricing and maintain market share.

- Strategic Partnerships: Nvidia is actively forging strategic partnerships with major players in the tech industry, further solidifying its position in the rapidly expanding AI landscape. These collaborations ensure a consistent pipeline of new applications and opportunities.

H2: Beyond AI: Data Centers and the Metaverse

While AI dominates the headlines, Nvidia's influence extends far beyond. The company's high-performance computing (HPC) solutions are integral to the operation of modern data centers worldwide, fueling everything from cloud computing to scientific research. Furthermore, Nvidia's technology is crucial to the development of the metaverse, a burgeoning field expected to revolutionize how we interact with digital environments.

- Data Center Dominance: Nvidia's GPUs are the preferred choice for many data center operators, ensuring a steady stream of revenue even outside the AI sector. This diversification reduces reliance on any single market segment.

- Metaverse Potential: The metaverse is still in its early stages, but Nvidia's role in creating realistic and immersive virtual worlds is undeniable. As the metaverse matures, Nvidia's involvement is poised to generate significant future returns.

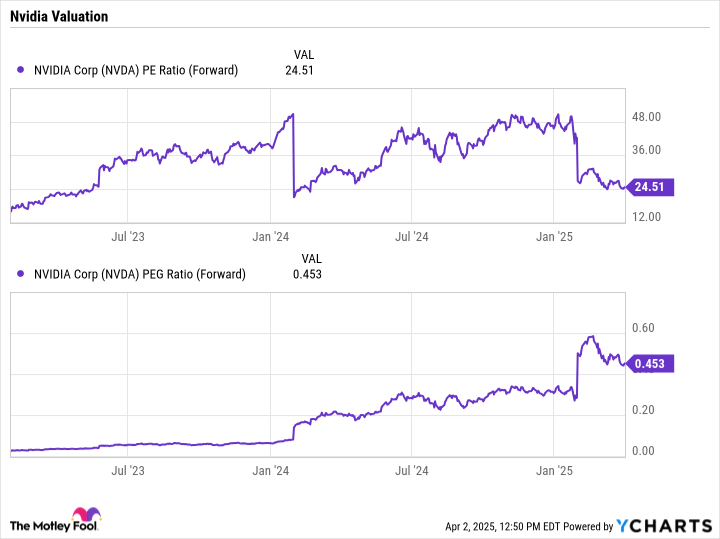

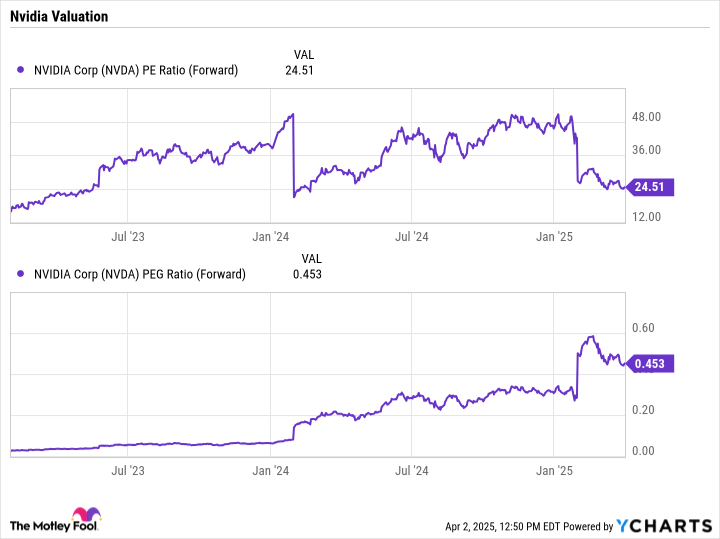

H3: Understanding the Risks

It's crucial to acknowledge potential downsides before investing. Nvidia's stock price is highly volatile, subject to market fluctuations and investor sentiment. Competition from other chip manufacturers is also a factor to consider, though Nvidia's current technological lead appears substantial. Thorough due diligence is essential before making any investment decision.

H2: Conclusion: A Strong Contender, but Proceed with Caution

Nvidia's position at the heart of the AI revolution, coupled with its strong presence in data centers and the burgeoning metaverse, presents a compelling case for investment. However, the inherent volatility of the tech sector and the potential for increased competition must be carefully weighed. Consider your risk tolerance and conduct thorough research before adding Nvidia to your portfolio. Consult with a financial advisor for personalized guidance tailored to your individual investment strategy. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Nvidia Stock? 3 Key Reasons To Consider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tariff Chaos Deepens Trump Signals Willingness To Negotiate As Markets Fall

Apr 08, 2025

Tariff Chaos Deepens Trump Signals Willingness To Negotiate As Markets Fall

Apr 08, 2025 -

Kakang Rudianto Umumkan Pernikahan Inspirasi Dari Beckham Putra

Apr 08, 2025

Kakang Rudianto Umumkan Pernikahan Inspirasi Dari Beckham Putra

Apr 08, 2025 -

The Battle Over Green Space Stadium Rules Under Scrutiny

Apr 08, 2025

The Battle Over Green Space Stadium Rules Under Scrutiny

Apr 08, 2025 -

Jiri Lehecka Vs Sebastian Korda Monte Carlo Masters 2025 Betting Odds And Prediction

Apr 08, 2025

Jiri Lehecka Vs Sebastian Korda Monte Carlo Masters 2025 Betting Odds And Prediction

Apr 08, 2025 -

Trumps Regulatory Agenda Could It Pave The Way For A Tether Us Stablecoin

Apr 08, 2025

Trumps Regulatory Agenda Could It Pave The Way For A Tether Us Stablecoin

Apr 08, 2025